In April, Gretchen Morgenson boldly called out the hypocrisy of BlackRock pillorying corporate short-termism while the investment giant simultaneously approved more than 96 percent of executive pay packages last fiscal year. She also described one BlackRock investor’s intrepid campaign to better align the company’s supposed philosophy with its executive pay practices: Stephen Silberstein, a retired software company founder, wrote a shareholder proposal for reform, and BlackRock investors and shareholders in general (including anyone with a pension or college savings) should take heed.

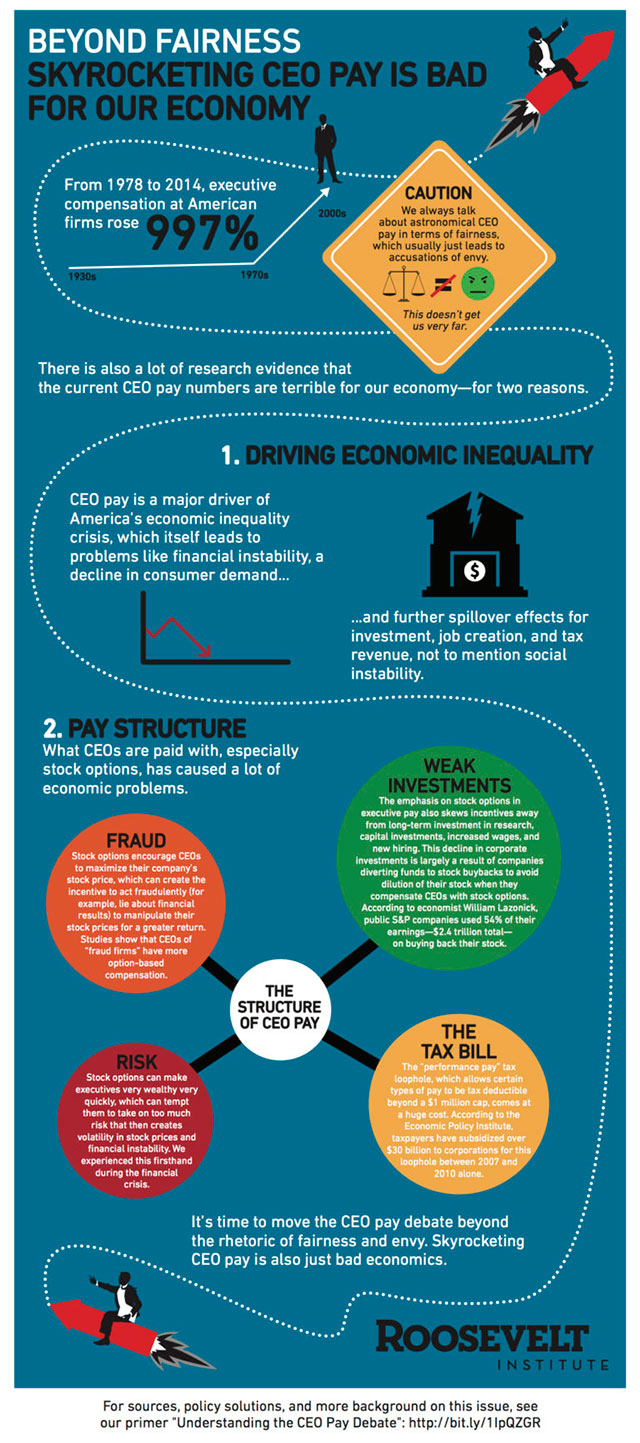

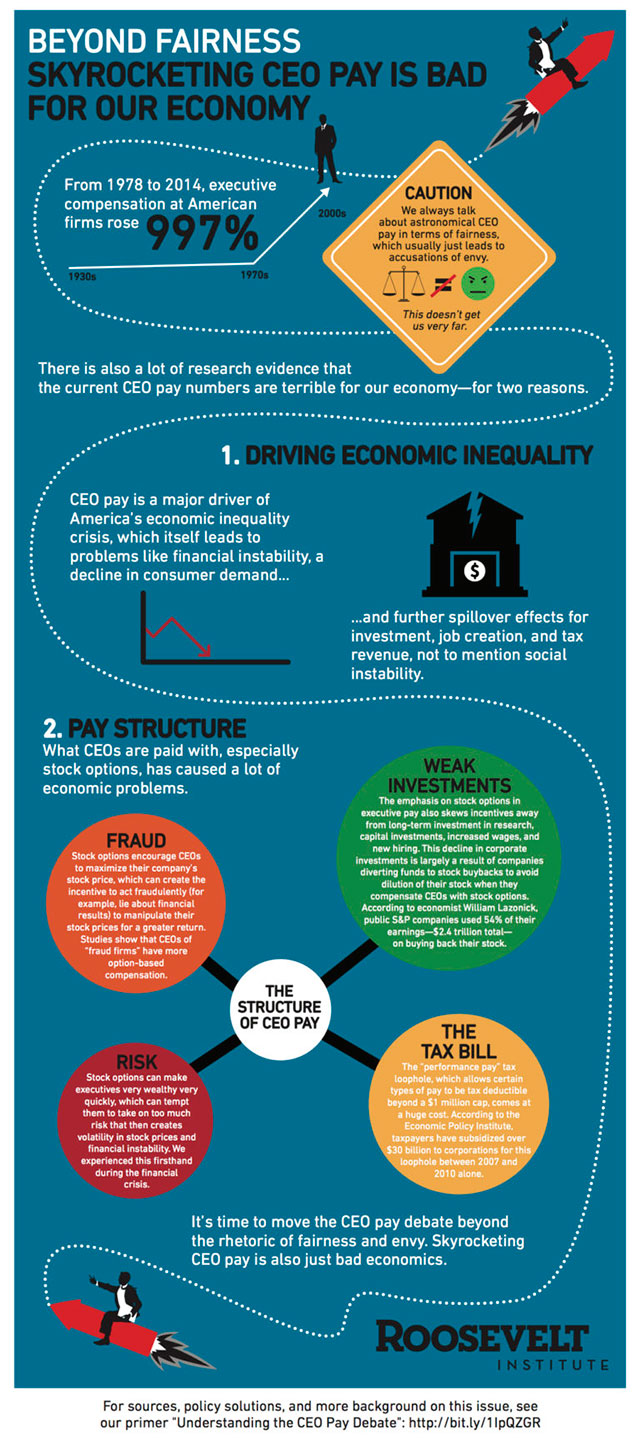

The important connection between short-termism and executive pay that Morgenson and Silberstein are making is not widely understood. People who object to America’s grotesque CEO pay practices usually do so in terms of fairness, which is an argument that certainly has its own merit. But what many Americans are not aware of is how bad CEO pay practices are for the economy, particularly in terms of how they are so tied up with short-termism.

Simply put, short-termism is the heavy emphasis corporate managers and shareholders have increasingly placed on the next quarter’s stock price over the long-term growth and viability of a company. Executive pay is arguably the primary driver of short-termism. Since the early 1990s, the trend has been to compensate executives primarily with “performance pay,” particularly stock options, in order to align the motivations and incentives of executives with corporate shareholders. (Incidentally, this practice helped to propel CEO pay into the stratosphere, as median pay for CEOs of S&P 500 Industrials soared from close to $2 million to nearly $6 million over the course of the 1990s. In 2014, median S&P 500 pay was $10.8 million.)

When executives get paid with stock equity, company stock gets “diluted.” In other words, a company’s outstanding shares rise and share prices fall. According to economist William Lazonick, this has led to the widespread practice of stock buybacks — that is, repurchasing a company’s stock to boost its value. The trouble is, this comes from the same pot of money that could and should be spent on new hiring, wage increases, and investment in research and innovation.

