Is sustainability finally cornering the stock market?

That’s one way to read a recent Bloomberg News report that investment funds with Environmental, Social and Governance (ESG) criteria — often marketed as “sustainable” investment funds — are outperforming the overall stock market.

On the one hand, investors are unmistakably losing patience with fossil fuels.

Coal production fell by 35 percent between 2008 and 2018, while coal’s share of electric power generation plummeted even more. Meanwhile, even as the fracking boom has turned the U.S. into the world’s largest oil and gas producer, it’s been fueled by ballooning debt — and its promises of profit haven’t materialized.

Consequently, coal, oil and gas stocks are dragging down the overall stock market relative to funds that avoid fossil fuel investments. Good news, right? Now for the bad news.

Two sectors that the best-performing ESG funds invest heavily in are financial services (such as Mastercard and Visa) and tech (such as Amazon and Google) — which, Bloomberg claims, “have historically been low-emission sectors.”

Unfortunately, it takes a singularly narrow view of what constitutes a “low-emission sector” to make this claim.

Take Amazon. With its vast supply chain and customers spanning much of the world, the company occupies a central place in a global economy that profits from unsustainable and ever-growing levels of extraction, production, consumption and waste.

In 2019, aside from the 12 percent of its revenue from selling cloud computing services, Amazon obtained 61 percent from sales to customers in the U.S. and Canada, and the bulk of the remaining 27 percent from customers in three other rich countries: Germany, the U.K. and Japan.

The U.S. has the fourth-highest per capita final consumption in the world and the highest greenhouse gas emissions attributable to imports. As a retailer incentivizing this consumption (especially through membership programs such as Amazon Prime), Amazon should be considered responsible for the resulting greenhouse gas emissions.

Moreover, shipping all those products requires a massive amount of packaging, which Amazon has made worse by switching to single-use plastic that can’t be recycled to package many of its shipments — exactly the wrong move in a world that’s awash with plastic waste.

Where does all this plastic come from? It’s fossil fuels, of course. Plastics are a major contributor to greenhouse gas emissions in every stage of their production, use and disposal. As a website that sells a lot of plastic junk, packaged in more plastic junk, Amazon is directly implicated in this damage.

Finally, the cloud computing services division of Amazon is also responsible for climate and environmental destruction — and not just because the company refuses to run its cloud entirely on sustainable energy. Even worse, it sells its cloud services to oil and gas companies, the company says, to “optimize production and profitability.”

Translation: Amazon profits from helping oil and gas companies destroy the planet at lower cost.

While the company happily pollutes in the service of profit, it doesn’t like to be reminded of this fact. It has been in the news lately for bullying and trying to silence employees who have spoken out about the company’s environmental misdeeds.

