Did you know that Truthout is a nonprofit and independently funded by readers like you? If you value what we do, please support our work with a donation.

On November 15, Jason Furman, the former chair of Obama’s Council of Economic Advisers, tweeted that student debt cancellation wasn’t good policy. Furman’s tweet lit up social media, leading to so much discussion the following day about student debt cancellation that #CancelStudentDebt trended on Twitter. Furman argued that cancelling student debt doesn’t provide a short-term stimulus, may be taxable, and is arbitrary or regressive.

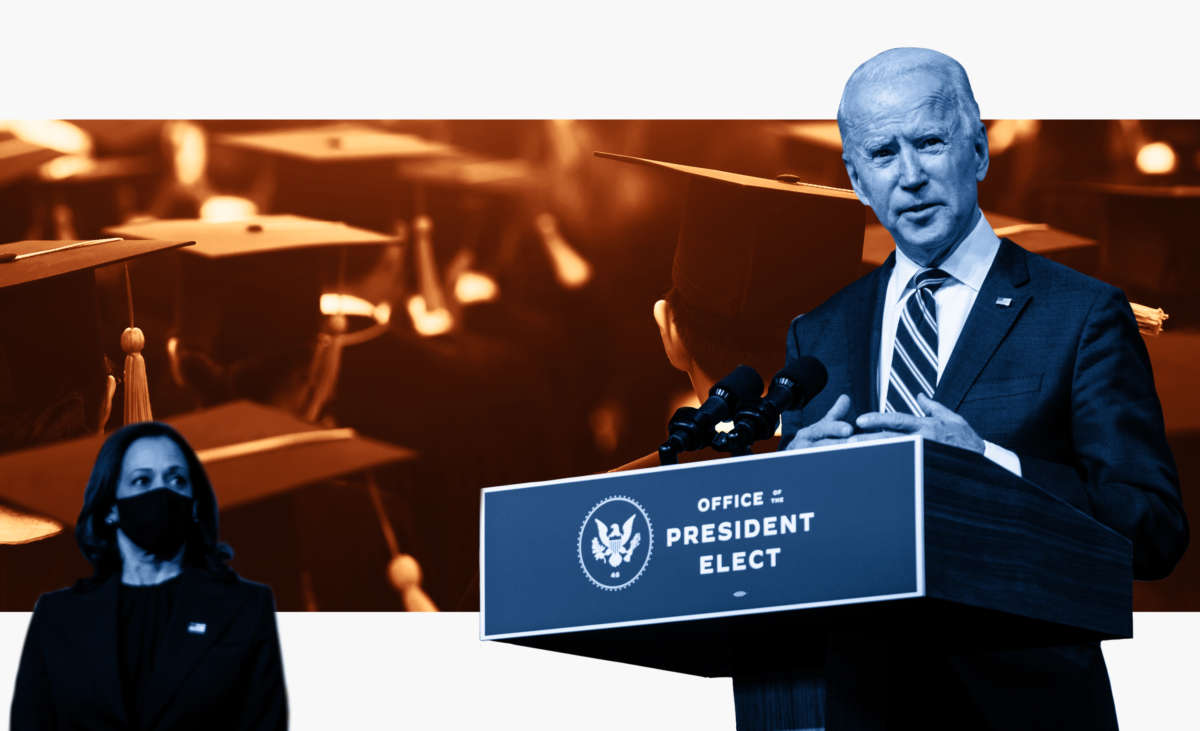

He’s wrong on every count. But the objections to student debt cancellation also ignore the current political reality, and threaten to leave on the table one of the most effective tools Joe Biden has to provide relief to over 44 million people, their families and communities, and the economy overall.

Trump has already cancelled the interest on federal student loans through executive action — first in March, for the week prior to the passage of the CARES Act, and again in August, to extend the suspension on 80 percent of federal student loan payments. This suspension applied to any borrower whose loans are held by the federal government — regardless of income. Critics of student debt cancellation have not raised concerns that the student loan suspension applies regardless of income — presumably because it has been done in response to the economic emergency. But that’s precisely why Biden proposed an “immediate cancellation” of at least $10,000 in federal student loan debt: he included this in his Racial Economic Equity plan as a coronavirus response.

Meanwhile, Republicans are busy taking credit for the student loan suspension: the Pennsylvania GOP sent out a mailer highlighting it. Sensing the popularity (cancellation is supported by a majority of registered voters), Trump wanted his own plan on student debt after seeing the debt cancellation proposals from the Bernie Sanders and Elizabeth Warren campaigns in 2019.

Critics of student debt cancellation are also ignoring the political realities. Furman’s main argument was that, assuming debt cancellation was taxable, it would not provide economic stimulus in the first year. As an alternative approach, Furman said that it would be better to “double SNAP” than cancel student debt, but then acknowledged that the Supplemental Nutrition Assistance Program hadn’t been expanded previously because “Republicans have blocked it.” With a likely Republican Senate, legislative action on any kind of economic stimulus will be similarly blocked.

