Did you know that Truthout is a nonprofit and independently funded by readers like you? If you value what we do, please support our work with a donation.

Just after news broke of President Joe Biden’s plan to fulfill his campaign promise to cancel student debt, Republicans introduced a bill that would explicitly bar him from doing so, despite evidence that the current towering burden of student debt constitutes a major economic crisis.

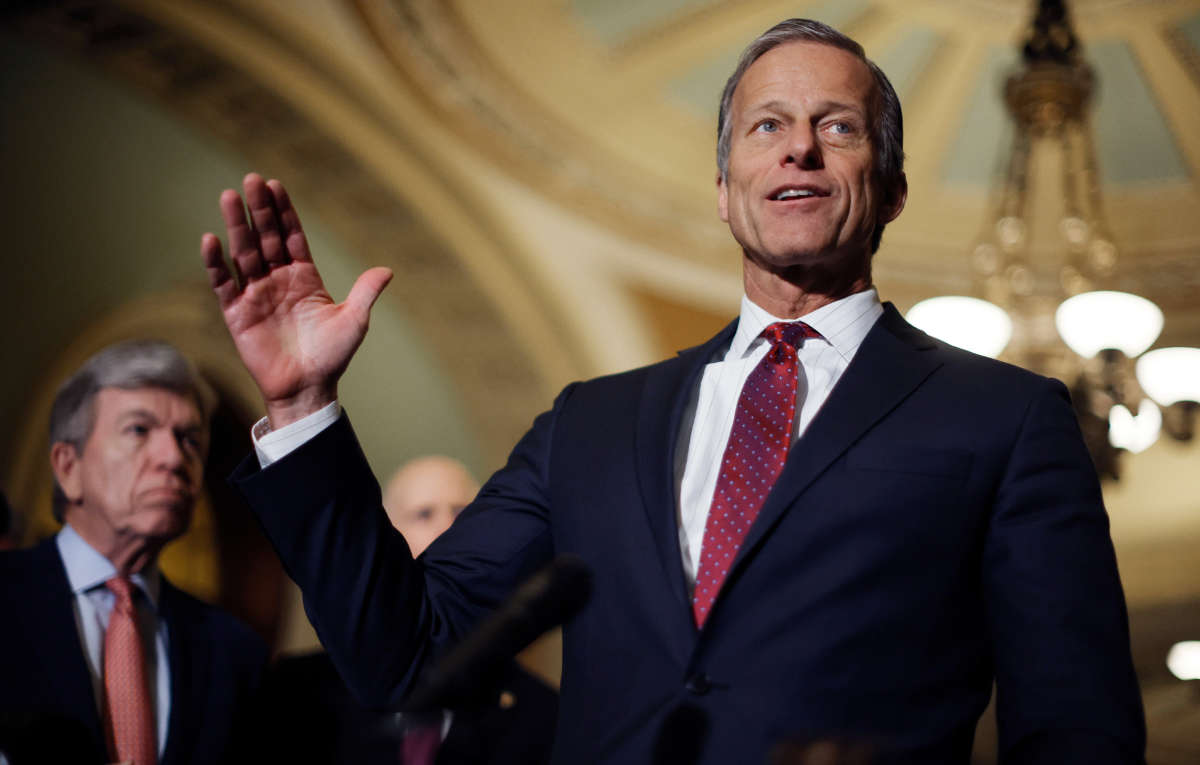

GOP Senators Bill Cassidy (Louisiana), John Thune (South Dakota), Richard Burr (North Carolina), and two others unveiled a measure that would bar the president from canceling student debt because of a national emergency, and limit the president’s ability to extend a student debt payment pause.

Their proposal, which is not likely to pass Congress, would also cap any future payment pauses for borrowers with a salary over four times the federal poverty line — or a mere $54,360 for single adults with no children. This is less than the average starting salary for college graduates from the class of 2020, which was $55,260.

The bill comes just after a potential breakthrough on the issue of student debt. Biden told House lawmakers in a meeting on Tuesday that he’s considering canceling a substantial amount of student debt after Democrats and debt activists have begged him for months to do so.

Roughly 43 million borrowers owe $1.9 trillion in student debt, according to the Student Debt Crisis Center. Debtors are often crushed by the weight of the debt, both financially and mentally; some owe triple or quadruple their original loan amount, and are burdened by the feeling or reality that the debt will never be repaid.

Debtors also face “hidden” costs due to their loans, with higher interest rates on things like home and car loans and credit cards. Canceling student debt could result in wide-reaching positive effects on the economy, boosting borrowers’ ability to buy a home or start a business.

Meanwhile, the student loan payment pause, which was originally put into effect by Donald Trump during the onset of the pandemic, has saved borrowers about $200 billion over the course of two years.

The Republicans argue that student loan cancellation and the payment freeze are a “handout” to wealthy college graduates and those who may have taken on loans for them, parroting a right-wing argument that the people who would benefit most from loan forgiveness are already wealthy and don’t need the money.

These arguments are based on false premises, however. People who take on student loans typically come from families without generational wealth that could cover the cost of tuition in the first place, and research has found that student loan forgiveness is progressive, meaning that it would provide the biggest benefits to the least wealthy debtors. The higher the loan amount that is canceled, the more progressive the benefit, the Roosevelt Institute found last year.

The report also found that cancellation would be crucial to closing the racial wealth gap, providing aid to Black and Latinx borrowers who suffer the most from student loan debt.

In their press release on the bill, the senators also say that the payment pause costs taxpayers $5 billion a month, citing Education Department data that shows $5 billion a month as the amount that borrowers save as a result of the pause extension. However, that’s an oversimplification of how federal student loans work and a flattening of the reason that the government gives student loans to begin with.

It also suggests that student loans should be a method of raising money for the government, a notion that even Trump has said is needlessly cruel. “That’s probably one of the only things the government shouldn’t make money off — I think it’s terrible that one of the only profit centers we have is student loans,” Trump said in 2015.

Student loans are given out with the purpose of making it easier for students to afford college tuition, which is rising at astounding rates. It’s in the government’s best interest to make higher education more accessible, as this can help strengthen democratic participation in society and stave off fascism.

To give loans, the government borrows money, adding to the deficit temporarily until the loans are paid back; the government sometimes collects a very limited profit from the loans due to interest. While it’s true that student loan cancellation may affect the deficit, a 2018 study by economic scholars found that the benefits of cancellation would be vast — not only for borrowers, but for the entire economy.

According to the study, a one-time mass cancellation of student debt would provide an immediate boost to the GDP and would generate up to $1.1 trillion in 2016 dollars in GDP over a decade. The policy would create jobs, reduce unemployment, and have a stimulus effect that would offset some of the cost of the program, with only a moderate negative effect on the deficit and inflation.

Press freedom is under attack

As Trump cracks down on political speech, independent media is increasingly necessary.

Truthout produces reporting you won’t see in the mainstream: journalism from the frontlines of global conflict, interviews with grassroots movement leaders, high-quality legal analysis and more.

Our work is possible thanks to reader support. Help Truthout catalyze change and social justice — make a tax-deductible monthly or one-time donation today.