When most environmentalists and folks who follow pipeline markets think of TransCanada, they think of the proposed northern half of its Keystone XL tar sands pipeline.

Flying beneath the public radar, though, is another TransCanada-proposed pipeline with a similar function as Keystone XL. But rather than for carrying tar sands bitumen to the Gulf Coast, this pipeline would bring to market shale gas obtained via hydraulic fracturing (“fracking”).

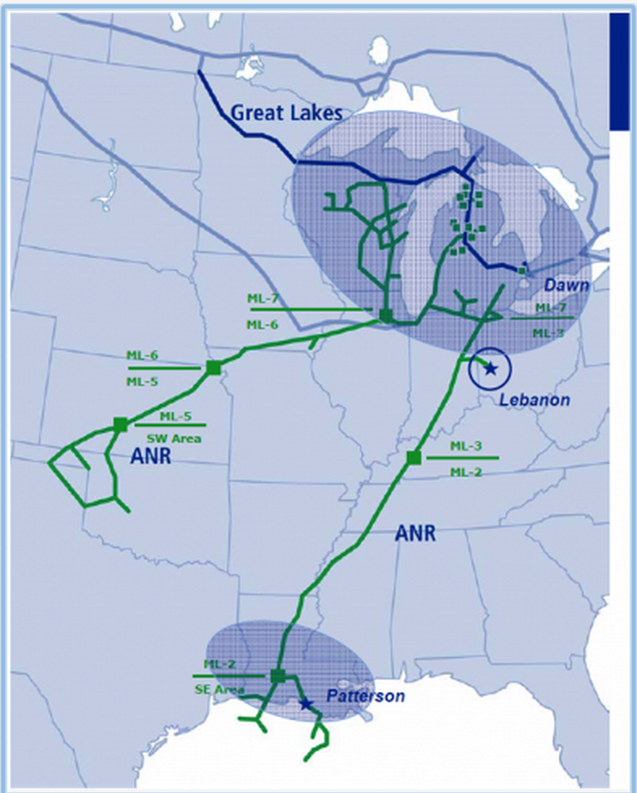

Meet TransCanada’s ANR Pipeline System.

Although not actually a new pipeline system, TransCanada wants ANR retooled to serve domestic and export markets for gas fracked from the Marcellus Shale basin and the Utica Shale basin via its Southeast Main Line.

“The [current Southeast Main Line] moves gas from south Louisiana (including offshore) to Michigan where it has a strong market presence,” explains a March 27 article appearing in industry publication RBN Energy.

Map Credit: RBN Energy

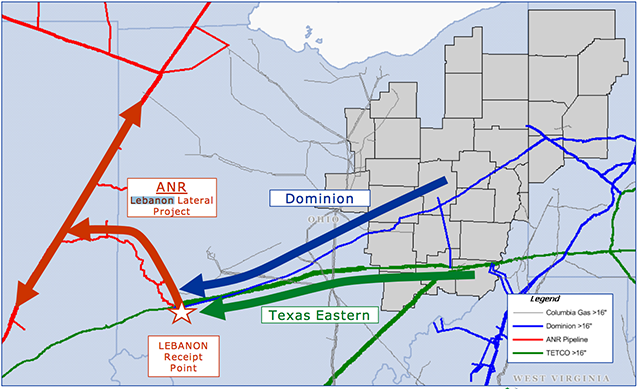

Map Credit: RBN Energy

Because of the immense amount of shale gas being produced in the Marcellus and Utica, TransCanada seeks a flow reversal in the Southeast Main Line of its ANR Pipeline System.

TransCanada spokeswoman Gretchen Krueger told DeSmogBlog that ANR’s flow reversal is a “more efficient use of the system based on market demand.”

Map Credit: TransCanada

Map Credit: TransCanada

TransCanada has already drawn significant interest from customers in the open seasons and negotiations held to date, so much so it expects to begin the flow reversal in 2015.

“ANR Pipeline system has secured almost 2.0 billion cubic feet a day (Bcf/d) of firm natural gas transportation commitments on its Southeast Main Line (SEML) at maximum rates for an average term of 23 years,” reads a March 31 TransCanada press release. “ANR secured contracts on available capacity on the [South East Mainline] to move Utica and Marcellus shale gas to points north and south on the system.”

Like Keystone XL, an Export Pipeline

Like Keystone XL, ANR’s flow reversal will serve — among other things — the global export market.

“This project will…allow more natural gas to move south to the Gulf Coast, where markets are experiencing a resurgence of natural gas demand for industrial use, as well as significant new demand related to natural gas exports from recently approved liquefaction terminals,” TransCanada CEO Russ Girling said in his company’s March 31 press release.

“ANR will continue to be an attractive transportation option due to its strategic foot print, interconnections, on-system storage and access to high demand markets.”

With the debate over liquefied natural gas (LNG) exports heating up in the U.S., ANR has arrived on scene right in the knick of time for the oil and gas industry.

Other Keystone XL: Cove Point or Sabine Pass?

