Honest, paywall-free news is rare. Please support our boldly independent journalism with a donation of any size.

In recent months Koch Industries Inc., the business conglomerate run by billionaire brothers Charles and David Koch, has repeatedly told a U.S. Congressional committee and the news media that the proposed Keystone XL oil sands pipeline has “nothing to do with any of our businesses.”

But the company has told Canadian energy regulators a different story.

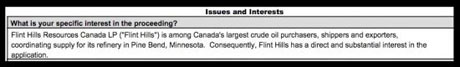

In 2009, Flint Hills Resources Canada LP, an Alberta-based subsidiary of Koch Industries, applied for—and won—”intervenor status” in the National Energy Board hearings that led to Canada's 2010 approval of its 327-mile portion of the pipeline. The controversial project would carry heavy crude 1,700 miles from Alberta to the Texas Gulf Coast.

In the form it submitted to the Energy Board, Flint Hills wrote that it “is among Canada's largest crude oil purchasers, shippers and exporters. Consequently, Flint Hills has a direct and substantial interest in the application” for the pipeline under consideration.

To be approved as an intervenor, Flint Hills had to have some degree of “business interest” in Keystone XL, Carole Léger-Kubeczek, a National Energy Board spokeswoman, told InsideClimate News. Intervenors are granted the highest level of access in hearings, with the option to ask questions. The Energy Board approved Canada's segment of the pipeline with little opposition, and Flint Hills did not exercise its right to speak.

InsideClimate News contacted the Flint Hills manager who filed the Canadian document. She referred questions to Koch Industries general counsel Mark Holden, who did not return calls. Neither did Koch spokespeople.

The State Department, which must approve the project because it crosses an international border, has spent three years reviewing the 1,375-mile U.S. leg of the pipeline proposal. Its decision, which is expected by the end of the year, will be the most far-reaching environmental decision of Barack Obama's presidency so far.

The project's supporters say the pipeline is needed because it would deliver a secure supply of oil from a politically stable ally and produce much-needed jobs during the recession. Opponents contend it would increase global warming emissions and raise the threat of oil spills in sensitive areas along the route. They also argue that gasoline prices in the Midwest would increase and that much of the 830,000 barrels of oil the pipeline could send into the United States each day would go to foreign markets.

Currently, Canadian crude can be pumped only as far as the U.S. Midwest, where a crude oil oversupply is keeping regional oil prices low. The Keystone XL would clear that bottleneck, send Canadian oil to the Gulf Coast and open access to world markets, creating a massive business opportunity for tar sands players.

“There's no ability to access world markets, and that's the reason why WTI [Midwest oil pricing] is depressed. Keystone XL will relieve that issue,” said Chad Friess, an oil and gas analyst at UBS Securities Canada Inc. in Calgary, Alberta. “Pricing is expected to improve as it comes on stream.”

A 2009 market analysis conducted for TransCanada, the Alberta-based company that hopes to build the pipeline, projected that it would create a $3 per-barrel increase, at minimum, for Canadian heavy crude in the Midwest. Canada's petroleum producers would benefit most from the price hike. The report predicts their annual revenues would increase $2 billion to $3.9 billion in 2013. But the entire industry—including the refineries and shipping businesses where Koch Industries has concentrated its efforts—would also profit.

“Keystone XL is about the whole industry,” said Danielle Droitsch, senior adviser to the Natural Resources Defense Council (NRDC), a nonprofit environmental organization that opposes the pipeline. “They will fetch a higher price of oil from the Gulf Coast market, which also happens to be an international market.”

Deep Involvement in Oil Sands Trade

The controversy over the Kochs and the pipeline was sparked by an InsideClimate News report from February. That analysis, also published on Reuters.com and later cited by various news organizations, found that Flint Hills is deeply involved in the Canada-Alberta oil sands trade and is well positioned to benefit if more heavy crude is exported to the United States.

The Koch brothers own nearly all of Wichita, Kan.-based Koch Industries, the second-largest private company in the United States. The energy and manufacturing conglomerate earns an estimated $100 billion in annual revenue from its network of subsidiaries—a mix of oil, gas, pipeline, chemical, fertilizer and paper and pulp companies. In addition to its Canadian operation, Koch's Flint Hills subsidiary operates oil refineries in Alaska, Texas and Minnesota as well as a dozen fuel terminals in the Midwest and Texas.

The Koch brothers have donated millions to Republican candidates and conservative movements, bankrolling groups involved in Tea Party causes and in campaigns to deny climate change science and the need for cleaner energy. Through their Flint Hills subsidiary, they underwrote the failed 2010 ballot initiative that would have suspended California’s landmark law capping greenhouse gases.

The United States already gets nearly a quarter of its oil, about 2 million barrels every day, from Canada. Half of it comes from Alberta's tar sands patch, where Flint Hills is responsible for shipping close to 25 percent of the oil sands crude being piped into the United States.

At the other end of the proposed Keystone XL supply chain, in the Texas refining corridor, Koch Industries has been upgrading its Corpus Christi refinery to be able to handle harder-to-process blends of tar sands, according to industry reports.

A String of Denials from Koch Industries

Koch Industries did not reply to questions about what it meant when it told Canadian regulators it had a “direct and substantial interest” in the Keystone XL. But after InsideClimate News reported on Feb. 10 that Koch Industries was well positioned to benefit from the pipeline, its representatives complained of media bias and denied to Reuters that it had any interest in Keystone XL.

As a result of the InsideClimate News report, Rep. Henry Waxman of California, the ranking Democrat on the House Energy and Commerce Committee's Energy and Power Subcommittee, began looking into the Koch connection to Keystone XL. Koch Industries representatives told Waxman's staff that Flint Hills had no financial interest in the pipeline.

