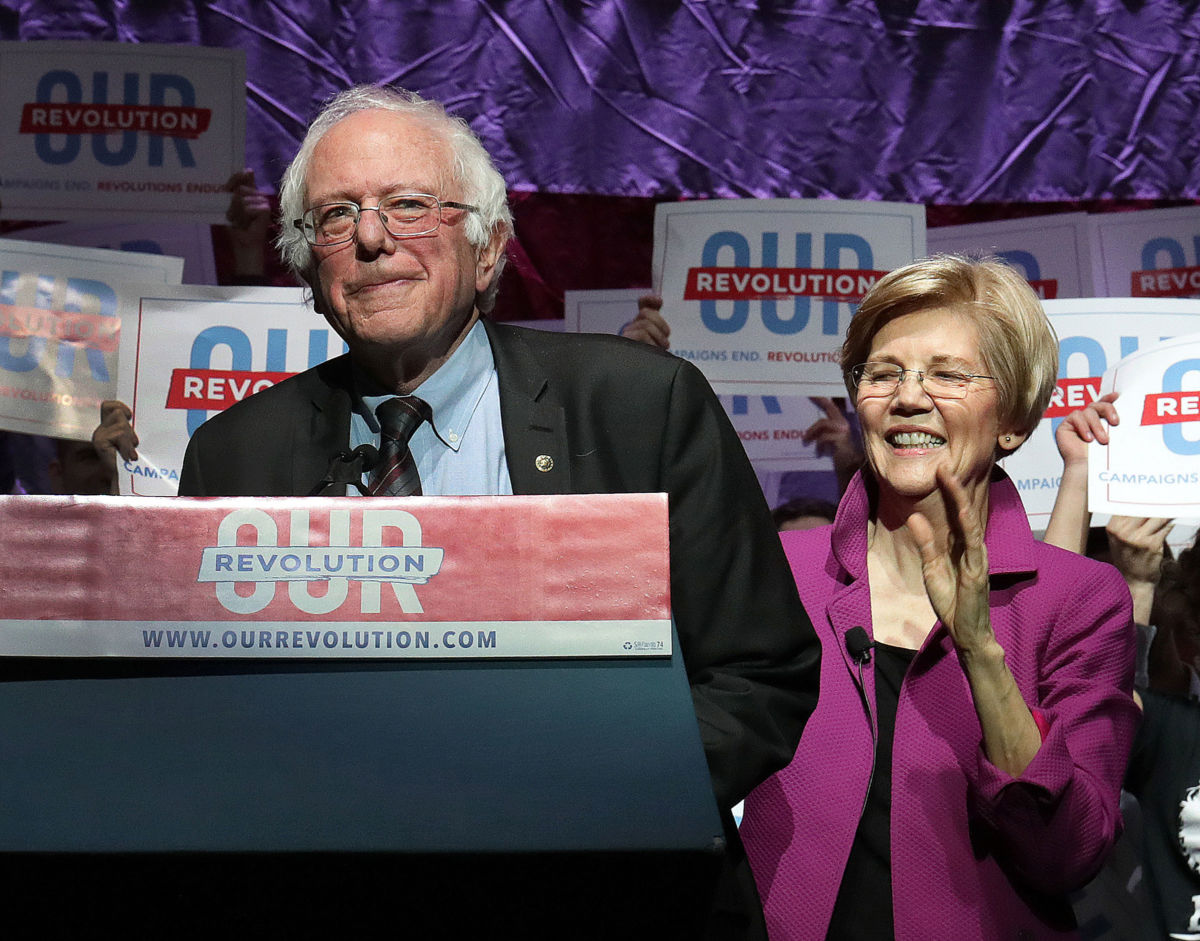

Mere days before the first Democratic primary debate, senators and presidential hopefuls Bernie Sanders (I-Vt..) and Elizabeth Warren (D-Mass.) unveiled dueling policies to tackle the trillion-dollar crisis of student debt.

