Honest, paywall-free news is rare. Please support our boldly independent journalism with a donation of any size.

Just after midnight on Oct. 17, President Obama signed legislation that avoided a dangerous default and reopened the government after the third-longest government shutdown in history. Under the terms of the deal, the government was funded through Jan. 15, 2014, and the debt limit was extended until Feb. 7, 2014.

A 29-member bipartisan conference committee, heavily weighted toward Senate representatives, was established and charged with developing budget recommendations by Dec. 13. Given the recent failures of such efforts to resolve differences between the House and Senate, the chances of success this time around are slim, suggesting another potential showdown after the holidays. As the committee begins its work, it is clear that the next couple of months will be an intense time full of opportunities to influence both policy and public opinion.

Sequestration: The Deepening Costs

“This was a hard vote for all of us,” California Rep. Karen Bass (D) told MSNBC’s Chris Hayes. Bass’s comment rejects any sort of celebration of the terms for ending the shutdown. Instead, she reminds us that while sequestration may have largely faded from the national news over the last six months, its painful impacts on families and communities across America will now continue until at least January and perhaps far longer. Children who would greatly benefit will continue to be turned away from Head Start; seniors who are hungry will continue to see their Meals on Wheels deliveries reduced; and states will see their budget woes grow as federal support payments for everything from housing to economic development continue to be curtailed. [Stories of the human and economic impact of the sequester continue to flow in and are being collected on our Sequestration Central page.]

Congressional Democrats fought for a shorter-term continuing resolution because they hoped that the new process would create opportunities for replacing the indiscriminate across-the-board spending cuts imposed by the sequester, with a combination of more targeted budget cuts and focused loophole closures and other revenue raisers.

Many government agencies took care to mitigate the sequester’s effects, thus avoiding the worst-case scenarios many, including the White House, said could occur. However, the way agencies often did this was by curtailing activities that mattered less in the short run – such as training and outreach – to bolster activities that had immediate implications, such as Occupational Safety and Health Administration inspections. However, this short-run mitigation has long-term consequences. The longer sequestration lasts, the more the negative effects of this approach will show. The bottom line is that we can pay for effective government now, or we’ll pay more to address the negative consequences later.

The Minority Staff of the House Appropriations Committee provided this useful look at the harm caused by continued sequestration under House spending levels:

- House funding for Special Supplemental Nutrition Program for Women, Infants, and Children (WIC), a highly effective nutrition program for low-income participants, would deny participation to about 214,000 eligible applicants. Compared to the president’s request, 454,000 eligible applicants would go unserved.

- Based on the Ryan budget, the House continues to inadequately fund the Food and Drug Administration, preventing the full implementation of vital food safety modernizations that protect consumers from foodborne outbreaks like the recent case of tainted pomegranate seeds imported from Turkey that infected people with hepatitis A.

- The National Science Foundation (NSF) would be cut $195.5 million below the FY 2013 level and $630 million below the president’s request at a time when maintaining the United States’ competitive edge in science and technology is more important than ever.

- NSF’s Research and Related Activities account would be funded at $536 million less than the president’s request. Nearly 1,800 fewer competitive awards would be funded, impacting nearly 20,000 researchers, teachers, students, and technicians.

- NSF’s Education and Human Resources account would be cut $55 million below the president’s request. This cut would result in nearly 90 fewer awards, affecting more than 1,600 researchers, teachers, and students. The federal government funds 53 percent of basic research investment in the U.S., compared to just 23 percent funded by industry, according to research cited by Jeff Madrick in Harper’s Magazine. These investments pay big dividends, according to Madrick: 77 of the 100 most important innovations of 2011 as identified by R&D Magazine were at least in part funded by the U.S. government.

- The House-reported bill would continue recent cuts to the IRS budget by slashing it by $2.85 billion below the FY 2013 pre-sequester level, and $3.85 billion, or 30 percent, below the level requested by the president. This will force the IRS to eliminate 25,000 positions, which in turn will cause both IRS audits and services offered to plummet. Only one in five phone calls from taxpayers will be answered at the IRS. Tax cheats will not be pursued as vigorously. In fact, the IRS projects that the cuts will result in $12 billion in uncollected revenue, thereby increasing the deficit.

