Honest, paywall-free news is rare. Please support our boldly independent journalism with a donation of any size.

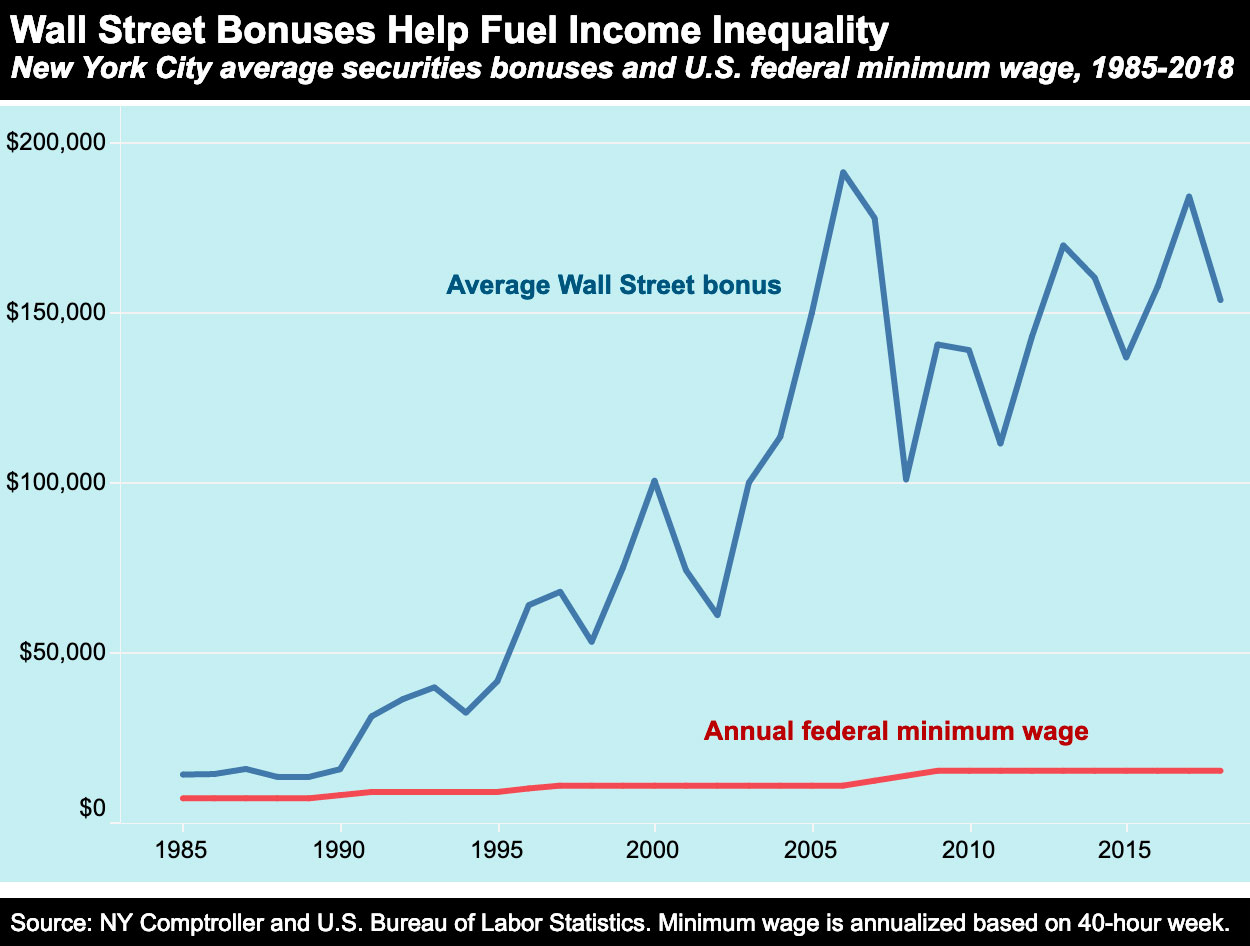

Bonuses were down last year in the New York-based securities industry, according to just-released data from the New York State Comptroller. But the average end of year payout in this lucrative and overwhelmingly white and male sector is still dramatically higher than in decades past, while pay in low-wage jobs with greater workforce diversity has stagnated.

Wall Street Pay v. the Minimum Wage

- The total bonus pool for 181,300 New York City-based Wall Street employees was $27.5 billion — more than 3 times the combined annual earnings of all 640,000 U.S. workers employed full-time (at least 35 hours) at the federal minimum wage.

