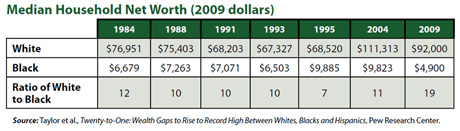

The Great Recession produced the largest setback in racial wealth equality in the United States over the last quarter century. In 2009 the average white household’s wealth was twenty times that of the average black household, nearly double that in previous years, according to a 2011 report by the Pew Research Center.

Driving this surge in inequality is a devastating drop in black wealth. The typical black household in 2009 was left with less wealth than at any time since 1984, after correcting for inflation.

It’s important to remember wealth’s special role in supporting a household’s economic well-being. Even though income forms the stream of money that collects into a household’s pool of wealth, wealth and income are crucially different. Income pays for everyday living expenses—the groceries, clothes, and gas. A family’s wealth, or net worth, includes all the assets they’ve built up over time (e.g., savings account, retirement fund, home, car) minus any money they owe (e.g., school loans, credit-card debt, mortgage). Access to such wealth determines whether a layoff or medical crisis creates a bump in the road, or pushes a household off a financial cliff. Wealth can also provide families with financial stepping-stones to advance up the economic ladder—such as money for college tuition, or a down payment on a house.

Racial wealth inequality in the United States has always been severe. In 2004, for example, the typical black household had just one dollar in net worth for every 11 dollars of a typical white household. This is because families slowly accumulate wealth over their lifetime and across generations. Wealth, consequently, ties the economic fortunes of today’s households to the explicitly racist economic institutions in America’s past—especially those that existed during key phases of wealth redistribution. For example, the Homesteading Act of 1862 directed the large-scale transfer of government-owned land nearly exclusively to white households. Also, starting in the 1930s, the Federal Housing Authority made a major push to subsidize home mortgages—for primarily white neighborhoods. On top of that, efforts by black communities to generate their own wealth by starting their own businesses were crushed by racial violence, or severely curtailed by Jim Crow Laws in effect until the mid-1960s.

The crisis in the housing market and the Great Recession made racial wealth inequality yet worse for two reasons. First, the wealth of blacks is more concentrated in their homes than the wealth of their white counterparts. Even though homes are typically the largest asset of most households, regardless of race, homes of black families make up 59% of their net worth compared to 44% among white families. White households typically hold more of other types of assets like stocks and IRA accounts. So when the housing crisis hit, driving down the value of homes and pushing up foreclosure rates, black households lost a far greater share of their wealth than did white households.

Second, mortgage brokers and lenders marketed subprime mortgages specifically to black households. Subprime mortgages are high-interest loans that are supposed to increase access to home financing for risky borrowers—those with a shaky credit history or low income. But these high-cost loans were disproportionately peddled to black households, even to those that could qualify for conventional loans. One study estimated that in 2007 nearly double the share of upper-income black households (54%) had high-cost mortgages compared to low-income white households (28%).

Subprime mortgages drain away wealth through high fees and interest payments. Worse, predatory lending practices disguise the high-cost of these loans with a “honeymoon” period of low payments. Payments then shoot up, often to unmanageable levels that lead to default and foreclosure, wiping out a family’s home-equity wealth. In 2006, Mike Calhoun, president of the Center for Responsible Lending, predicted that the surge of subprime lending within the black community would “…likely be the largest loss of African-American wealth that we have ever seen, wiping out a generation of home wealth building.” We now know how prescient his prediction was.

To reverse the rise in racial wealth inequality, we need policies that specifically build wealth among black households. Economists William Darity of Duke University and Darrick Hamilton of The New School propose one possible—and politically-viable—strategy: a wealth-means-tested “baby bonds” program. This policy stops short of being a reparations policy, but still disproportionately transfers wealth to black communities. Federally-managed, interest-bearing trusts would be given to the newborns of asset-poor families, and could be as large as $50,000 to $60,000 for the child of the most asset-poor families. When these children reach age 18, they would be able to use the funds for a down payment on a house, to pay tuition, or to start a business. Darity and Hamilton estimate such a program would cost roughly $60 billion per year. Letting the Bush-era tax cuts expire for the top 1% of income earners would more than cover this cost.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $33,000 in the next 2 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.