Did you know that Truthout is a nonprofit and independently funded by readers like you? If you value what we do, please support our work with a donation.

The world of international trade negotiators is an increasingly secret one, with even other agencies of national governments not fully aware of what is being offered by their negotiators in such deals. One current example is a pending “trade” deal called the Trade in Services Agreement (TISA), which is being negotiated among 50 countries, including the United States, the EU, Australia, Canada, Chile, Costa Rica, Hong Kong, Iceland, Israel, Japan, Liechtenstein, Mexico, New Zealand, Norway, Panama, Peru, South Korea, and Switzerland. This agreement is apparently supposed to be “classified” information – in other words, secret and unknown to the public that will be affected by it – for a full five years after it is enters into force or the negotiations are terminated!

That an international treaty that has binding and enforceable obligations can be treated as secret for five years after it comes into force is not only bizarre but almost unthinkable. The need for such secrecy would be inexplicable even if such agreements were actually in the interests of people whose governments are involved in such negotiations. That secrecy is sought would on its own be reason for concern, but the little that has been leaked out of the state of the negotiations suggests even more reasons for alarm, especially because such a deal would have far-reaching implications for financial stability and adversely affect everyone in the world.

One critical element of this relates to liberalisation of rules around financial services, discussed in an Annexe. An April 2014 draft of this Annexe is now available on Wikileaks in yet another important public service provided by this organisation. This draft may have been already superseded by the ongoing negotiations, which are apparently to continue in Geneva in the last week of June, but if it is an indication of what is under way then it deserves to arouse much more public outcry.

The draft defines financial services in the broadest possible manner: “A financial service is any service of a financial nature offered by a financial service supplier of a Party. Financial services include all insurance and insurance-related services and all banking and other financial services.” This explicitly includes not just banking related activities but also security market transactions, asset management, brokering, derivatives market activity, provision of financial information and advice, and so on.

It was the deregulation of precisely these activities that created perverse incentives for risky behaviour and the moral hazard that were so marked in Northern financial markets in the run-up to the global crisis. And the crisis and its aftermath created devastation for real economies and continue to make people suffer through the consequent effects like fiscal austerity. The rampant market imperfections that characterise finance mean that if it is relatively unregulated or only lightly regulated, it will necessarily be prone to boom-and-bust cycles can be just as damaging in future.

Remarkably in such a context, the draft TISA seems to be locking signatory countries into a situation in which they will be unable to undertake the required re-regulation of finance even if such market imperfections persist and their adverse consequences get even more marked. The substance of the legal provisions is to attack or reduce the possibilities of the re-regulation of finance that was attempted in halting and limited manner in the aftermath of the Global Financial Crisis in 2008.

According to Professor Jane Kelsey, whose legal analysis of the document is also available on Wikileaks, the substantive rules target what the still powerful financial services industry sees as obstacles to its seamless global operations, including:

- Limits on the size of financial institutions (too big to fail);

- Restrictions on activities (e.g. deposit taking banks that also trade on their own account);

- Requiring foreign investment through subsidiaries (regulated by the host) rather than branches (regulated from their parent state);

- Requiring that financial data is held onshore;

- Limits on funds transfers for cross-border transactions (e-finance);

- Authorisation of cross-border providers;

- State monopolies on pension funds or disaster insurance;

- Disclosure requirements on offshore operations in tax havens;

- Requiring that certain transactions must be conducted through public exchanges, rather than invisible over-the counter (OTC) operations;

- Approval for sale of ‘innovative’ (often potentially toxic) financial products;

- Regulation of credit rating agencies or financial advisers;

- Controls on hot money inflows and outflows of capital;

- Requirements that a majority of directors are locally domiciled;

- Authorisation and regulation of hedge funds; etc.

But why would countries seek to sign such an agreement that ties their hands so comprehensively, and that too, when it obviously has to be done with such stealth? The continued political power of financial lobbies is clearly evident in this. And this comes not only from the unpleasant reality that big financial players contribute substantially to the campaign funds of leaders in most elected democracies. It also stems from the perception that many governments have that finance still represents a major source of GDP and the provision of cross-border financial services a major source of both foreign exchange and profitability.

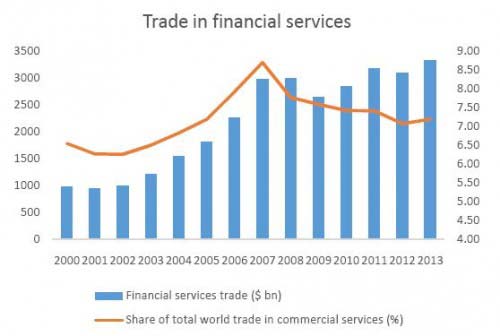

Indeed, as Chart 1 indicates, until the Global Financial Crisis, the export of financial services was growing rapidly both in absolute terms and as a share of total global trade in commercial services. But 2007 proved to be a turning point – thereafter the recovery in dollar terms has been uneven at best and the share of financial services has fallen as a share of services trade.

Chart 1: Trade in financial services slowed down after the global crisis

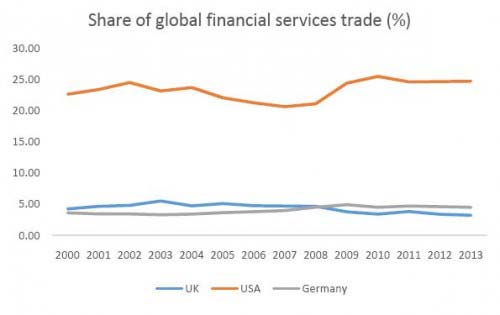

As Chart 2 shows, the country most interested in this is the United States, whose share of global trade in financial services still hovers around a quarter. By contrast, the United Kingdom has seen its share drop slightly while that of Germany has increased slightly in the region of 5%, but that role does explain the strong interest of those countries also in such negotiations.

Chart 2: USA still dominates in exporting financial services

The peculiarity of these negotiations, however, is that even if they do provide more market access and more freedom of functioning to financial service providers in these countries, they will do so at the cost of much higher potential financial instability and all the attendant consequences for market volatility. And the unfortunate point is that such financial fragility in the core economic powers has not just ripple effects but generates financial tsunamis in much of the rest of the world, even if they have tried to institute their own controls and have not signed such agreements. It is remarkable how, despite all that the world’s population has gone through because of the vagaries of finance in the very recent past, such deals that limit the power of governments to control finance are still even being considered, in secret behind closed doors.

Originally published in the BusinessLine.

Media that fights fascism

Truthout is funded almost entirely by readers — that’s why we can speak truth to power and cut against the mainstream narrative. But independent journalists at Truthout face mounting political repression under Trump.

We rely on your support to survive McCarthyist censorship. Please make a tax-deductible one-time or monthly donation.