Following weeks of uncertainty and months of legislative setbacks, Senate Republicans mustered up 51 votes in the early hours of Saturday morning to pass the most extensive tax rewrite in recent decades. The bill marks the party’s first major policy achievement under President Donald Trump.

The legislation was drawn up by Senate Republicans through an almost entirely secretive process, and despite concerns from a few Republicans over the bill’s potential impact, they were swayed with a series of last-minute changes. The massive tax overhaul passed along a 51-49 vote margin with no Democrats voting for the bill, and Sen. Bob Corker, R-Tenn., as the lone Republican opposition vote.

Just hours prior to the vote senators were given the 479-page bill which was filled with changes and differed from the original version that passed through two Senate panels in recent weeks. Democrats sharply criticized the secretive legislative process, as well as the last-minute changes and the fact that they had been expected to vote on a sweeping piece of legislation that impacts the entire country mere hours after seeing the bill for the first time.

Democrats also slammed the Republicans for one specific page of the bill that contained practically illegible hand-written changes.

While the plan has been pitched by both Trump and Republicans as a tax break for middle and low-income families, economists and nonpartisan analyses have indicated that’s hardly what will happen under the bill.

“By 2027, all that’s really left is a big corporate tax cut,” Joseph Rosenberg, a senior research associate at the Tax Policy Center explained, Salon previously reported. “This primarily benefits high-income people — people with a lot of capital income — shareholders, people who have capital gains dividends, and people who have interest income.”

The tax plan heavily favors multinational corporations as the corporate tax rate will permanently be cut to 20 percent, from the current 35 percent. The legislation also “eliminates some tax breaks like the deduction for state and local income taxes and phases out the individual tax cuts at the end of 2025,” which will disproportionately impact working class earners, the New York Times reported.

I was just handed a 479-page tax bill a few hours before the vote. One page literally has hand scribbled policy changes on it that can’t be read. This is Washington, D.C. at its worst. Montanans deserve so much better. pic.twitter.com/q6lTpXoXS0

— Senator Jon Tester (@SenatorTester) December 2, 2017

UPDATE: Senate Republicans are so desperate to pass their tax bill tonight that they’re now making handwritten changes to their already handwritten changes…

Seriously. pic.twitter.com/KQfW7bOyk1

— Senator Dick Durbin (@SenatorDurbin) December 2, 2017

Tonight, I feel mostly regret at what could have been.

Tax reform is an issue that is ripe for bipartisan compromise. There is a sincere desire on this side of the aisle to work with the GOP, particularly on tax reform, but we have been rebuffed, time & time again

— Chuck Schumer (@SenSchumer) December 2, 2017

With an elimination of the alternative minimum tax, and the estate tax it’s hard to argue the wealthiest earners in the nation will not be showered with tax cuts while middle-class families will either see no change, or an increase in their taxes.

The bill is largely reliant on a $1.5 trillion tax cut that Republicans and the Trump administration have said will spur substantial economic growth, and pay for itself despite explicit contradictions from CEOs.

However, the party that has long been known for its concern of the national debt and deficit, downplayed any concerns.

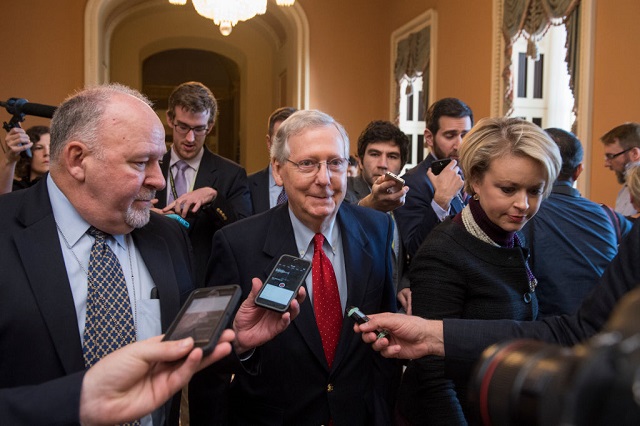

“I’m totally confident this is a revenue-neutral bill,” McConnell said, according to the Times. “I think it’s going to be a revenue producer.”

Since GOP tax reform plans have now passed in both the House and the Senate, the chambers will reconcile any differences in order to place a final version on the president’s desk.

“We are one step closer to delivering MASSIVE tax cuts for working families across America. Special thanks to @SenateMajLdr Mitch McConnell and Chairman @SenOrrinHatch for shepherding our bill through the Senate. Look forward to signing a final bill before Christmas!” Trump tweeted in approval.

We are one step closer to delivering MASSIVE tax cuts for working families across America. Special thanks to @SenateMajLdr Mitch McConnell and Chairman @SenOrrinHatch for shepherding our bill through the Senate. Look forward to signing a final bill before Christmas! pic.twitter.com/gmWTny3SfS

— Donald J. Trump (@realDonaldTrump) December 2, 2017

Biggest Tax Bill and Tax Cuts in history just passed in the Senate. Now these great Republicans will be going for final passage. Thank you to House and Senate Republicans for your hard work and commitment!

— Donald J. Trump (@realDonaldTrump) December 2, 2017

Trump is silencing political dissent. We appeal for your support.

Progressive nonprofits are the latest target caught in Trump’s crosshairs. With the aim of eliminating political opposition, Trump and his sycophants are working to curb government funding, constrain private foundations, and even cut tax-exempt status from organizations he dislikes.

We’re concerned, because Truthout is not immune to such bad-faith attacks.

We can only resist Trump’s attacks by cultivating a strong base of support. The right-wing mediasphere is funded comfortably by billionaire owners and venture capitalist philanthropists. At Truthout, we have you.

Truthout has launched a fundraiser, and we must raise $31,000 in the next 4 days. Please take a meaningful action in the fight against authoritarianism: make a one-time or monthly donation to Truthout. If you have the means, please dig deep.