Fresh shots have been fired in North Carolina’s Republican-led class war.

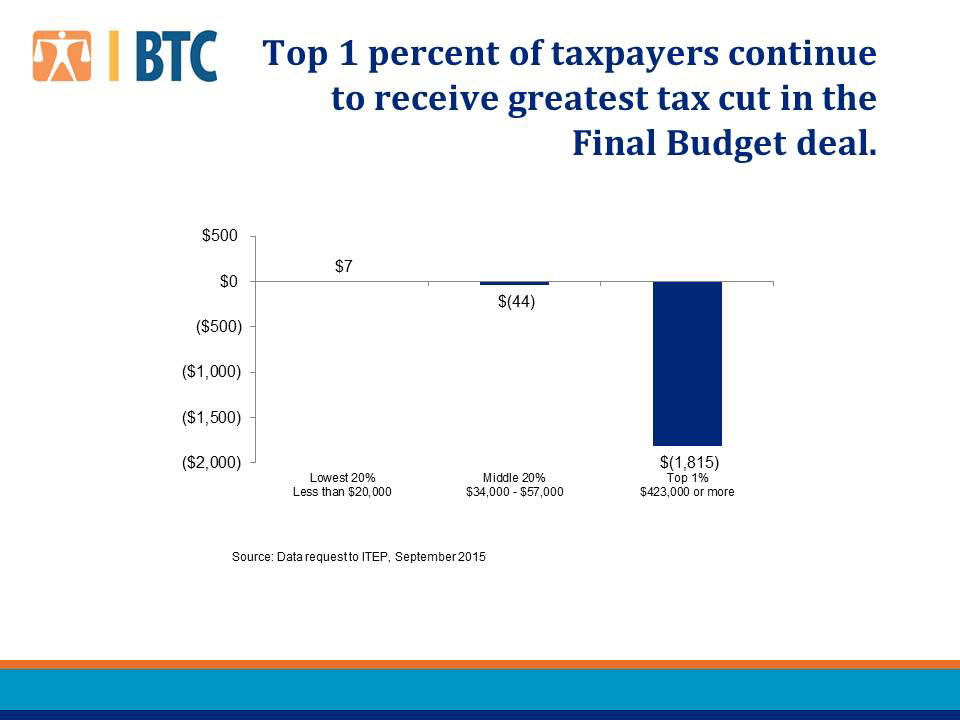

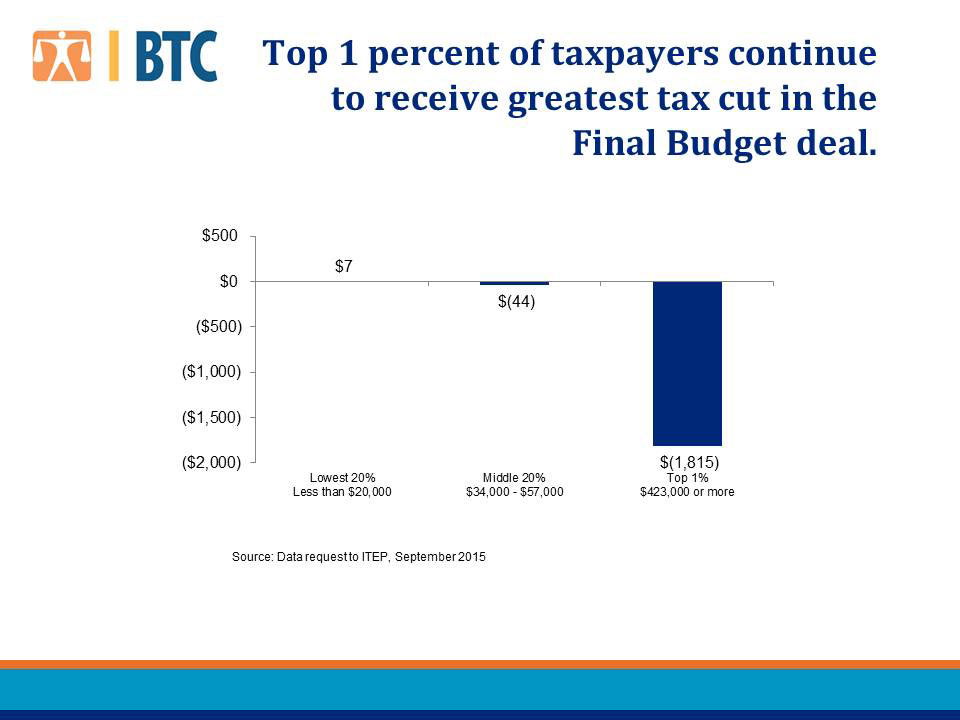

Last week, North Carolina’s Republican legislature and Republican governor agreed to once again lower the state’s income tax rate, this time from 5.7 percent to 5.49 percent – making it the state’s lowest income tax rate in 100 years. According to local think tank NC Policy Watch, the new income tax rates mean that those earning $20,000 will actually pay an average of $7 more per year. The middle class – those making between $34,000 and $57,000 a year – will save an average of $44. And the top 1 percent of North Carolinians who make over $423,000 a year will save an average of $1,815.