Some recent media coverage of the prospective Dominion Cove Point LNG export facility located in Lusby, Maryland has drawn comparisons to the Keystone XL debate because both involve key pipeline systems, with accompanying plans to export product globally and the Obama Administration has final say over approval (or disapproval) of the pipeline.

Yet, while Cove Point awaits final approval from the U.S. Federal Energy Regulatory Commission (FERC), Cheniere’s Sabine Pass LNG export facility was approved by FERC in April 2012 and opens for business in late 2015.

Enter TransCanada into the mix with ANR and it’s the perfect storm: a Keystone XL pipeline for fracking run by the same company that owns Keystone XL.

Creole Trail: ANR’s Connection to Sabine Pass

ANR feeds into the same Gulf Coast export and refinery markets Keystone XL is set to feed into (and the same ones its already-existing southern half, the Gulf Coast Pipeline Project feeds into).

Port Arthur, Texas — the end point for Keystone XL — is a mere 20 minute drive away from Sabine Pass, Louisiana.

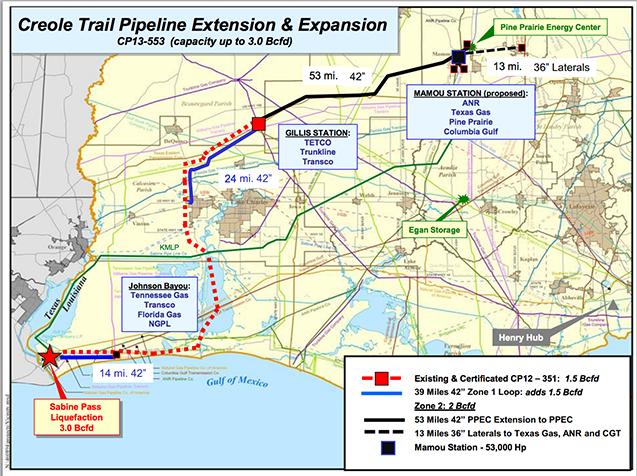

That’s where Cheniere’s Creole Trail Pipeline comes into play, a 94-mile pipeline completed in 2008. Cheniere proposed an expansion project in September 2013 to FERC for Creole Trail, which FERC is still currently reviewing.

Map Credit: Cheniere

Map Credit: Cheniere

If granted the permit by FERC, the expansion would allow Creole Trail to connect to TransCanada’s ANR pipeline at the Mamou Compressor Station located in Evangeline Parish, Louisiana.

Mamou Compressor Station already received an expedited air permit in October 2013 from the Louisiana Department of Environmental Quality (DEQ).

Exports Gone Wild, Climate Disruption Gone Wild

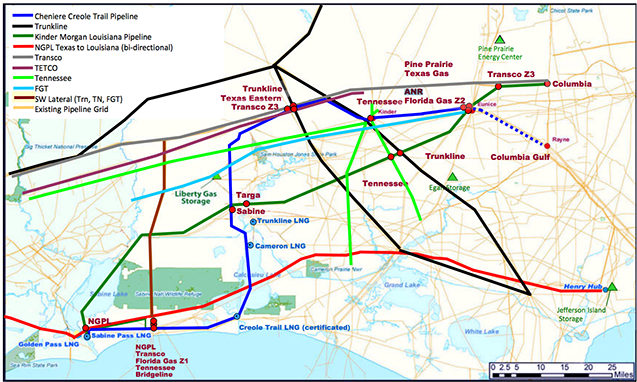

Beyond Sabine Pass, ANR and Creole Trail also connect to other key prospective LNG export terminals neighboring Sabine Pass LNG. That’s depicted clearly in a map appearing in a June 2013 Cheniere corporate presentation.

Map Credit: Cheniere

Map Credit: Cheniere

U.S. Senator Mary Landrieu (D-LA) — new chair of the U.S. Senate Energy and Natural Resources Committee who recently hosted a hearing promoting U.S. fracked gas exports — has called for expedited permitting by FERC of one of those export terminal proposals, Cameron LNG (owned by Sempra Energy which has given her $10,000 toward her re-election efforts).

In short, TransCanada’s ANR — like its tar sands carrying brother Keystone XL — will open the floodgates for exports gone wild.

Which is a short way of saying, given the climate impacts of both shale gas production and tar sands production, both will also help lock in climate disruption gone wild.

Our most important fundraising appeal of the year

December is the most critical time of year for Truthout, because our nonprofit news is funded almost entirely by individual donations from readers like you. So before you navigate away, we ask that you take just a second to support Truthout with a tax-deductible donation.

This year is a little different. We are up against a far-reaching, wide-scale attack on press freedom coming from the Trump administration. 2025 was a year of frightening censorship, news industry corporate consolidation, and worsening financial conditions for progressive nonprofits across the board.

We can only resist Trump’s agenda by cultivating a strong base of support. The right-wing mediasphere is funded comfortably by billionaire owners and venture capitalist philanthropists. At Truthout, we have you.

We’ve set an ambitious target for our year-end campaign — a goal of $250,000 to keep up our fight against authoritarianism in 2026. Please take a meaningful action in this fight: make a one-time or monthly donation to Truthout before December 31. If you have the means, please dig deep.