The Budgetary and Economic Context

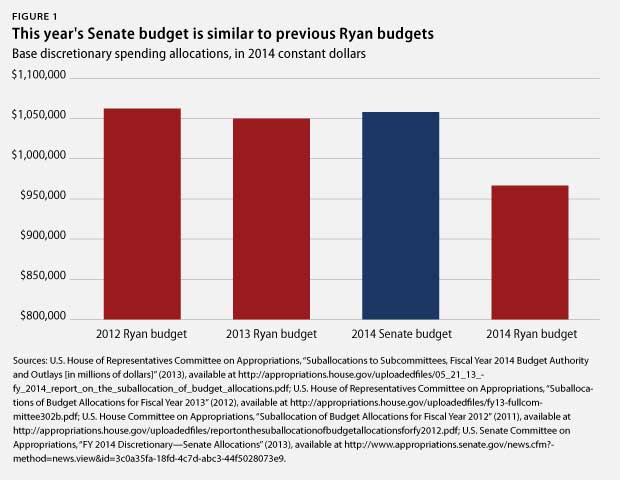

Between now and any new bills to keep the government funded, due on Jan. 15, sequestration levels are continuing under the bipartisan Senate-drafted plan. This is a major step back and a compromise from what Senate Democrats wanted in the budget that they passed in April. However, the Senate Democrats’ April budget proscribed budget levels similar to those proposed by House Budget Committee Chairman Paul Ryan (R-WI). Thus Democrats have substantially compromised from their previous, higher budget positions.

“Progressives have repeatedly made significant concessions in order to protect the economy from a series of manufactured crises,” wrote the Center for American Progress’s Michael Linden and Harry Stein. The “legislation to keep the government open sets funding levels that are even lower than previous compromises.”

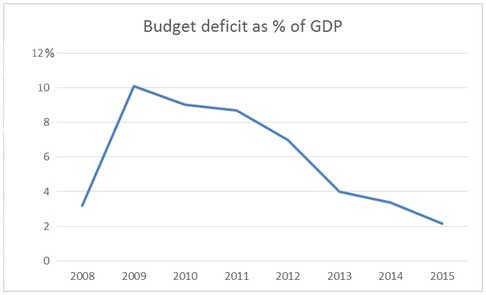

As a result of these lower levels of spending, as well as more tax revenue, the size of the annual U.S. federal deficit has dropped substantially. It is projected to stay at historically low levels for the next several years. Since peaking in 2009 at 10 percent of GDP, the Congressional Budget Office recently estimated that the deficit is currently under four percent of GDP and is expected to decline to about two percent of GDP by Fiscal 2015.

The sequester is holding back growth and impeding job creation according to the Congressional Budget Office: “In the absence of sequestration, CBO estimates, GDP growth would be about 0.6 percentage points faster during this calendar year, and the equivalent of about 750,000 more full-time jobs would be created or retained by the fourth quarter.” Reflecting on this assessment, Federal Reserve Chairman Ben Bernanke told the Senate Banking Committee last February that it would be best for Congress to “consider replacing the sharp, frontloaded spending cuts required by the sequestration with policies that reduce the federal deficit more gradually in the near term but more substantially in the longer run.”

Sacking the Sequester and Assuring Adequate Resources to Invest in America

Replacing the sequester is necessary but not sufficient. If we allow the debate to be circumscribed by the sequester, we will be buying into conservative framing that government must get by at some of the lowest funding levels in modern history. Individual and corporate income tax revenue in the United States as a share of GDP was 8.9 percent last year. It was 10.2 percent of GDP in 1987 after two significant tax cuts under Ronald Reagan and 14.1 percent of GDP in 1952 when Dwight Eisenhower sat in the Oval Office.

Rather than putting the deficit first, we should instead put people first and shift the conversation to creating good jobs and understanding government’s role in that. We need adequate government revenue to invest in schools that prepare students for 21st century jobs, including stepping up investments in science, math, and technology. We need adequate revenue to invest in basic research that will reestablish the United States as a leader in innovation, thereby creating jobs in exciting new industries. We need to reclaim compassion as a core American value and assure that those who are vulnerable – whether due to poor health, old age, job loss, poverty, or natural disaster – that they can feel secure in the knowledge that their fellow Americans won’t let them down. We need to invest in helping U.S. families and U.S. businesses become more energy efficient. And we need to protect people and the environment with greater transparency and stronger safeguards.

Here are some of our favored ideas for reaching these goals:

Revenue-positive tax reform ($500+ billion) – Tax reform will be a significant part of the budget debate. Many in Congress have expressed interest in revenue-neutral tax reform, closing some of the loopholes but using these savings to lower individual and corporate tax rates. This would lock in today’s low level of tax collections for decades to come and undo successes earlier this year in restoring top tax rates to pre-Bush tax cut levels.

We support changes that would make the tax code fairer and more progressive. Specifically, we favor closing the following tax loopholes and using the additional revenue to invest in jobs, infrastructure, education, and strengthened regulatory enforcement:

End offshore tax abuse (would raise $220 billion over 10 years) – Multinational corporations have intensified their use of aggressive accounting practices to shift their U.S. profits to offshore tax havens. By some accounts, corporate tax haven abuse alone costs the U.S. Treasury $90 billion a year. Nearly $2 trillion of U.S. corporate assets are currently held offshore – all of it untaxed in the United States.

