I’m going to call this a news item and let you draw the obvious conclusions.

First, the money quote, then the article that contains it. The quote:

In 2012, the top 5 percent of earners were responsible for 38 percent of domestic consumption, up from 28 percent in 1995, the researchers found.

Even more striking, the current recovery has been driven almost entirely by the upper crust, according to Mr. Fazzari and Mr. Cynamon. Since 2009, the year the recession ended, inflation-adjusted spending by this top echelon has risen 17 percent, compared with just 1 percent among the bottom 95 percent.

More broadly, about 90 percent of the overall increase in inflation-adjusted consumption between 2009 and 2012 was generated by the top 20 percent of households in terms of income, according to the study, which was sponsored by the Institute for New Economic Thinking, a research group in New York.

The study mentioned above is fascinating. but reading the report in the New York Times will get you well started. The article is filled with data like this, and thus it’s a must-read in my opinion.

Most consumption now occurs at the top

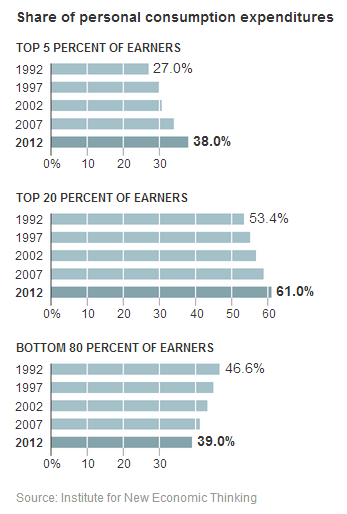

The section just quoted covered change in consumption. There’s information about consumption itself as well, divided among the various moneyed and de-moneyed classes. Take a look at this chart, especially the three bottom lines:

The top 5% of income now accounts for almost 40% of consumption. The top 20% of income now consumes more than 60% of all consumption. Which means that 80% of the nation, by income, accounts for less than 40% of consumption. Again, the trend is widening, as the graphs show.

The “shrinking middle”

The NY Times piece is filled with examples of higher-end products and retailers doing well, along with the very low end (like Dollar Tree). It’s the middle that’s seeing a ton of trouble — dwindling sales, store closings and plummeting stock prices. A taste from the article:

Investors have taken notice of the shrinking middle. Shares of Sears and J. C. Penney have fallen more than 50 percent since the end of 2009, even as upper-end stores like Nordstrom and bargain-basement chains like Dollar Tree and Family Dollar Stores have more than doubled in value over the same period.

The same trend is true for restaurants, where the middle class brands — think Olive Garden and the like — are hurting. At Olive Garden (average bill of about $16 per diner), revenue is falling. At Capital Grille (average bill of about $70 per diner), revenue is up.

Economic growth could be flat at best

Mr. Fazzari, at some point in the article says: “It’s going to be hard to maintain strong economic growth with such a large proportion of the population falling behind.” True on its face.

(Want an added thought? Imagine economic growth when the generation with meager 401k’s and no pension money goes into retirement. They’re waiting in the wing as we speak.)

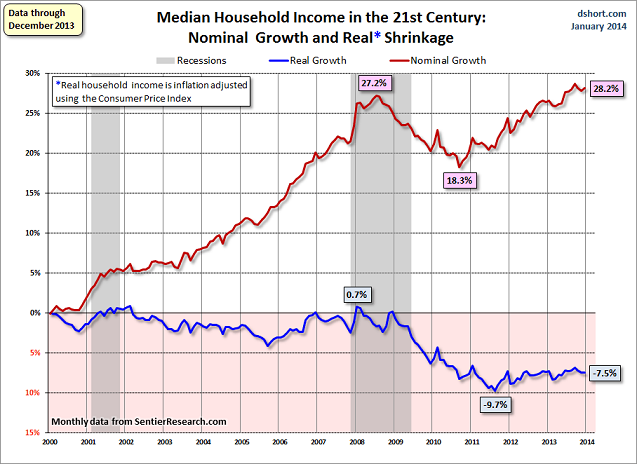

Update: From the comments, this graph, from the January update of this data at Doug Short’s site (click to enlarge):

Short’s comment on it:

[This] chart is my preferred way to show the nominal and real household income — the percent change over time. Essentially I have taken the monthly series for both the nominal and real household incomes and divided them by their respective values at the beginning of 2000. …

The stunning reality illustrated here is that the real median household income series spent most of the first nine years of the 21st century struggling slightly below its purchasing power at the turn of the century. Real incomes (the blue line) hit an interim peak at a fractional 0.7% in early 2008, far below the nominal illusionary peak (as in money illusion) of 27.2% six months later and now at 27.8%, just fractionally off its new high of 28.7% set in September. In contrast, the real recovery from the trough has been depressingly slight.

Tales of the carved-out middle. Do the rich really need the rest of us? If by “us” you mean middle-class Americans, the answer is likely, “No, not any more.”

We’re resisting Trump’s authoritarian pressure.

As the Trump administration moves a mile-a-minute to implement right-wing policies and sow confusion, reliable news is an absolute must.

Truthout is working diligently to combat the fear and chaos that pervades the political moment. We’re requesting your support at this moment because we need it – your monthly gift allows us to publish uncensored, nonprofit news that speaks with clarity and truth in a moment when confusion and misinformation are rampant. As well, we’re looking with hope at the material action community activists are taking. We’re uplifting mutual aid projects, the life-sustaining work of immigrant and labor organizers, and other shows of solidarity that resist the authoritarian pressure of the Trump administration.

As we work to dispel the atmosphere of political despair, we ask that you contribute to our journalism. Over 80 percent of Truthout’s funding comes from small individual donations from our community of readers, and over a third of our total budget is supported by recurring monthly donors.

You can help by giving today. Whether you can make a small monthly donation or a larger gift, Truthout only works with your support.