- Since 1985, the average Wall Street bonus has increased 1,000 percent, from $13,970 to $153,700. If the minimum wage had increased at that rate, it would be worth $33.51 today, instead of $7.25.

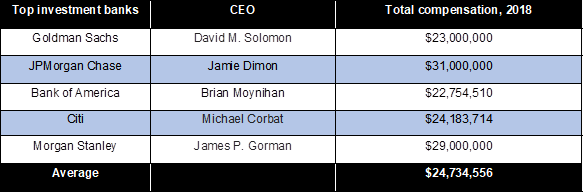

- These bonuses come on top of salary and other forms of compensation. The CEOs of the top 5 U.S. investment banks hauled in an average of $24.7 million in total compensation in 2018.

Wall Street Bonuses and Gender Inequality

The rapid increase in Wall Street bonuses over the past several decades has contributed to gender inequality, since workers at the bottom of the wage scale are predominantly female, while the financial industry is overwhelmingly male, particularly at the upper echelons.

- The CEOs of the five largest U.S. investment banks are all white men, and the share of their senior executives and top managers who are male ranges from 68-80 percent. (JPMorgan Chase: 74%, Goldman Sachs: 78%, Bank of America Merrill Lynch: 68%, Morgan Stanley: 80%, and Citigroup: 68%)

- Securities industry employees are 1 percent male nationally, and more than two-thirds male in New York City.

- By contrast, men make up just 37 percent of the 1.8 million Americans who are working either full- or part-time at the federal minimum wage of $7.25 per hour.

Wall Street Bonuses and Racial Inequality

The rapid increase in Wall Street bonuses over the past several decades has also contributed to racial inequality. People of color are disproportionately represented in jobs that pay less than $15 per hour, while the lucrative financial industry is overwhelmingly white.

- At the five largest U.S. investment banks, the share of executives and top managers who are white ranges from 77.9 to 84.3 percent. (JPMorgan Chase: 3%, Goldman Sachs: 80.4%, Bank of America Merrill Lynch: 83.5%, Morgan Stanley: 84.2%, and Citigroup: 77.9%)

- Securities industry employees are 9 percent white nationally, and more than two-thirds white in New York City.

- By contrast, whites make up only 4 percent of people in jobs that pay less than $15 per hour, according to a 2016 National Employment Law Project report.

Washington Inaction on Wall Street Pay and Minimum Wage

Since 2010, the year the Dodd-Frank financial reform became law, regulators have failed to implement that law’s Wall Street pay restrictions and Congress has failed to raise the minimum wage. These two failures speak volumes about who has influence in Washington — and who does not.

Powerful Wall Street lobbyists have succeeded in blocking Section 956 of the 2010 Dodd-Frank financial reform legislation, which prohibits financial industry pay packages that encourage “inappropriate risks.” Regulators were supposed to implement this new rule within nine months of the law’s passage but have dragged their feet — despite widespread recognition that these bonuses encouraged the high-risk behaviors that led to the 2008 financial crisis, costing millions of Americans their homes and livelihoods.

In 2011, regulators issued a proposed rule that did not go far enough to prevent the type of behavior that led to the 2008 crash. As spelled out in detail in Institute for Policy Studies comments to the SEC, the proposed rule fell short in several areas, including overly lenient bonus deferrals, weak stock-based pay restrictions, and enforcement proposals that leave too much discretion to bank managers. While regulators responded to criticism by agreeing to issue a new proposal, this work was not completed before the end of the Obama administration.

During the Trump administration, regulators have put the issue on a back burner as Republicans have maneuvered to get rid of the Wall Street pay restrictions altogether. In 2017, the U.S. House of Representatives passed the Financial CHOICE Act, which would’ve repealed most of the Dodd-Frank reform package, including the Wall Street pay provision. Due to Democratic opposition in the Senate, a scaled back Wall Street deregulation bill was adopted.

In contrast to the Wall Street lobbyists, advocates for the working poor have been ignored by the majority of U.S. lawmakers in their calls for a raise in the federal minimum wage to $15 per hour. According to the Economic Policy Institute, this hike would directly benefit 28.1 million workers.

Due to Washington inaction, the federal minimum wage continues to be a poverty wage, while the reckless bonus culture is alive and well on Wall Street.

Press freedom is under attack

As Trump cracks down on political speech, independent media is increasingly necessary.

Truthout produces reporting you won’t see in the mainstream: journalism from the frontlines of global conflict, interviews with grassroots movement leaders, high-quality legal analysis and more.

Our work is possible thanks to reader support. Help Truthout catalyze change and social justice — make a tax-deductible monthly or one-time donation today.