The Labor Department reported that the economy created just 38,000 new jobs in May, the weakest job growth since September of 2010, when it lost 52,000 jobs. In addition, the jobs numbers for the prior two months were revised down by 59,000, bringing the average for the last three months to just 116,000.

The household survey showed a drop of 0.3 percentage points in the unemployment rate, but this is not especially good news. The decline was almost entirely due to people leaving the labor force. The employment-to-population ratio [EPOP] was unchanged at 59.7 percent, 0.2 percentage points below the peak for the recovery.

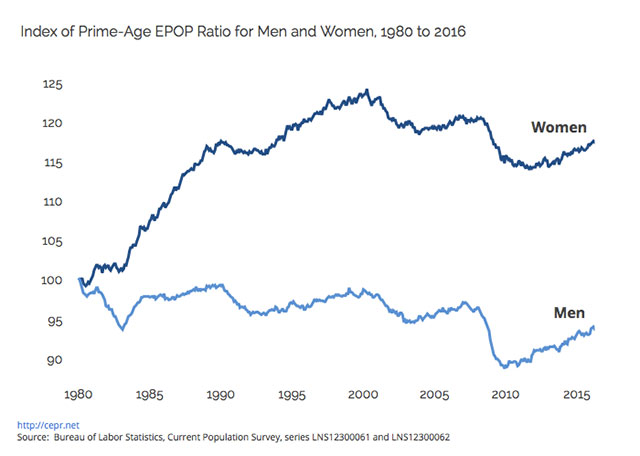

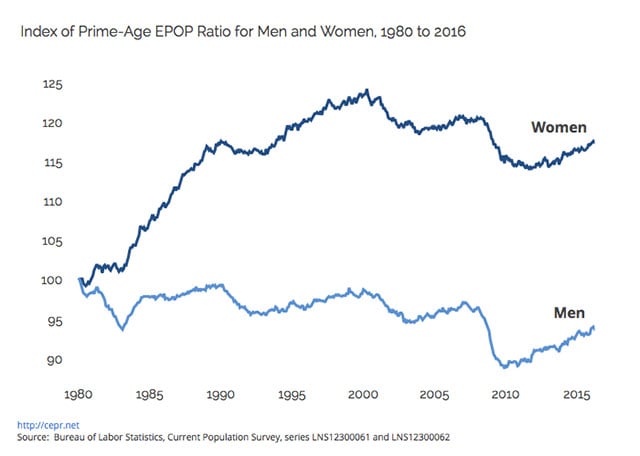

The drop in EPOPs is especially disturbing since it is among prime-age workers and it is for both women and men. The EPOP for prime age workers is still 2.5 percentage points below its pre-recession peak and 4.0 percentage points below the peaks reached in 2000. While many analysts have tried to explain this drop as a supply side story, it seems implausible that a very slight downward trend for men would happen to sharply accelerate in 2001, just as the upward trend for prime age women reverses to a downward trend, due to supply side factors. The only plausible explanation is that the demand for labor has weakened sharply.

Consistent with this pattern, older workers have accounted for a disproportionate share of recent job growth. Employment of workers over age 55 has increased by 831,000 (2.5 percent) over the last year. By comparison, employment has risen by just 460,000 for workers between the ages of 35-44 and 35,000 for workers between ages 45-54. Workers between the ages of 25-34 have been big job gainers, increasing employment by 743,000 over the last year.

Other data in the household survey was mixed. The number of people involuntarily working part-time jumped by 468,000 (7.8 percent). However, the duration measures of unemployment all fell in May. The percentage of unemployment due to voluntary quits was little changed. The number of people who chose to work part-time continued its upward path, growing by 137,000. It is now 656,000 above its year-ago level.

There was little positive news in the establishment survey. While the strike at Verizon lowered the May jobs number by roughly 35,000, the picture would be little different without the strike. The weakness was widely spread across sectors. Only the healthcare sector showed much strength, adding 45,700 jobs, although the relatively high-paying professional and technical services sector added 25,800 jobs. The restaurant sector added 22,200 jobs roughly the same as its average over the last year.

Mining continued to shed jobs in May, losing another 10,200. Manufacturing lost another 10,000 jobs, all of it due to a drop of 18,000 in the durable sector. Over the year, employment in durable manufacturing is down by 80,000. Construction lost 15,000 jobs in May, bringing the two-month loss to 20,000. Retail added just 11,400 jobs after losing 5,100 jobs in April. The temp sector remains weak, losing 21,000 jobs in May. Employment is up by just 17,100 over the last year. Government employment rose by 13,000, but most of this was due to a rise an increase in Postal Service jobs of 9,700.

There is little change in the wage growth picture, with wages up by 2.5 percent over the last year, although the annualized rate comparing the most recent three months with the prior three months is somewhat better at 2.9 percent. It is important to remember that wages have been rising faster than total compensation, as employers have been reducing the generosity of their health care benefits.

Adding to the picture of weakness in this report, the one-month employment diffusion index, which shows the percentage of industries adding jobs, was just 51.3 in May, the lowest reading since February of 2010. The 3-month and 6-month indexes, which reflect employer hiring intentions, were similarly weak. The index of aggregate hours rose just 0.1 percent in May, the same as the prior two months, and is actually below its January level. It would be difficult for the Fed to look at these data and say that the economy should be growing more slowly. Due to weak employment growth, the index of aggregate weekly hours is below its January level.

We’re not backing down in the face of Trump’s threats.

As Donald Trump is inaugurated a second time, independent media organizations are faced with urgent mandates: Tell the truth more loudly than ever before. Do that work even as our standard modes of distribution (such as social media platforms) are being manipulated and curtailed by forces of fascist repression and ruthless capitalism. Do that work even as journalism and journalists face targeted attacks, including from the government itself. And do that work in community, never forgetting that we’re not shouting into a faceless void – we’re reaching out to real people amid a life-threatening political climate.

Our task is formidable, and it requires us to ground ourselves in our principles, remind ourselves of our utility, dig in and commit.

As a dizzying number of corporate news organizations – either through need or greed – rush to implement new ways to further monetize their content, and others acquiesce to Trump’s wishes, now is a time for movement media-makers to double down on community-first models.

At Truthout, we are reaffirming our commitments on this front: We won’t run ads or have a paywall because we believe that everyone should have access to information, and that access should exist without barriers and free of distractions from craven corporate interests. We recognize the implications for democracy when information-seekers click a link only to find the article trapped behind a paywall or buried on a page with dozens of invasive ads. The laws of capitalism dictate an unending increase in monetization, and much of the media simply follows those laws. Truthout and many of our peers are dedicating ourselves to following other paths – a commitment which feels vital in a moment when corporations are evermore overtly embedded in government.

Over 80 percent of Truthout‘s funding comes from small individual donations from our community of readers, and the remaining 20 percent comes from a handful of social justice-oriented foundations. Over a third of our total budget is supported by recurring monthly donors, many of whom give because they want to help us keep Truthout barrier-free for everyone.

You can help by giving today. Whether you can make a small monthly donation or a larger gift, Truthout only works with your support.