The Labor Department reported the economy added 215,000 jobs in July, while the overall unemployment rate was unchanged at 5.3 percent. The unemployment rate for African Americans fell from 9.5 percent to 9.1 percent, the lowest level since February of 2008. The employment-to-population ratio (EPOP) remained unchanged at 59.3 percent for the population as a whole and 55.8 percent for African Americans.

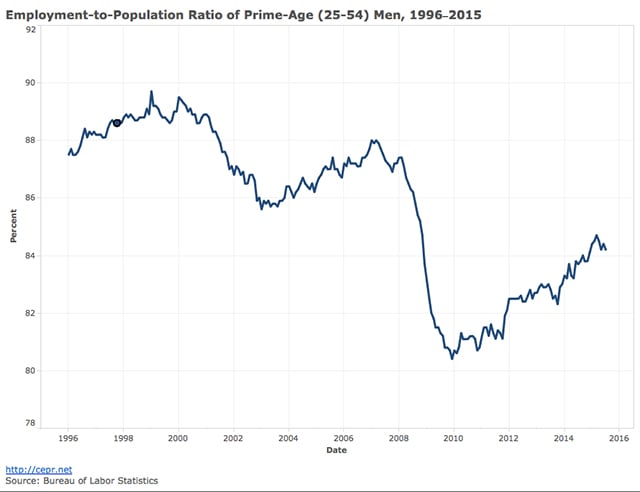

While the unemployment rate has been falling sharply in the last four years, the EPOP has moved much less, having risen by just 1.1 percentage point from its low point in 2011. Only a small portion of this decline can be explained by demographics as the EPOP for prime age men (ages 25-54) is still down by almost three percentage points from its pre-recession level. This is almost certainly an indication of ongoing weakness in the labor market.

Most of the other data in the household survey showed little change. The median duration of unemployment spells remained constant, while the average duration and share of long-term unemployment both increased slightly, but were still below May levels. The share of unemployment due to voluntary quits increased to 10.2 percent, the same as the March level.

There has been an interesting shift in the age distribution of employment growth in the last year. Earlier in the recovery, workers over age 55 had accounted for the bulk of growth in employment. This group accounted for 68.1 percent of employment growth from July of 2010 to July of 2013; however, they account for just 42.7 percent of employment growth over the last two years.

This is primarily a story of lower employment growth among women over age 55. Employment growth for women over age 55 had averaged 679,000 in the two years from July 2011 to July 2013; it has averaged just 374,000 in the last two years. This likely reflects the impact of the Affordable Care Act, as many pre-Medicare age women no longer need to rely on their jobs to get insurance for themselves or family members. Younger workers, between the ages of 25-34, may have been the beneficiaries of this decision as there has been a notable uptick in employment growth among this group.

In addition to the healthy job growth in July, the increases for May and June in the establishment data were also revised up slightly to bring the 3-month average to 235,000. However, there is still no evidence of this job growth leading to wage pressures. The average hourly wage rose 5 cents in July, but this followed a drop of 1 cent in June. This brings the annual growth rate for the last three months compared to the prior three months to just 1.9 percent, compared with a 2.1 percent increase over the last year.

The mix of jobs was a bit peculiar with the non-durable manufacturing sector adding 23,000 jobs. This is the biggest gain in the sector since a gain of 26,000 in August of 1991. This was driven by gains of 9,100 in food processing and 5,800 in plastics and rubber products. By contrast, health care had slower growth, adding 27,900 jobs after adding an average of 45,900 jobs the prior three months. Insurance carriers were again a big job gainer, adding 9,600 jobs. Retail added 35,900 jobs and restaurants added 29,300, both roughly in line with their averages over the last year.

The management services sector added 13,700 jobs. This sector has grown especially rapidly in the recovery adding 356,000 jobs in the last five years, an increase of 19 percent. The temporary employment sector lost 8,900 jobs. The government sector had a gain of 5,000 jobs driven by a gain of 8,000 at the local level.

The overall story in this report is moderately positive, but still indicates the labor market has a long way to go to recover from the downturn. It is important to recognize that these are healthy job growth numbers, but not what we would expect after a steep downturn. At its peak growth, the economy was adding more than 400 thousand jobs a month following the 1981-82 recession. This would be equivalent to 600 thousand a month in today’s labor market.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $46,000 in the next 7 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.