This has “nothing to do with any of our businesses,” Koch spokespeople were quoted as telling the congressman's staff members in a May 20 letter that Waxman sent to Reps. Fred Upton (R-Mich.), the Energy and Commerce Committee chair, and Ed Whitfield (R-Ky.), who chairs the Energy and Power Subcommittee.

In that letter, Waxman urged the Republican congressmen to seek documents from Koch Industries that Waxman's own staff had been unable to obtain. At the time, Upton and Whitfield were fast-tracking a bill—which passed the House on July 26 but was ignored by the Senate—that would force the Obama administration to decide on Keystone XL by Nov. 1.

The Energy and Power Subcommittee denied Waxman's request. A subcommittee aide told reporters at the time that the letter was “a transparently political stunt.”

The Los Angeles Times has reported that Koch Industries and its employees were the largest single oil and gas donor to members of the Energy and Commerce Committee during the 2010 campaign. That included $20,000 in contributions to Upton, who is leading the charge to block EPA's new rules for greenhouse gas emissions. Upton was once considered a moderate, who had voted for amendments strengthening the Clean Air Act. At one point his website contained a statement, now removed, that “climate change is a serious problem that necessitates serious solutions.”

Koch Industries issued a statement after Waxman released his letter to Upton and Whitfield. “As we explained to Representative Waxman's staff … we have no financial interest in the project,” said Philip Ellender, president and chief operating officer for Koch Companies Public Sector. “Given these facts, we are confused about why Koch is being singled out and inserted into these discussions.”

In late May, Ellender responded to a second InsideClimate News story, this one about questions raised by Waxman. Ellender told Reuters in an email that “we have no financial stake in the pipeline” and called the article “factually inaccurate.” He did not identify any specific inaccuracies.

In June, Koch Industries asked the Los Angeles Times to correct an op-ed written by Michael Brune, executive director of the Sierra Club. Brune described Keystone XL as being “backed” by the Koch brothers.

“Koch is not involved in the Keystone Pipeline project in any way as we have stated publicly and as has been widely acknowledged,” Koch spokesperson Melissa Cohlmia said in a letter requesting the correction, which ran on July 15. “This is not a matter of opinion since there are no facts to the contrary.”

Keystone XL to Benefit All Oil Sands Players

Koch Industries, like the rest of the oil industry, is well positioned to benefit from a pipeline that would double U.S. oil sands imports.

The company's Flint Hills subsidiary already has an oil terminal in Hardisty, Alberta, the starting point of the Keystone XL. It sends about 250,000 barrels of diluted bitumen a day to a heavy oil refinery it owns near St. Paul, Minn., making that refinery “among the top processors of Canadian crude in the United States,” the company website says.

Flint Hills is not among the six shippers that have already signed contracts to send their oil through the Keystone XL. But Steven Paget, vice president of energy infrastructure at FirstEnergy Capital, an oil and gas brokerage firm based in Calgary, said every oil sands player would benefit from the pipeline, because the price of all Canadian crude would rise.

Most of Alberta's heavy oil is currently shipped to the Chicago area or to Cushing, Okla., the world's largest oil storage facility and the point where prices are set for U.S. crude. Stockpiles at Cushing are depressing crude prices in the country's midsection below the global benchmark and pinching profits across the entire tar sands supply chain.

The price spread on Tuesday was nearly $25, with the global benchmark, known as the Brent crude oil marker, trading at just below $100 and the Cushing price, known as West Texas Intermediate or WTI, settling at a one-year low of about $76. “Once this [Cushing] bottleneck is relieved, the expectation is that WTI will appreciate to something closer to world oil prices,” said Friess of UBS.

Paget, the FirstEnergy Capital analyst, said “such a pricing differential will be too attractive to [oil sands] shippers. They will sign up for commitments to ship … to the Gulf,” growing their operations and bottom lines.

Refiners that have upgraded their Gulf Coast plants to handle heavy crude are especially well positioned to take advantage of a new gush of oil.

A 2010 analysis by Accufacts Inc., an energy consulting firm that focuses on pipelines, identified Koch's Corpus Christi plant as one of 22 Gulf Coast refineries—out of more than 50—that is now capable of refining “a significant volume of blended bitumen,” the type of crude that would flow through the Keystone XL. The report was prepared for the Natural Resources Defense Council and was based on data from the U.S. Energy Information Administration, a division of the Department of Energy.

The Accufacts report predicted that 90 percent of the 500,000 barrels of Keystone XL bitumen expected to eventually reach the Gulf each day would be handled in refineries on the line's route in the Houston and Nederland, Texas areas. It said 10 percent could be handled in Corpus Christi and elsewhere along the Gulf Coast via connecting pipelines.

Refining heavy crudes, which are cheaper to purchase than light varieties, is profitable for refiners, Paget said. “By buying cheaper oil, it reduces their costs. They may have to make more capital expenditures. But for the long term, their input costs will be [recovered] later.”

Friess said that while producers will benefit most from the pipeline, refineries along the Gulf—which he described as the “most sophisticated refineries in the world”—will profit, too, because they'll be able to outbid other refining markets for Canadian crude.

Droitsch, the NRDC adviser, said the entire industry is banking on an Obama green light by year-end. “The pipeline basically sends an overall signal to industry that they can continue with their expansion plans.”

Press freedom is under attack

As Trump cracks down on political speech, independent media is increasingly necessary.

Truthout produces reporting you won’t see in the mainstream: journalism from the frontlines of global conflict, interviews with grassroots movement leaders, high-quality legal analysis and more.

Our work is possible thanks to reader support. Help Truthout catalyze change and social justice — make a tax-deductible monthly or one-time donation today.