Did you know that Truthout is a nonprofit and independently funded by readers like you? If you value what we do, please support our work with a donation.

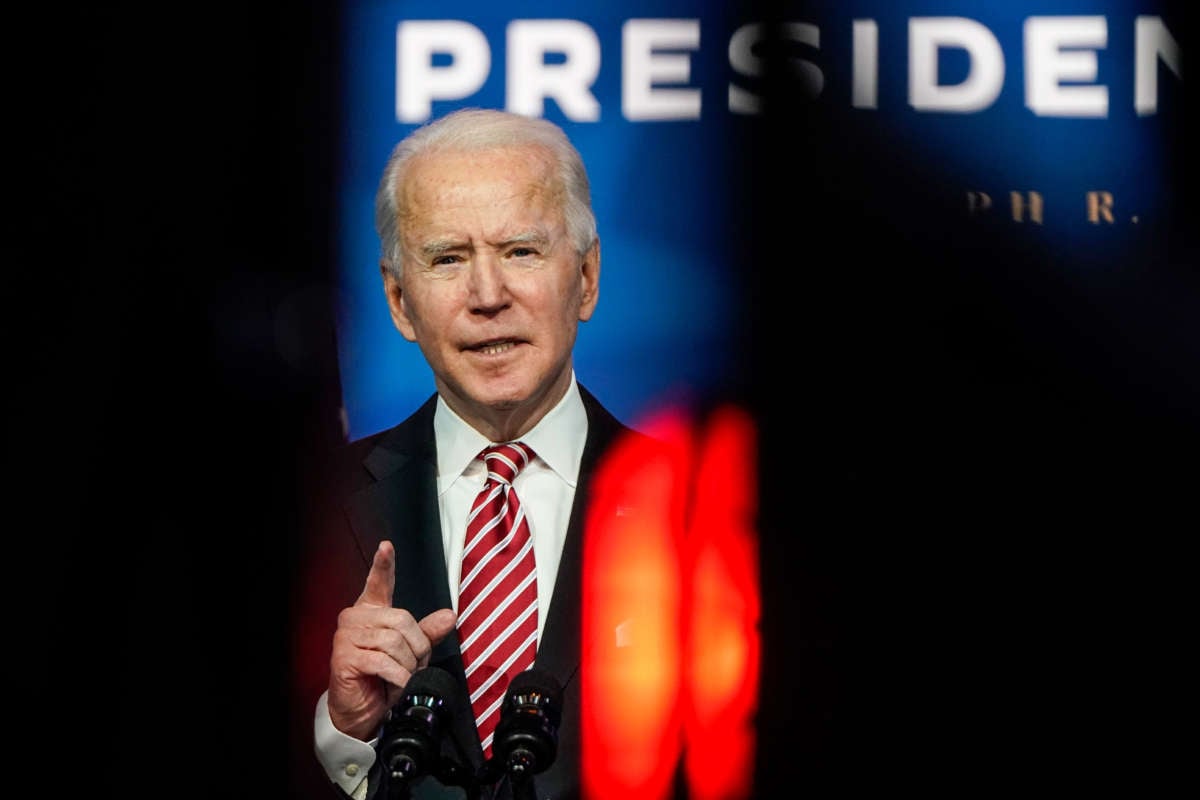

President Joe Biden is exploring the possibility of canceling student loan debt of up to $50,000 per debtor, his chief of staff Ron Klain said on Thursday. Biden has asked Education Secretary Miguel Cardona to compile a memo detailing how he could legally do so as president.

“He asked his secretary of education — just put on the job a few weeks — once he got on the job to have his department prepare a memo on the president’s legal authority. Hopefully, we’ll see that in the next few weeks,” said Klain in an interview with Politico’s Ryan Lizza. “And then he’ll look at that legal authority, he’ll look at the policy issues around that, and he’ll make a decision.”

Though Biden has previously come out against canceling $50,000 worth of student debt, Klain did not confirm the amount Biden is considering when Lizza asked about the $50,000 figure specifically.