Student debt cancellation does clearly provide stimulus: one study estimated that cancelling all student debt would boost the U.S. GDP up to $108 billion and add 1.5 million jobs per year. And Moody’s Investors Service has said that student loan debt cancellation would “yield a tax-cut-like stimulus to economic activity” in the near-term.

While there are policies that would likely be more broadly stimulative in the short term than cancelling student debt — for example, sending out more cash stimulus payments — their prospects look dim. Republicans have already balked at another round of these checks, even before Trump lost the presidential election, defying the wishes of the White House.

One clear lesson of 2020 (and years past) is that Senate Majority Leader Mitch McConnell will do anything to stack the judiciary with ultra-conservative judges — whether that meant pushing through a vote on Amy Coney Barrett despite multiple Republican senators testing positive for coronavirus, or refusing to let the Senate consider bills passed through the Democratic-majority House. McConnell and the Senate Republican Caucus are ready to act to sabotage the economy under a Biden presidency. They telegraphed their intentions this year, with their strong and public opposition to a second stimulus package — and their lack of concern for the looming end to the evictions moratorium and student loan suspension, both due to expire on December 31.

In such a hostile political environment, cancelling student debt using the authority Congress gave to the secretary of education is, as Sen. Elizabeth Warren put it, the “single most effective” executive action Biden could take “to provide massive consumer-driver stimulus” to the economy.

Student debt cancellation is not “regressive,” as Furman argued, appearing to use it as a shorthand for “not progressive.” But regressive means that it costs poor people disproportionately more than rich people. Student debt cancellation does the opposite. Those with the lowest incomes benefit far more from cancellation than the wealthy.

As Marshall Steinbaum of the University of Utah documented, with $50,000 in federal student debt cancellation, those with the lowest earnings would go from owing more student debt than their annual income to owing just about one-fifth as much as their annual income.

According to a Brandeis University study, $50,000 of federal student debt cancellation would wipe out all student debt for as many as 80 percent of households in the bottom 80 percent of incomes (for 2019, that would be households with less than $111,112 in income). Over 40 percent of people who hold student debt don’t have a college degree to show for it — but $50,000 in student debt cancellation would make 90 percent of them student debt-free.

Analysis from the Brookings Institution shows that student loan default is highest amongst those who borrow a relatively small amount (less than $6,125). The consequences of federal student default are punitive and lasting: damaged credit, which impacts the ability to apply for jobs or access other credit; inability to apply for government loan programs like the Paycheck Protection Program; and in some states, losing your driver’s or professional license. Cancelling federal student loans would free millions of people from these punitive consequences.

Cancellation would also help lessen the disproportionate burden of student debt on Black and Brown borrowers. Black graduates owe on average $7,400 more on student loans than white graduates. The problem is only getting worse: Louise Seamster of the University of Iowa found that median Black student debt has increased by 41 percent from 2016-2019, while average student debt for Black households tripled in the 12 years surrounding the 2008 recession. In 2016, 15 percent of Latinx student loan borrowers were in default and 29 percent were seriously delinquent on their payments.

The Mapping Student Debt paints a visual picture of the disproportionate impact, showing high rates of delinquency that are often concentrated in neighborhoods of color. Cancelling student debt would create positive network effects to these communities — as dollars not going to student loans can be spent locally instead, and wiping out loans for those in default will improve credit, debt-to-income ratios, help pay down other debts and decrease barriers to employment.

These positive benefits to debt cancellation aren’t conjecture. One study that examined debt cancellation found that even those who weren’t currently making payments saw enormous benefits: More geographic and job mobility, increased ability to pay down other debts and a $4,000 increase in their incomes over three years.

Furman was also wrong to declare that cancelling student debt would be taxable — a point he later conceded had “some ambiguity.” There are multiple reasons the IRS could draw on to clarify that student debt cancellation broadly is not taxable. Bharat Ramamurti, a member of the Congressional Oversight Commission, highlighted several of those reasons, including deeming the cancellation a disaster payment.

Another reason the IRS has historically found student debt cancellation should not be taxed is because the taxpayer was insolvent (meaning their debts exceed their assets). Given that the median student loan debt of both Black borrowers and borrowers under 40 far exceeds their household wealth — and these borrowers hold the bulk of student loan debt — the IRS could also determine the debt cancellation isn’t taxable due to broad insolvency. Finally, as Georgetown University Law professor John Brooks pointed out, the Trump administration has already cancelled student loan interest payments, and the IRS hasn’t asserted taxation on it.

In the middle of a pandemic, with few other options on the table, failure to provide relief to millions by cancelling student debts the government holds would be an abdication of responsibility. We should celebrate the fact that even in the face of a GOP Senate that aims to sabotage any attempts at economic recovery, there’s still a clear tool the government can use on day one to provide relief to millions of households and the economy writ large.

Media that fights fascism

Truthout is funded almost entirely by readers — that’s why we can speak truth to power and cut against the mainstream narrative. But independent journalists at Truthout face mounting political repression under Trump.

We rely on your support to survive McCarthyist censorship. Please make a tax-deductible one-time or monthly donation.