Did you know that Truthout is a nonprofit and independently funded by readers like you? If you value what we do, please support our work with a donation.

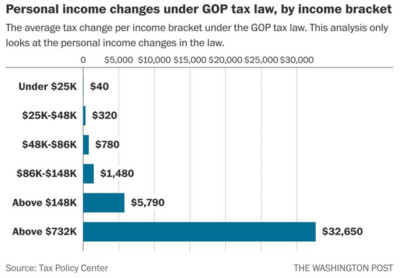

In its first analysis of how the GOP tax plan will affect Americans’ personal income taxes alone, the nonpartisan Tax Policy Center (TPC) this week underscored what experts and most of the public already knew: that the Republican tax law will pour tens of thousands of extra dollars into pockets of the wealthy few while providing mere crumbs for the poor.

Specifically, according to TPC’s new report, the top one percent of earners will receive an average annual tax cut of around $33,000 just from individual tax changes under the GOP law. The poorest Americans, by contrast, will see an average break of about $40 per year.

“While most of the corporate tax cuts flow to the top of the income distribution, what this shows is that even in the direct changes to the individual-side of the tax code, most of those changes are still being allocated to the top,” Kim Rueben, a senior fellow at TPC, told the Washington Post.

The Post published a visual of the disproportionate gains seen by those at the very top:

As the Post’s Jeff Stein noted in a breakdown of TPC’s analysis on Friday, the tax break for the wealthiest is even larger — $51,140 — when the corporate tax cuts and the reduction of the estate tax are factored in.

TPC’s analysis of the Republican tax plan — which President Donald Trump signed into law last December — comes as profitable companies continue their stock buyback binge while most Americans report seeing very few if any changes in their paychecks.

Despite Treasury Secretary Steve Mnuchin’s promise that Americans would start seeing a positive bump in their checks no later than February 15, the majority of the public said they have yet to see any boost from the GOP tax law, according to a CNBC poll published on Tuesday.

Press freedom is under attack

As Trump cracks down on political speech, independent media is increasingly necessary.

Truthout produces reporting you won’t see in the mainstream: journalism from the frontlines of global conflict, interviews with grassroots movement leaders, high-quality legal analysis and more.

Our work is possible thanks to reader support. Help Truthout catalyze change and social justice — make a tax-deductible monthly or one-time donation today.