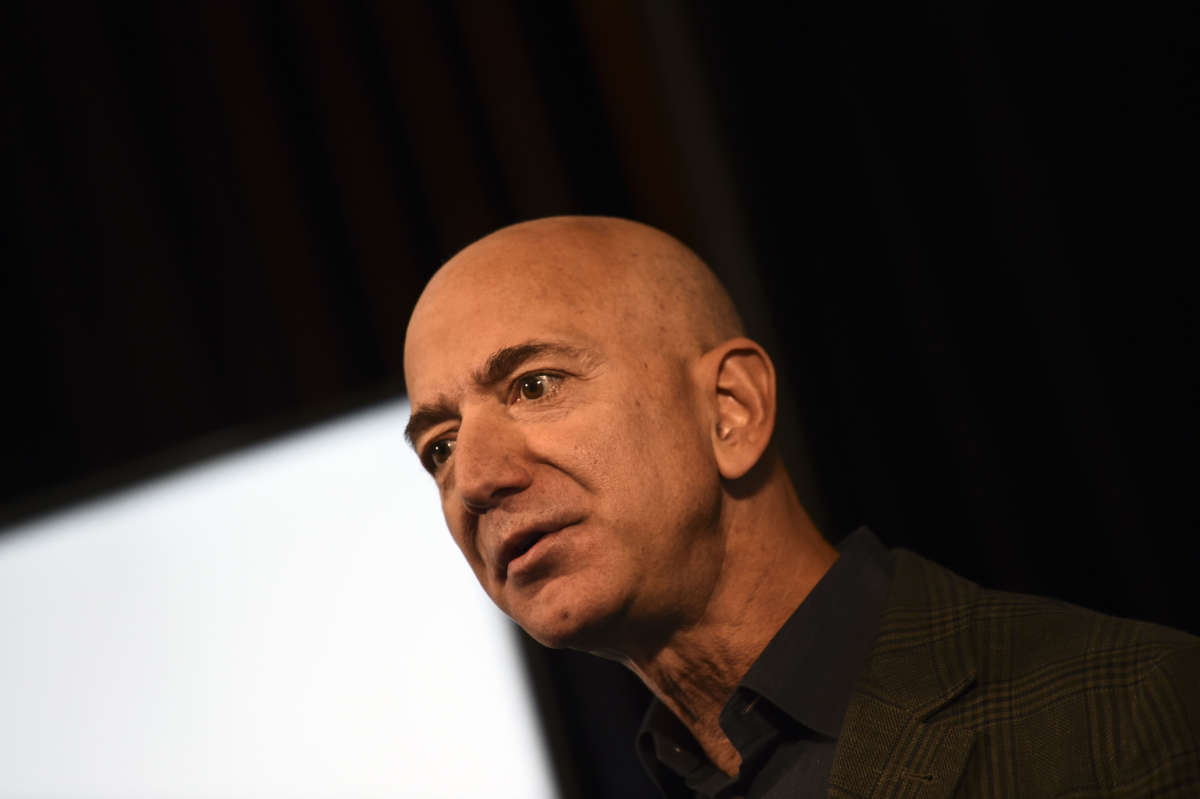

The recent announcement that Amazon founder and CEO Jeff Bezos is donating $10 billion to the newly created Bezos Earth Fund must be seen in this context. It represents merely 8 percent of his net worth of nearly $123 billion, donated to a fund that he controls (as against, say, established organizations with a long track record of fighting for climate justice). And, as Amazon Employees for Climate Justice point out, “one hand cannot give what the other is taking away.”

Amazon is by no means the only anomaly when it comes to businesses some investors consider “sustainable.” The same Bloomberg article refers to a fund that invests in credit card companies “because they can reduce inequality by promoting access to financing for people around the world.”

It’s worth noting that, according to the most recent Federal Reserve data, average credit card interest rates in the U.S. were 14.87 percent. The credit card industry is extractive in the broader sense of the term — extracting high interest payments from struggling lower- and middle-income households, draining communities of wealth.

Make no mistake — it’s a good sign that investors are turning away from fossil fuels. We can’t divest from those industries quickly enough. But it takes either naiveté or willful ignorance to assume that tech or finance are “sustainable” by contrast.

The bigger problem is that the stock market, by its very nature, is dependent on growth at all costs. It’s institutionally incapable of recognizing that the cycle of endless production, consumption, growth and waste is inherently unsustainable. We need a profound political transformation to reverse this trend, not greenwashing masquerading as “socially responsible” investment.

Such a transformation has to start from movements of affected people — workers employed by exploitative corporations, communities affected by their polluting practices, and more. Two movements taking on Amazon provide effective examples.

One is the Athena Coalition, which brings together Amazon warehouse workers and racial and economic justice organizations taking on the company to defend community self-determination. Organized communities, such as those represented in the Athena Coalition, can win against giant corporations.

A year ago, Amazon canceled its plans to build a second corporate headquarters in New York after many of the current members of the Athena Coalition (which hadn’t yet been formed) pressured the company on a range of issues, including the company’s poor record on workers’ rights, the potential gentrification impact of the proposed headquarters, the tax breaks and subsidies the company was seeking, and its sale of technology to law enforcement and immigration enforcement agencies.

Another example is the aforementioned Amazon Employees for Climate Justice, an alliance of Amazon software engineers and other professional employees who are challenging the company on its climate impact, often at great personal risk.

The company’s announcement of a goal of net zero greenhouse gas emissions by 2040, and founder-CEO Bezos’s commitment to donate $10 billion for climate action are far from just and adequate responses to the climate crisis. But it’s also clear that the company and its leader wouldn’t have made even these token gestures without growing pressure from employees. The timing of the net zero emissions pledge — it was made on September 19, 2019, the day before more than 1,500 Amazon employees joined the global climate strike — makes the connection clear.

It is from movements such as these that a new political and economic system that places people and planet over corporate profit will emerge.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $50,000 in the next 9 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.