Adopt Buffett Rule ($171 billion over 10 years) – The Buffett Rule would require that taxpayers earning $1 million or more to pay an effective tax rate at least as high as middle-class taxpayers.

End subsidies for CEO pay ($75 billion over 10 years) – Current tax law allows corporations to deduct limitless amounts of executive pay so long as the pay is based on achieving measurable performance targets. Pending legislation would eliminate the performance pay loophole and cap this deduction at $1 million per executive per year; current law also allows corporations to report one cost for stock-based compensation and to deduct a higher amount from their taxes.

Abolish Carried Interest Exception ($21 billion over 10 years) – The carried interest exception allows hedge funds managers to pay taxes on their earnings at the 20 percent capital gains rate, rather than the individual income tax rates. The nine top hedge fund managers each made more than $500 million in 2012.

Eliminate “corporate tax extenders” that reward offshore tax dodging (one-year cost in 2013: $10 billion) – The corporate tax extenders bill is a package of 30 corporate tax subsidies renewed as a package every year or two by Congress. The cost of the total package when last renewed in January was nearly $41 billion. Of these, two subsidies have little economic value and exist simply to reward companies that have successfully shifted U.S. profits offshore. These two provisions are referred to as the “active financing exception” and “the controlled-foreign corporation look-through.”

Targeted user fee increases ($2+ billion over ten years) – User fees accounted for nearly $300 billion in government revenue in fiscal year 2012. The president’s budget for 2014 proposes an additional $221 million in user fees pertaining to heightened inspections of U.S. food production facilities and imports of foreign-produced foods. Additional user fee opportunities are possible to fund enhanced enforcement of worker health and safety laws.

Give Medicare Part D the power to negotiate drug prices ($123 billion over ten years) – Medicare Part D is a program that subsidizes prescription drug purchases. For those whose income is less than 150 percent of the poverty line, a low-income subsidy helps pay for monthly premiums, annual deductibles, and drug co-payments. Low-income subsidy beneficiaries make up approximately 40 percent of Part D beneficiaries, but they account for three-quarters of the government’s spending on the program. The White House proposes to allow those who qualify for Part D subsidies to receive the same government-negotiated rebates available to Medicaid recipients.

Reforming crop insurance subsidies ($4-$80 billion over ten years) – Crop insurance subsidies were originally intended to make insurance against crop losses more affordable to family farmers. However, crop insurance programs have morphed into corporate welfare. The government props up the business side of crop insurance companies – paying for their operations and guaranteeing their profits – and also subsidizes farmers’ purchases of crop insurance. The White House has proposed new rules that would limit the rate of return crop insurers could earn and curtail government reimbursement of the insurer’s operating costs. These changes would save $4 billion over 10 years. A bolder package of reforms proposed by the Environmental Working Group would save $80 billion over the next decade.

Cancel F-35 aircraft and invest instead in extending life of existing fleet ($78 billion over ten years) – The controversial F-35 Joint Strike Fighter has strong critics in both political parties and is an inferior weapon, especially given its price tag. Development of the aircraft is horrifically over-budget, and the Pentagon forecasts it will cost more than $1 trillion to operate and maintain the aircraft over its serviceable life. A Congressional Budget Office analysis found that investing in new systems for existing F-16 and F/A-18 aircraft could extend their lives and allow them to address the same threats that the F-35 aims to protect against. Doing so would save $78 billion, according to CBO.

Other Defense Savings ($82 billion over ten years) – Several weapons program could be replaced with cheaper effective alternatives that would create substantial savings. Also, some activities that are not necessary to national security, such as military bands, could be cut back.

Nick Schwellenbach contributed to this article.

Trump is silencing political dissent. We appeal for your support.

Progressive nonprofits are the latest target caught in Trump’s crosshairs. With the aim of eliminating political opposition, Trump and his sycophants are working to curb government funding, constrain private foundations, and even cut tax-exempt status from organizations he dislikes.

We’re concerned, because Truthout is not immune to such bad-faith attacks.

We can only resist Trump’s attacks by cultivating a strong base of support. The right-wing mediasphere is funded comfortably by billionaire owners and venture capitalist philanthropists. At Truthout, we have you.

We’re in the midst of a fundraiser, and as of right now, we have until midnight to raise $12,000. Please take a meaningful action in the fight against authoritarianism: make a one-time or monthly donation to Truthout. If you have the means, please dig deep.