Truthout is a vital news source and a living history of political struggle. If you think our work is valuable, support us with a donation of any size.

“Bank of America, Bad for America” went the chant of protesters outside of the Charlotte headquarters with a large ball and chain marked with the word “DEBT” sitting it the background. Meanwhile shareholders piled into the annual meeting that serves as a formality of transparency for publicly traded companies . Unlike previous years, executives experienced something more than formality as people armed with shares of the big bank came to the mic demanding answers and accountability for Bank of America’s alleged fraudulent mortgage practices, funding in predatory payday loan stores, investing in dirty coal, and crashing the economy. The laundry list of wrongdoing by the bank cost millions of families their homes and their health.

According to a Bloomberg report from the inside a shareholder complained of his stocks loss of value and called the bank a “felon.” CEO Brian Moynihan responded with a loaded defense saying, “We abide by the law every day.” That is anything but true.

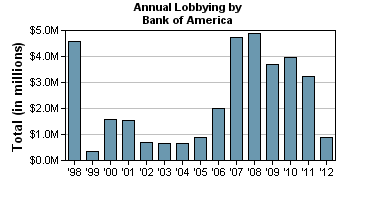

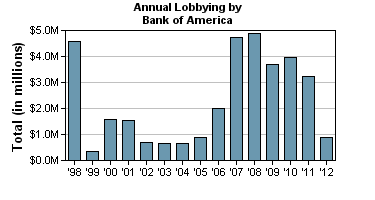

Even after spending millions upon millions of dollars in lobbying fees over the last few years the banks efforts to write the laws failed them. If, as Moynihan suggests, the bank followed the law then why did they need to settle a foreclosure fraud case with the federal government? The illegal practices of the bank, and others because BofA did not act alone, caused tremendous personal harm to hardworking people.

Even after spending millions upon millions of dollars in lobbying fees over the last few years the banks efforts to write the laws failed them. If, as Moynihan suggests, the bank followed the law then why did they need to settle a foreclosure fraud case with the federal government? The illegal practices of the bank, and others because BofA did not act alone, caused tremendous personal harm to hardworking people.

Maria Reyes came from California to tell her heartbreaking story. Before Bank of America bought Countrywide her family bought a home in Hayward, located in the Bay Area, but the conditions of the loan were later found to be deceitful. Countrywide put down her husband’s income as $5,000 a month when he was actually on workers’ compensation. To make matters worse her two sons, also living in and paying for the home, lost their jobs in the construction business during the economic collapse. She only had the house for five years before Bank of America refused to work with her and foreclosed on the home. You can hear Maria tell her story through a translator in the video below.

Robert Kerns, a lawyer in Las Vegas, works with families experiencing similar problems. One client that he could talk about consisted of a outright lies and fraudulent practices against an Ethiopian couple that had become naturalized citizens. During the process to obtain a mortgage for their first home they were told one thing while paperwork said another. After they handed over their life-savings for a down payment their proposed mortgage payment doubled. When they threatened to go elsewhere the bank told them they would have to forfeit the down payment. An outright lie but only detectable with the knowledge of the law like Kerns practices.

These stories are not unique to just a few people. It is a story shared by millions of American homeowners who banks knowingly misguided in order to profit. At the same time Moynihan has received millions in compensation, including $7 million last year alone, while the stock price of the bank has dropped in half since he started in 2010. Prior to the financial collapse Bank of America paid a 64 cent dividend, it now sits at a penny.

A mic check commenced after two hours of questions from activist shareholders and dodging by Moynihan.

“Many of you people may think there are a lot of crazies here today, but this is a pushback,” an attendant told Moynihan moments before. “You’re hearing despair.”

Moynihan’s practiced answers gave little comfort to people struggling to stay in their homes or the one’s fighting for cleaner air. According to Sonny Garcia of National People’s Action, victims of the foreclosure crisis stressed the difficulty in working with Bank of America’s customer service and loan modification process. Moynihan responded with the feel good answer of talking with bank representatives after the shareholders meeting. Quick on their feet an organizer from Garcia’s organization responded appropriately:

“So what we have to do to get loan modifications is to buy a stock, stand in line for two hours, get shook down by the police, get intimidated by other security just so we can get a loan modification.”

It contrasts with their recent announcement that the bank is sending out 200,000 letters asking for mortgage holders to apply for principal write down. But digging deeper into the announcement reveals it at a nice publicity stunt as David Dayen notes.

Protesters want to highlight the hypocrisy coming from Bank of America executives and other billion dollar corporations. Their continued ownership of our nation’s democracy has harmed the lives of many of the protesters. Prior to the rally on Wednesday, organizers staged a boxing match titled “Bank versus America” which pitted a person portraying BofA CEO Brian Moynihan and another representing the 99 percent. In the end, the 99 percent won but for now the fight continues.

The youth burdened with massive student loan debt. Homeowners pledged by banks unwilling to work with them. Asthma, cancer, stroke, heart disease added to communities due to dirty coal and mountaintop removal. Neighborhoods and communities destroyed because of a big bank’s desire for profit over everyday people.

A terrifying moment. We appeal for your support.

In the last weeks, we have witnessed an authoritarian assault on communities in Minnesota and across the nation.

The need for truthful, grassroots reporting is urgent at this cataclysmic historical moment. Yet, Trump-aligned billionaires and other allies have taken over many legacy media outlets — the culmination of a decades-long campaign to place control of the narrative into the hands of the political right.

We refuse to let Trump’s blatant propaganda machine go unchecked. Untethered to corporate ownership or advertisers, Truthout remains fearless in our reporting and our determination to use journalism as a tool for justice.

But we need your help just to fund our basic expenses. Over 80 percent of Truthout’s funding comes from small individual donations from our community of readers, and over a third of our total budget is supported by recurring monthly donors.

Truthout has launched a fundraiser to add 500 new monthly donors in the next 9 days. Whether you can make a small monthly donation or a larger one-time gift, Truthout only works with your support.