In other words, buybacks epitomize corporate short-termism. They are bad for the long-term health of companies, for workers, for shareholders, and for the economy as a whole. And buybacks — along with policies such as the performance pay tax loophole — are the reason that companies can pay corporate executives so much. Lazonick argues that “the only logical explanation for open-market stock repurchases … is that corporate executives benefit personally from this mode of corporate resource allocation through their ample stock-based pay.”

Larry Fink, BlackRock’s chief executive, is rumored to be positioning himself as a candidate for Treasury Secretary if Hillary Clinton is elected. As such, he is likely to intensify his public fight over short-termism. But BlackRock investors (who can still vote until May 25, the date of the annual shareholders meeting) and the American public in general need to remember that CEOs must play a central role in making the transition away from corporate short-termism toward long-term value, and that can only happen if we also reform the ways in which CEOs are paid.

For more information on the economic problems of CEO pay, see this infographic:

Angry, shocked, overwhelmed? Take action: Support independent media.

We’ve borne witness to a chaotic first few months in Trump’s presidency.

Over the last months, each executive order has delivered shock and bewilderment — a core part of a strategy to make the right-wing turn feel inevitable and overwhelming. But, as organizer Sandra Avalos implored us to remember in Truthout last November, “Together, we are more powerful than Trump.”

Indeed, the Trump administration is pushing through executive orders, but — as we’ve reported at Truthout — many are in legal limbo and face court challenges from unions and civil rights groups. Efforts to quash anti-racist teaching and DEI programs are stalled by education faculty, staff, and students refusing to comply. And communities across the country are coming together to raise the alarm on ICE raids, inform neighbors of their civil rights, and protect each other in moving shows of solidarity.

It will be a long fight ahead. And as nonprofit movement media, Truthout plans to be there documenting and uplifting resistance.

As we undertake this life-sustaining work, we appeal for your support. Please, if you find value in what we do, join our community of sustainers by making a monthly or one-time gift.