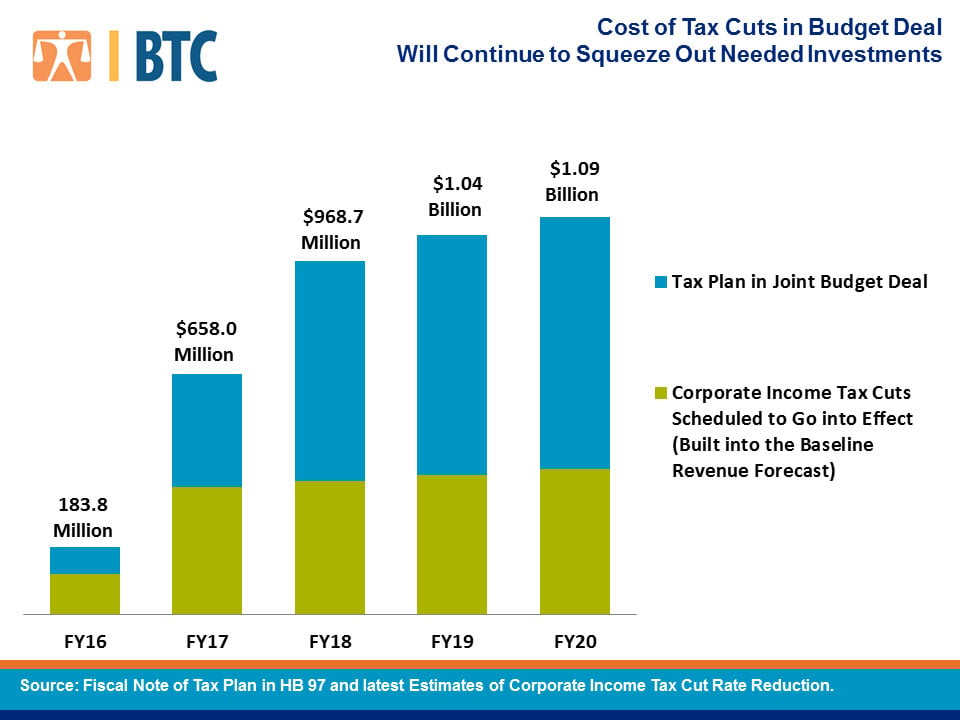

In addition to the lowered income tax rate, North Carolina also lowered the state’s corporate tax rate to 3 percent. But those tax cuts won’t come into effect until the end of Fiscal Year 2016, meaning that a new crop of state legislators will be left to grapple with much less in tax revenue. It’s estimated that by the time the new corporate tax rate comes into effect, the state will have $350 million less in revenue to spend on necessary public services like education, healthcare, roads and social services.

So how will North Carolina pay for new tax cuts that primarily benefit the rich? By raising taxes on the poor, of course. The roughly $400 million in income tax cuts will be offset by increasing the sales tax on services that are primarily used by the poor. On March 1, new sales tax rates of 6.75 percent will go into effect across North Carolina, and will largely apply to car repairs as well as installation and repair of appliances. As this op-ed from the conservative-leaning Raleigh News & Observer noted, the wealthy can afford new cars and warranties for appliances, so this tax will fall disproportionately on the poor. The author also aptly noted that North Carolina Republicans chose not to increase taxes on services the rich use, like accountants, lawyers, architects and interior designers.

The class war in North Carolina has been raging since 2010 when Republicans took over control of the state legislature for the first time since reconstruction. After Pat McCrory was elected governor in 2012, North Carolina became another experimental lab for conservative policymakers to force through a number of extreme policies. In addition to cutting taxes for the rich and raising them on the poor, the state’s GOP majority has demolished public education, disenfranchised Democratic-leaning voters (that law is currently on trial), attacked women’s reproductive rights (that law was struck down by the U.S. Supreme Court), criminalized the disclosure the chemicals in fracking fluid, and passed numerous other pieces of draconian legislation. The NC GOP’s extremism was even too much for one former Republican, who cited his party’s extreme rightward shift as the reason for his switch to the Democratic Party.

A pattern emerges when comparing North Carolina with states like Kansas and Wisconsin, which all experienced a total Republican takeover between 2010 and 2012. The justification for passing such extreme tax cuts for the wealthy is always the same: that wealth will eventually “trickle down” and alleviate poverty, supporters say. But in North Carolina, poverty either stagnated or rose between 2007 and 2013 – well after the “economic recovery” that officially began in 2009. According to NC Policy Watch, by the end of 2013, poverty was more widespread in North Carolina, affecting 1.7 million people. (A four-person household earning less than $24,000 is considered to be living in poverty). While the Tar Heel state’s poverty rate was 17.9 percent by the end of 2013, child poverty was an astonishing 25.2 percent – up 6 points from the start of the recession.

Kansas and Wisconsin both serve as examples of conservative economics run amok – something that North Carolina voters may now get especially attuned to. In both of those states, every metric used to measure social welfare is down considerably. Despite Wisconsin Gov. Scott Walker giving out $1.14 billion to Wisconsin’s corporations at the expense of public education, healthcare, and infrastructure, the state’s job growth lags behind the rest of its Midwestern neighbors. And in Kansas, the much-maligned tax cuts for the wealthy and corporations that Gov. Sam Brownback forced through have since created a $406 million hole in the state budget. Kansas’s credit rating has meanwhile been downgraded by two separate agencies, each of which cited a lack of confidence in the state’s political leadership.

Policies like the most recent tax cut package in North Carolina have long since proven not to work to anyone’s benefit except the rich. If conservative economics worked, there would be ample proof by now.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $46,000 in the next 7 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.