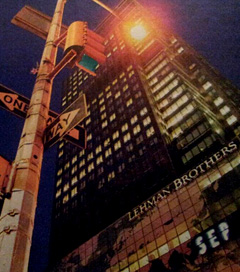

Last week, federal court Judge James M Peck approved the final phase of the Lehman Brothers bankruptcy, which began with the investment bank's collapse on 15 September 2008. That bankruptcy, the largest in US history, precipitated the credit markets' disintegration that cascaded into the global economic meltdown that has deepened ever since. With roughly $450bn still owed by the bank, Judge Peck approved that Lehman Brothers has only $65bn left to settle creditors' claims. The latter must thus accept just over 14 cents for every dollar Lehman Brothers owed them. “Thieves,” they are probably muttering.

Lehman Brothers' bankruptcy has revealed multiple layers of ramifying corruption and theft among global banks in the US and elsewhere, as well. Many juicy details are covered in the nine-volume court examiner's report of 11 March 2010. It documents the bank executives' mammoth misjudgments in their investment decisions, including their repeated violations of the basic banking principle not to borrow short-term and lend the proceeds long-term. The bank examiner shows misleading statements made about their activities and how they disguised Lehman's financial health and credit-worthiness. It appears that various legal and semi-legal mechanisms were used to manipulate their accounts, and otherwise violate the spirit and letter of laws and regulations.

Of course, Lehman Brothers' top bank executives rewarded themselves stupendously while directing Lehman Brothers into collapse. In October 2008, the CEO of Lehman Brothers, Richard S Fuld, argued over pay with Congressman Henry Waxman during public hearings on the bankruptcy. Fuld insisted he had taken “only” $310m in compensation during the seven years before 2008, whereas Waxman's figure was $485m. “Thieves,” one can imagine Waxman muttering.

Lehman Brothers failed partly because of massive investments in subprime mortgage-backed securities notoriously misrated as “secure” by rating companies like Moody's, Standard and Poor and Fitch. In April of 2010, the New York Times reported that Lehman had secretly manipulated its balance sheets by using a small “alter ego” company it owned, Hudson Castle. Later in 2010, New York Attorney General Andrew Cuomo filed suit against Ernst and Whitney, Lehman Brothers' accountants, accusing them for having “substantially assisted … a massive accounting fraud.”

The bankruptcy of Lehman Brothers opened a window on strategies and tactics of many large private banks around the world. The hows and whys of their catastrophic mishandling of their “fiduciary duties” – basically, to be fundamentally prudent and trustworthy in how they manage other people's money – stand revealed. They no longer deserve public trust. Yet, to date, the weak new rules and laws passed in the wake of the global crisis have changed little.

Lehman Brothers' collapse and its aftermath threatened global capitalism and not merely other big global banks. “Too big to fail” thus became those banks' slogan in demanding and obtaining the dominant influence over governments. After Lehman's collapse, governments bailed out those banks, no matter the cost. By borrowing vast sums to fund those bailouts, governments raised national debts to reduce the big banks' private debts. Hence today's European sovereign debt crisis.

Consider the irony: governments today impose austerity on the rest of us because “the markets” demand no less to keep credit flowing to those governments. Behind this dubious abstraction – “the markets” – hide the chief lenders to governments. Those are the same global banks that received the government bailouts paid for by massive government borrowing since 2007. “Thieves,” mutter the Occupy Wall Street folk – and who can blame them?

The lesson here is that large-scale global banking cannot safely be entrusted to private banks. Their behavior yields socially unacceptable costs. They failed their fiduciary duties, betraying both public and private trust. Their continued existence imposes equally unacceptable risks. Modern societies do not leave military security to private armies, nor education to private schools, nor ports, harbors and transportation systems to private conveyors, nor control of the money supply to private banks. Governments, enterprises and households have now become dependent on credit in most advanced industrial economies. The extension of credit ought to be as equally socialised as dependence on credit has become. Lehman Brothers' bankruptcy exposes big global private banking as unaffordable and anachronistic.

This article was originally published in The Guardian UK.

Press freedom is under attack

As Trump cracks down on political speech, independent media is increasingly necessary.

Truthout produces reporting you won’t see in the mainstream: journalism from the frontlines of global conflict, interviews with grassroots movement leaders, high-quality legal analysis and more.

Our work is possible thanks to reader support. Help Truthout catalyze change and social justice — make a tax-deductible monthly or one-time donation today.