Poland is not yet lost. But its leaders remain determined to give disaster a chance.

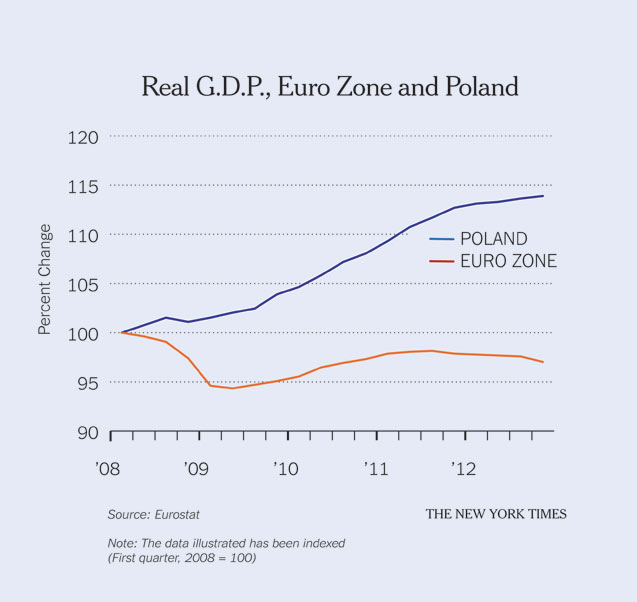

Poland is one of Europe’s relative success stories. It avoided the severe slump that afflicted much of the European periphery, then had a fairly strong recovery.

As you can see on the chart, growth has faltered more recently, largely due to fiscal austerity plus Polish officials’ puzzling decision to emulate the European Central Bank and raise interest rates in 2011.

Still, by European standards there’s a refreshing absence of sheer economic horror.

And a lot of that relative success clearly had to do with the fact that Poland not only kept its own currency, but allowed the zloty to float. As a result, during the years of big capital flows to the European periphery, Poland saw a currency appreciation rather than differential inflation, and it was able to correct that real exchange rate quickly when crisis struck.

So what does Poland’s leadership want to do? Why, join the euro, of course. It really does make me want to bang my head against a wall.

Think of Spain, Ireland, and now Cyprus. How much more evidence do we need that the euro is a trap, which can all too easily leave countries with no good options in the face of crisis? Even if you’ve bought into the legend of Latvia, which you shouldn’t, you should be willing to acknowledge that euro membership is at best a gamble, with a potentially terrible downside.

One Size Fits None

This week Joe Weisenthal at Business Insider reported on Europe’s truly dismal purchasing managers’ indexes (survey-based indexes that act as early-warning indicators for official economic data). There’s no doubt at all that the Continent is falling deeper into recession, even in the core countries.

And reading this news reminds me of something I’ve been meaning to write — namely that discussions of Europe’s troubles and the debate over austerity, often suffer from a tendency to blur two somewhat different issues.

One issue — which is the one that gets the most attention — involves the degree of austerity imposed on debtor countries. Clearly, debtor nations have very little choice about going along with demands from the troika (the E.C.B., the European Commission and the International Monetary Fund) unless they’re willing to abandon the euro — and that’s a line nobody has yet been willing to cross, although Cyprus and the onset of capital controls there bring the possibility closer.

I would argue that enlightened self-interest on the troika’s part would call for milder austerity. But even austerity skeptics would agree that some austerity in these countries is unavoidable; that’s the price of one-size-fits-all monetary policy.

But there’s a separate issue — the status of Europe as a whole.

What has happened in Europe is that the peripheral countries have been forced into extreme austerity, but this has not been offset in the core countries — in fact, core countries have also engaged in austerity measures, albeit not as severe. So the overall result has been a sharp fiscal contraction in Europe — the cyclically adjusted balance is now much tighter than it was before the crisis, even though private-sector demand remains very weak — with no offset from looser monetary policy.

European policy makers seem surprised that this policy mix has led to a double-dip recession, but they have no right to be — it’s exactly what basic macroeconomics would have told you to expect.

And this in turn tells you that the euro is an even more flawed construction than optimum currency area theory might have predicted. The theory emphasized the problem of a one-size-fits-all system in the face of “asymmetric shocks” — countries are supposed to cope separately if they’re slumping while the rest of the currency area is booming.

But it turns out that in times of broad economic weakness this problem is compounded by the asymmetry of the pressures countries face, in which troubled economies are compelled to tighten policy but less troubled economies feel no need to loosen, so that the overall stance of political and economic policy has a strong deflationary bias.

As Matt O’Brien, an associate editor at The Atlantic, recently wrote, this is the same issue countries confronted under the gold standard — a problem they dealt with, eventually, by going off gold.

If European policy makers really want to save the euro, what they should be doing is pushing hard against their system’s deflationary bias. Unfortunately, as far as I can tell they aren’t even willing to acknowledge that the problem exists.

Help us Prepare for Trump’s Day One

Trump is busy getting ready for Day One of his presidency – but so is Truthout.

Trump has made it no secret that he is planning a demolition-style attack on both specific communities and democracy as a whole, beginning on his first day in office. With over 25 executive orders and directives queued up for January 20, he’s promised to “launch the largest deportation program in American history,” roll back anti-discrimination protections for transgender students, and implement a “drill, drill, drill” approach to ramp up oil and gas extraction.

Organizations like Truthout are also being threatened by legislation like HR 9495, the “nonprofit killer bill” that would allow the Treasury Secretary to declare any nonprofit a “terrorist-supporting organization” and strip its tax-exempt status without due process. Progressive media like Truthout that has courageously focused on reporting on Israel’s genocide in Gaza are in the bill’s crosshairs.

As journalists, we have a responsibility to look at hard realities and communicate them to you. We hope that you, like us, can use this information to prepare for what’s to come.

And if you feel uncertain about what to do in the face of a second Trump administration, we invite you to be an indispensable part of Truthout’s preparations.

In addition to covering the widespread onslaught of draconian policy, we’re shoring up our resources for what might come next for progressive media: bad-faith lawsuits from far-right ghouls, legislation that seeks to strip us of our ability to receive tax-deductible donations, and further throttling of our reach on social media platforms owned by Trump’s sycophants.

We’re preparing right now for Trump’s Day One: building a brave coalition of movement media; reaching out to the activists, academics, and thinkers we trust to shine a light on the inner workings of authoritarianism; and planning to use journalism as a tool to equip movements to protect the people, lands, and principles most vulnerable to Trump’s destruction.

We urgently need your help to prepare. As you know, our December fundraiser is our most important of the year and will determine the scale of work we’ll be able to do in 2025. We’ve set two goals: to raise $100,000 in one-time donations and to add 1300 new monthly donors by midnight on December 31.

Today, we’re asking all of our readers to start a monthly donation or make a one-time donation – as a commitment to stand with us on day one of Trump’s presidency, and every day after that, as we produce journalism that combats authoritarianism, censorship, injustice, and misinformation. You’re an essential part of our future – please join the movement by making a tax-deductible donation today.

If you have the means to make a substantial gift, please dig deep during this critical time!

With gratitude and resolve,

Maya, Negin, Saima, and Ziggy