Biden has also previously asked the Justice Department to examine the legality of canceling student debt with an executive order. Betsy DeVos, former head of the Education Department under Donald Trump, advised against canceling student loans when she left her post in January. DeVos was infamous for substantially weakening student loan forgiveness programs and rejecting borrowers who rightfully applied for forgiveness.

On Monday, Cardona issued a waiver to make it easier for people with disabilities to have their student loans canceled. Previously, people with disabilities looking to have their student loans canceled were subject to a three-year monitoring period in which they would have to submit paperwork proving that their income is below or at the poverty line every year.

The department has now waived the requirement for that paperwork for the duration of the pandemic and made it retroactive to when Trump first declared a national emergency in March of last year.

The department says that this will help over 230,000 borrowers. More than 41,000 borrowers who had a combined $1.3 billion in loans reinstated due to a failure to report their earnings will get their loans canceled and get refunds for the payments they made during the pandemic; the other 190,000 won’t have to submit income documentation.

The Biden administration also on Tuesday announced an expansion of a pause on student loan interest for more than a million borrowers who are in default of their loan payments. It protects those with loans made as part of the Federal Family Education Loan Program from having their tax refunds seized, White House Press Secretary Jen Psaki said.

Biden has previously said that he is in favor of Congress canceling $10,000 worth of student loan debt per borrower and that any relief of up to $50,000 should be targeted. Biden has previously said that he doesn’t want forgiveness to be going toward people who went to “Harvard and Yale and Penn.”

But progressives and Democrats have been pushing him to cancel more, which lawmakers like Sen. Elizabeth Warren (D-Massachusetts) and Senate Majority Leader Chuck Schumer (D-New York) say he can do with the “stroke of a pen” via an executive order.

The lawmakers, alongside education law experts, argue that it’s perfectly legal to do so. Senators Schumer and Warren announced a proposal in February calling on Biden to cancel up to $50,000 for all borrowers. They say that it is not only the morally correct thing to do, but it would also help kick-start the economy in a time of great need.

Advocates for canceling student debt say that it would result in dramatically better economic outcomes for people who either took on their own debt or took on the debt of their child. “Data show that canceling the student loan debt would result in greater homeownership rates, more housing stability, improved credit scores, higher incomes, higher GDP, more small business formation and more jobs,” Warren said in February.

Since the idea to cancel student debt first gained mainstream political purchase over the past years, Democrats and activists have continually called upon Congress and the president to use their powers to free members of the public from student loans. Student loans can take decades to pay off and are an oppressive force in the lives of many people who took on debt for something that loan cancellation activists say is a basic right.

Warren, Schumer and Sen. Bob Menendez (D-New Jersey) tucked a provision into last month’s stimulus bill to help pave the way for Biden to cancel student loans. The provision makes it so that loan forgiveness would be tax-free through 2025, eliminating the possibility of a surprise tax bill for those whose loans are forgiven.

Labor unions representing teachers, firefighters and health care workers have recently also called on Biden to cancel student debt for people working in public service via an executive order. The Public Service Loan Forgiveness program promises that those who have kept up with loan payments and worked in public service for 10 years can get the rest of their loans forgiven. But the program is deeply broken and mismanaged, and more than 98 percent of people who apply are rejected.

A terrifying moment. We appeal for your support.

In the last weeks, we have witnessed an authoritarian assault on communities in Minnesota and across the nation.

The need for truthful, grassroots reporting is urgent at this cataclysmic historical moment. Yet, Trump-aligned billionaires and other allies have taken over many legacy media outlets — the culmination of a decades-long campaign to place control of the narrative into the hands of the political right.

We refuse to let Trump’s blatant propaganda machine go unchecked. Untethered to corporate ownership or advertisers, Truthout remains fearless in our reporting and our determination to use journalism as a tool for justice.

But we need your help just to fund our basic expenses. Over 80 percent of Truthout’s funding comes from small individual donations from our community of readers, and over a third of our total budget is supported by recurring monthly donors.

Truthout has launched a fundraiser to add 500 new monthly donors in the next 9 days. Whether you can make a small monthly donation or a larger one-time gift, Truthout only works with your support.