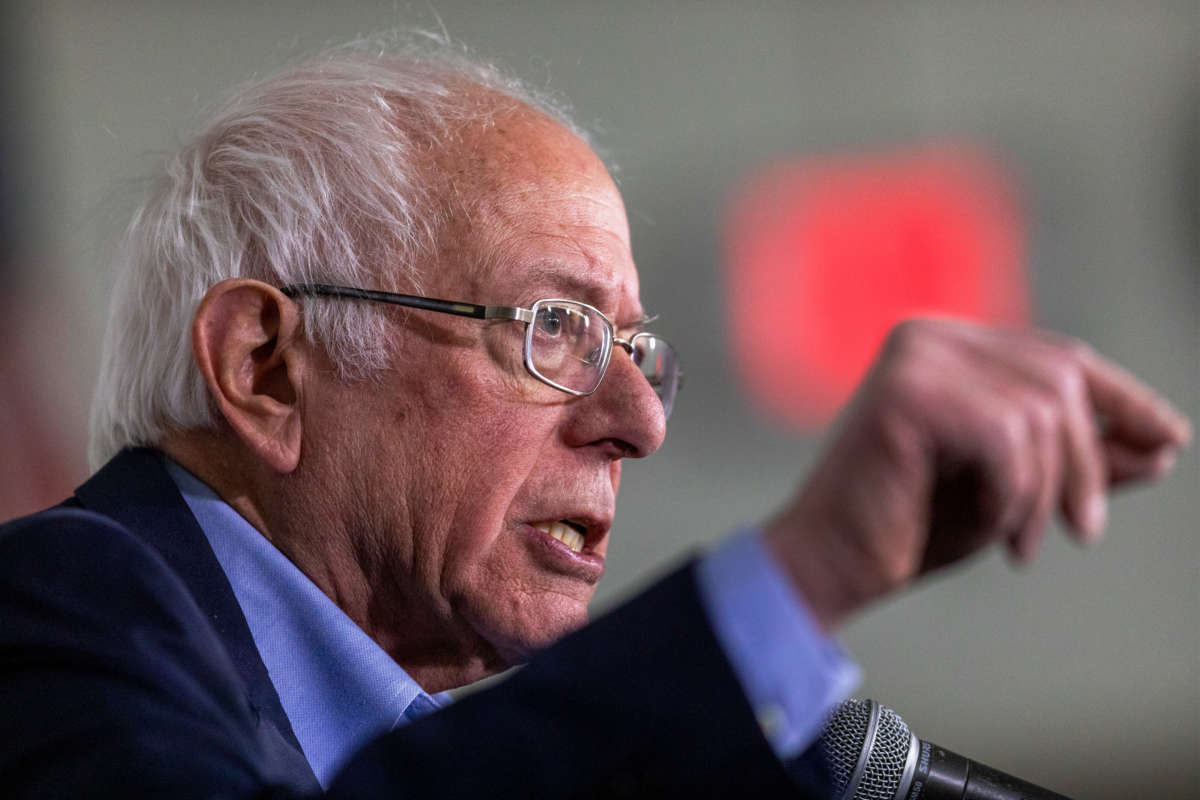

As part of his ongoing duties as chairman of the Senate Committee on the Budget, Sen. Bernie Sanders (I-Vermont) is introducing two bills on Thursday aimed at raising taxes on corporations and the wealthy.

One bill would raise the corporate tax rate to the pre-Donald Trump threshold of 35 percent, reports NPR. In 2017, former President Trump lowered the statutory corporate tax rate to 21 percent via a Republican package filled with corporate tax cuts and tax cuts for the rich. The effective tax rate for these corporations ends up being closer to 10 percent or 15 percent each year.

Earlier this week, The Washington Post reported that the White House was considering raising the corporate tax to a less-ambitious 28 percent to pay for an upcoming infrastructure bill. Sanders’s proposal, which he previously championed during his 2020 presidential run, would help pay for more of the bill, which is not yet unveiled and currently estimated at $3 trillion.

The second bill that Sanders introduced Thursday would drastically raise the estate tax and make it grow progressively. The current limits on the estate tax are abysmal for government funding: Estates can be worth up to $23.4 million for a married couple before taxes kick in, a number that grows each year and doubled under Trump.

Get our free emails

Sanders aims to fix that by lowering the exemption threshold to $3.5 million per individual and $7 million for a married couple. The tax would begin at 45 percent for estates worth $3.5 million to $10 million, 50 percent for $10 million to $50 million, 55 percent for estates between $50 million and $1 billion, and 65 percent for those over $1 billion. In contrast, the current tax maxes out at 40 percent for anything over $1 million.

Sanders says the estate tax is aimed at the top 0.5 percent of estates — the current estate tax only captures about the top 0.1 percent. Despite this, Republicans have tried time and again to repeal it anyway.

The estate tax currently has four co-sponsors, reports CNBC, and the two bills will be brought separately by representatives in the House.

The tax bills, along with several other tax proposals like the hikes being considered by the White House and the wealth tax introduced by a cohort of progressive lawmakers including Sanders and Sen. Elizabeth Warren (D-Massachusetts), could help the government raise the funds needed to pay for ambitious plans for the Democratic Party that lie ahead.

The upcoming infrastructure bill could kick-start green projects like electrifying public transit and make community college free, while plans to address proposals like Medicare for All and vital climate proposals will have to come while Democrats have control of the government. Taxing the rich in order to pay for such ambitious proposals has become a rallying cry for the left.

To Sanders and many other progressives, the taxes are not only about raising funds for future projects but also about making corporations and the wealthy in the U.S. pay their fair share — and in doing so, helping middle-class and working-class Americans. “Reshaping the tax code is part of his broader effort to redistribute wealth in the country,” wrote NPR’s Kelsey Snell.

On Thursday morning, Sanders held a Budget Committee hearing on what he described as “the need to end a corrupt and rigged tax code that has showered trillions of dollars in tax breaks for the wealthiest people in our country and the most profitable corporations.”

“We can no longer tolerate many large corporations making billions of dollars a year in profits paying nothing, zero, in federal income taxes,” Sanders said.

Due to tax loopholes, many corporations like Amazon end up paying no federal income taxes each year. Sanders pointed out on Sunday that this was the case for Zoom, which, despite enjoying a 4,000 percent increase in profits from the pandemic, paid $0 in income taxes for 2020.

Since he took his helm at the head of the Budget Committee, Sanders has been busy working on sweeping changes aimed at helping middle-class and working-class Americans economically. While still pushing for a $15 federal minimum wage, Sanders has introduced legislation to lower prescription drug prices in the U.S. and tax companies whose CEOs make significantly more than their lowest-paid workers.

Trump is silencing political dissent. We appeal for your support.

Progressive nonprofits are the latest target caught in Trump’s crosshairs. With the aim of eliminating political opposition, Trump and his sycophants are working to curb government funding, constrain private foundations, and even cut tax-exempt status from organizations he dislikes.

We’re concerned, because Truthout is not immune to such bad-faith attacks.

We can only resist Trump’s attacks by cultivating a strong base of support. The right-wing mediasphere is funded comfortably by billionaire owners and venture capitalist philanthropists. At Truthout, we have you.

Our fundraising campaign is over, but we fell a bit short and still need your help. Please take a meaningful action in the fight against authoritarianism: make a one-time or monthly donation to Truthout. If you have the means, please dig deep.