Flanked by progressive representatives outside the Capitol Monday, Sanders revealed his plan to cancel all $1.6 trillion of outstanding student debt and make all public colleges and universities free of tuition and fees.

Warren’s proposal would eliminate tuition and other costs at public universities nationwide, but would only cancel the loans of debtors making less than $250,000 a year, an estimated total of $640 billion.

Regardless of their differences, both proposals face fierce opposition from a number of financial firms that have fought to prevent meaningful student loan reform. These companies — student loan lenders and servicers alike — contribute hundreds of thousands to key congressional leaders through PACs and spend millions on lobbying annually to stymie pro-borrower initiatives and maintain a profitable status quo.

The overwhelming majority — 89 percent — of educational loans are direct loans, with the Department of Education serving as direct lender to eligible students, setting the interest rate and terms, and disbursing funds. The remainder are provided through private financial institutions, with the majority coming from only three companies: Wells Fargo, Discover Company and Sallie Mae.

Regardless of whether a loan is private or public, it is likely serviced by a different company that serves as a middleman between lender and borrower. These companies handle billing, refinancing, loan forgiveness, bankruptcy and other issues on behalf of the government.

More than 90 percent of federal loans are managed by just three companies: Navient, Great Lakes Higher Education Corporation and the Pennsylvania Higher Education Assistance Agency, which does business as Fedloan. These companies profit by securing lucrative federal contracts and by earning commissions on each loan serviced.

Servicers Accused of Misconduct

These servicers are increasingly come under fire in recent years as the nation’s outstanding student debt nearly tripled since 2007, swelling from $550 billion to more than $1.6 trillion today.

The Consumer Financial Protection Bureau is suing Navient for allegedly causing students to lose hundreds of thousands of dollars by steering them toward higher-cost payment plans that profited the company. The company is also accused of failing to process payments on time, meaning borrowers were wrongly labelled as delinquent and hit with exorbitant fees, as well as issuing predatory loans to students before the company split from Sallie Mae in 2014.

Navient responded by claiming that it was not the company’s responsibility to inform customers of prudent alternatives. According to the company, “there is no expectation that the servicer will ‘act in the interest of the consumer.’”

Navient is not alone in being accused of acting against the best interests of borrowers.

The Massachusetts’ attorney general is suing Fedloan, claiming the company intentionally undermined a federal debt forgiveness program for government, non-profit and military workers by failing to address issues with payments not processing and overcharging.

Great Lakes faces a class action lawsuit for allegedly misinforming borrowers that their loans would be forgiven under the aforementioned debt forgiveness program when they were, in fact, ineligible. Defendants claim their finances were thrown into chaos by the company’s false advising.

The subject of over 5,000 complaints to the CFPB, these companies stay afloat via a steady income stream from the very federal government opposing them in court. Their D.C. influence machine may be responsible for that.

Small But Targeted Contribution Network

Student loan companies contribute less money to candidates through affiliated PACs than every other segment of the financial industry. In the 2018 election cycle, the financial sector spent more than $100 million on political contributions through PACs. Student loan companies contributed less than $1 million.

But what the industry’s contributions lack in size, they make up for in prudent application. As many larger industries do, student loan servicers give to members of Congress in positions of power on relevant committees regardless of political affiliation.

In the 2016 cycle, industry PACs contributed $16,700 to Virginia Foxx (R-N.C.), who said that she had “very little tolerance” for students with large amounts of debt.

“There’s no reason for that,” she said speaking on students routinely occuring debts of $80,000 or more. Foxx was the chairwoman of the House Subcommittee on Higher Education and Workforce Training at the time.

In December 2016, she became chairwoman of the House Committee on Education and the Workforce.

In December 2017, Foxx introduced the Promoting Real Opportunity, Success, and Prosperity through Education Reform (PROSPER) Act. The bill would have eliminated all but one federal student loan option and cut government spending on Pell Grants and student loans by $14.6 billion over 10 years. It also would have allowed borrowers to accrue interest on loans while still in school, which would cost students thousands of additional dollars. It promised no reform or additional oversight for student loan servicers.

