Honest, paywall-free news is rare. Please support our boldly independent journalism with a donation of any size.

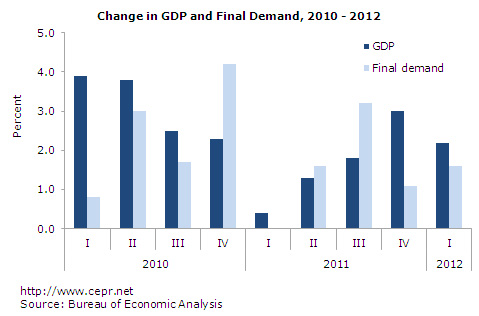

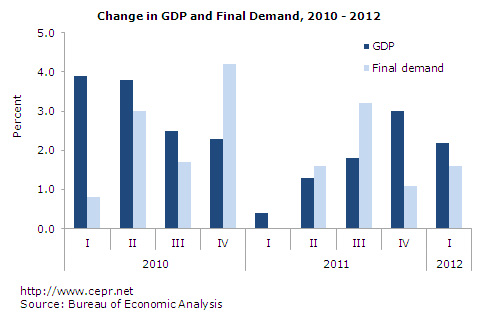

Growth in Gross Domestic Product fell to 2.2 percent in the first quarter of 2012 after increasing at a 3.0 percent annualized rate in the fourth quarter of 2011 and 1.8 percent in the quarter before that. Increased accumulation of private inventories accounted for 0.59 percentage points to total growth compared with 1.81 percentage points in the previous quarter, but final demand rose at a 1.6 percent annualized rate compared with 1.1 percent in the fourth quarter of last year.

Investment contributions to growth fell almost across the board in the first quarter, adding 0.77 percentage points to GDP growth compared with 2.59 percentage points in the previous quarter. Fixed investment (that is, excluding inventory changes) added only 0.18 percentage points to the total.

Within fixed investment, nonresidential structures fell at a 12.0 percent rate, subtracting 0.35 percentage points from growth in GDP. This category of investment is still coming off very low levels following a mini-boom in 2008. This fall was offset by residential investment, which added 0.40 percentage points. The 19 percent growth in housing was in part a result of the unusually fair weather and is likely to slow later in the year. Weak growth in equipment and software (1.7 percent annualized) may be in part due to a reduction of the bonus depreciation that was in effect last year.

Personal consumption expenditures grew at a 2.9 percent annualized rate in the first quarter of the year, including 15.3 percent growth in durable goods. Motor vehicles and parts added 0.68 percentage points to overall growth as the weather certainly moved up some purchases of new cars. Motor vehicle output added 1.12 percentage points to growth in the quarter.

Services added 0.57 percentage points to GDP growth with the largest contribution coming from financial services, which grew at a 4.5 percent annualized rate in the quarter after a 2.9 percent fall in the fourth quarter of last year. Food service also grew at a 4.5 percent annualized rate — a modest slowing of last quarter’s 5.5 percent rate. As noted in January’s report, growth in consumption of health care has been slowing.

After seeing a 0.6 percent annualized rate of decline in the third quarter of 2011, health care grew at a 2.2 percent annualized rate in the fourth quarter and 0.6 percent in the first quarter of 2012. Over the last year, consumption of health care services has grown only 1.2 percent compared with 2.1 percent for the economy as a whole.

Trade was a very minor drag on GDP growth in the first quarter, subtracting 0.01 percentage points off the overall rate. Imports subtracted 0.74 percentage points while increased exports added 0.73 percentage points. In each case, goods and services contributed almost equally to growth — though trade in goods constitutes a share of both imports and exports several times larger than does that of services.

An across-the-board fall in government consumption and investment subtracted 0.60 percentage points from overall economic growth, the bulk coming from a fall in defense spending, which fell at an 8.1 percent annualized rate. State and local government expenditures fell at a 1.2 percent rate in the quarter, subtracting 0.14 percentage points from growth in GDP. This report marks the seventh-consecutive quarter of decline in this category, which has shrunk more than 6 percent since the recession began in the fourth quarter of 2007.

Over the last three months, the price of core personal consumption expenditures rose at a modest 2.1 percent annualized rate. In combination with weak job growth, it is clear that the economy is not performing especially well. This is particularly true as the economy should be capable of higher-than-normal growth coming out of a deep recession. From recent lows, there may be an increase in the pace of nonresidential investment. However, with the recent good weather providing a temporary boost to both consumption and investment and continued drag in the public sector, there is not much promise for sustained growth in the immediate future.

A terrifying moment. We appeal for your support.

In the last weeks, we have witnessed an authoritarian assault on communities in Minnesota and across the nation.

The need for truthful, grassroots reporting is urgent at this cataclysmic historical moment. Yet, Trump-aligned billionaires and other allies have taken over many legacy media outlets — the culmination of a decades-long campaign to place control of the narrative into the hands of the political right.

We refuse to let Trump’s blatant propaganda machine go unchecked. Untethered to corporate ownership or advertisers, Truthout remains fearless in our reporting and our determination to use journalism as a tool for justice.

But we need your help just to fund our basic expenses. Over 80 percent of Truthout’s funding comes from small individual donations from our community of readers, and over a third of our total budget is supported by recurring monthly donors.

Truthout’s fundraiser ended last night, and we fell just short of our goal. But your support still matters immensely. Whether you can make a small monthly donation or a larger one-time gift, Truthout only works with your help.