Honest, paywall-free news is rare. Please support our boldly independent journalism with a donation of any size.

Washington – The Bush-era tax cuts that are set to expire on Dec. 31 are expected to be extended temporarily by the lameduck Congress, with a two-year extension the most promising compromise.

But the path to getting that fix approved is going to be bumpy, and there’s fear that if the debate gets unusually ugly, the extension won’t be approved at all this year. Failing to act means tax rates will jump next year and will return to pre-2001 and 2003 rates.

Nonetheless, there’s reason for optimism that the Dec. 31 deadline will be met: The key players are sending strong signals they’re willing to accept a temporary fix. And the Internal Revenue Service is warning lawmakers that the later they wait to change 2011 tax law, the more likely it is that consumers and businesses could face confusion and delays in getting refunds.

Thursday, David Axelrod, a top adviser to President Barack Obama, told the Huffington Post the administration is ready to accept an extension.

“We have to deal with the world as we find it,” he said. “The world of what it takes to get this done.”

President Barack Obama said last week he was ready for a “serious conversation” on a compromise, despite his longstanding insistence he wants the cuts continued only for individuals with an adjusted gross income less than $200,000 and couples less than $250,000.

On the Republican side, Sen. Orrin Hatch, R-Utah, who’s slated to become the top Republican on the tax-writing Senate Finance Committee, said this week that a temporary extension “would garner support from Democrats and Republicans alike. That path forward is an extension of all the tax relief well past the next election.”

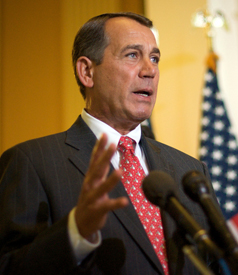

Some Republican leaders in the House of Representatives also have signaled that they’re open to a vote on a two-year fix. But others in GOP are digging in. Ohio’s John Boehner, who’s set to become House speaker, said Wednesday he wants a permanent extension.

But the temporary extension is gaining momentum because it would allow both parties to use the issue in the 2012 campaign. And making the tax cuts permanent wouldn’t require a vote until a lame duck session after the 2012 presidential election.

Do you like this? Click here to get Truthout stories sent to your inbox every day – free.

All this logic and leadership firepower, though, may not convince the rank and file in Congress to move ahead.

Most Democrats have been adamant that there should be no more tax breaks for the wealthy. The current top rates, now 33 and 35 percent, would return to pre-Bush levels of 36 and 39.6 percent for the richest Americans.

Many also think that continuing the tax cuts is too costly.

Letting the tax cuts for wealthiest expire would reduce the deficit by about $700 billion over 10 years. Extending all the cuts adds to the deficit — the shortfall between what government collects and what it spends — by an estimated $2.5 trillion over a 10-year period.

Democrats aren’t eager to fight only for the middle-class tax cuts because many moderates made it clear before the election they wanted all the cuts extended. Their rationale: They didn’t want to be accused of raising taxes during the economic slump.

In the Senate, since at least four Democrats expressed such reservations, it seems nearly impossible to get support for middle class-only cuts.

Robert Bixby, the executive director of the Concord Coalition, a bipartisan budget watchdog organization, said: “That’s really just the tip of the iceberg.”

That’s because Congress also must extend a fix to the alternative minimum tax, a creeping tax that was never indexed to inflation and thus threatens to snare 21 million taxpayers if it isn’t patched. A bipartisan group of senators this week voiced support for raising the AMT limit in 2010.

Should that limit continue to expand, “you’re really talking about $4 trillion to make them permanent over 10 years. The expectations of getting a balanced budget anytime soon are quite exaggerated,” Bixby said.

Boehner has pledged to cut spending by $100 billion a year, but Bixby thinks that’s hardly a serious solution to the nation’s budget woes.

“If you are extending tax cuts that cost more than $100 billion a year, and entitlements (Social Security and Medicare) are growing at more than $100 billion a year, you are really not improving the situation dramatically,” Bixby said, adding that hard choices about cutting the sacred cows of government spending are needed.

But allowing even some rates to return to pre-Bush levels, other Democrats argue, means taxes are going up during a serious economic slump.

“Most economists predict that our nation will face continued economic weakness for the next 18 months to two years,” said Senate Budget Committee Chairman Kent Conrad, D-N.D. “The general rule of thumb is that you do not raise taxes or cut spending during an economic downturn. That would be counterproductive.”

While there’s talk of compromise, the political squabbling already has consequences on taxpayers, as IRS Commissioner Douglas Shulman noted in a Nov. 5 letter to key lawmakers.

“The later that Congress passes tax law changes that affect 2010, the more strain it would have on the IRS’s limited resources, which have been tapped on numerous occasions over the last three years to implement tax legislation,” Shulman wrote.

“If an AMT is not enacted until late this year, it is likely that the IRS would need to delay the ability of millions of AMT taxpayers to file their tax returns and access any refunds that may be due.”

Lawmakers in both parties talk about supporting the economic recovery, but their inability to agree on the tax changes carries real consequences for taxpayers and businesses.

“I would also stress that if AMT legislation affecting 2010 tax returns is enacted after January 1, 2011, it is not clear that the IRS could provide the benefits of the legislation during the normal tax filing season and it would cause severe disruption to the tax filing season,” Shulman said.

On The Web

Trump is silencing political dissent. We appeal for your support.

Progressive nonprofits are the latest target caught in Trump’s crosshairs. With the aim of eliminating political opposition, Trump and his sycophants are working to curb government funding, constrain private foundations, and even cut tax-exempt status from organizations he dislikes.

We’re concerned, because Truthout is not immune to such bad-faith attacks.

We can only resist Trump’s attacks by cultivating a strong base of support. The right-wing mediasphere is funded comfortably by billionaire owners and venture capitalist philanthropists. At Truthout, we have you.

Our fundraising campaign is over, but we fell a bit short and still need your help. Please take a meaningful action in the fight against authoritarianism: make a one-time or monthly donation to Truthout. If you have the means, please dig deep.