Committee Democrats decried the bill, with ranking member Bobby Scott (D-Va.) saying, “H.R. 4508 eliminates necessary guardrails and dilutes consumer protections that safeguard students and taxpayers.”

When Democrats flipped the House in 2018 and took the reins of the education committee, loan companies maintained their influence by playing both sides. In the 2018 midterm cycle, they contributed $20,000 to Foxx and $8,000 to Scott, who would become the new chairman with Democrats in power.

The Democratic response to the PROSPER Act came in July 2018 when Scott introduced the Aim Higher Act, which would expand the Public Service Loan Forgiveness program, expand federal grant programs and require states to lower the cost of education, including making community college tuition-free.

However, the bill does not legislate solutions to complaints against the servicing companies, only mentioning that the Secretary of Education would be directed to advise companies on best practices.

The industry’s donation pattern is mirrored in the Senate, where education policy runs through the Senate Health, Education, Labor, and Pensions Committee. Industry PACs contributed $6,000 to chairman Lamar Alexander (R-Tenn.) in 2014 and more than three times that amount ($18,500) to Democratic ranking member Patty Murray (D-Wash) in 2016.

Lobbying Might

Far more important in the industry’s influence strategy is its extensive lobbying network. The industry has spent over $25 million lobbying the federal government since 2014, amassing dozens of well-connected lobbyists to protect their interests in Washington.

Navient alone is responsible for nearly half of this total, spending almost $11 million over the past five years lobbying Congress, the White House, the Federal Communications Commission and other government offices. Three former congressmen — Tom Reynolds, Denny Rehberg and Vin Weber — lobby for the embattled servicer.

Weber and Rehberg, who were in office from 1989-1993 and 2001-2013 respectively, now head prominent lobbying firm Mercury Public Affairs, one of the most powerful influence firms in Washington. Federal prosecutors are reportedly investigating the firm for serving as unregistered agents of the Ukranian government in seeking to influence policy for a nonprofit tied to then-President Viktor Yanukovych.

Lobbying records show that Navient “actively lobbied on education issues, student borrowing and loan servicing issues” in Foxx’s PROSPER Act.

Lauren Maddox, former assistant secretary of communications of the Department of Education and education adviser for the Trump transition team, has lobbied for Ceannate Corp., a student loan collection company, since joining Holland & Knight in 2016.

Patty Murray’s former communications director Todd Webster also lobbies for the industry, serving as vice president of Cornerstone Government Affairs and personally lobbying for Sallie Mae.

The industry has enjoyed a wave of deregulation and favorable government treatment from Secretary of Education Betsy Devos, who has rolled back Obama-era protections for student borrowers and declared that states couldn’t sue companies that handle student loans despite several ongoing state lawsuits against servicers.

Editor’s note from Center for Responsive Politics: This story has been amended to reflect the fact that 89 percent of educational loans are direct, not 77 percent as previously reported, and that there are three, not four, major companies servicing loans as of 2019, as Nelnet purchased Great Lakes Higher Education Corporation in 2017. Additionally, the story was changed to note that student loan debt tripled from 2007 to 2019, not 2006.

Our most important fundraising appeal of the year

December is the most critical time of year for Truthout, because our nonprofit news is funded almost entirely by individual donations from readers like you. So before you navigate away, we ask that you take just a second to support Truthout with a tax-deductible donation.

This year is a little different. We are up against a far-reaching, wide-scale attack on press freedom coming from the Trump administration. 2025 was a year of frightening censorship, news industry corporate consolidation, and worsening financial conditions for progressive nonprofits across the board.

We can only resist Trump’s agenda by cultivating a strong base of support. The right-wing mediasphere is funded comfortably by billionaire owners and venture capitalist philanthropists. At Truthout, we have you.

We’ve set an ambitious target for our year-end campaign — a goal of $205,000 to keep up our fight against authoritarianism in 2026. Please take a meaningful action in this fight: make a one-time or monthly donation to Truthout before December 31. If you have the means, please dig deep.