Did you know that Truthout is a nonprofit and independently funded by readers like you? If you value what we do, please support our work with a donation.

Hurricane Helene slammed into the Florida coast on Thursday night, bringing pounding rains and “fierce, whipping winds that sounded like jet engines revving,” according to the New York Times. As it ripped through Florida and moved into Georgia, more than 2 million people lost power. While hurricanes are no stranger to the Gulf Coast, climate change has intensified their destructive impacts, and Hurricane Helene is the just the latest case of the extreme weather events that are rising in their frequency and ferocity.

Over the past year, the corporate media, from The Washington Post to the Financial Times, have covered a rising crisis for the insurance industry that’s being caused by extreme weather events like Hurricane Helene: the growing risks and skyrocketing costs of insuring homes and other properties across wide swaths of the U.S.. The popular New York Times podcast “The Daily” went so far as to run an episode titled “The Possible Collapse of the U.S. Home Insurance System.”

Across virtually all of this coverage, the “insurance industry” and “extreme weather” are posed as entirely separate phenomena that now happen to be clashing to create a “crisis.” But a critical fact is omitted from this narrative: For the insurance industry, this is largely a self-induced crisis because of its massive, decadeslong underwriting of — and investment in — the very fossil fuel operations that are driving climate change-induced extreme weather events.

Top insurers, from AIG to Liberty Mutual to Chubb, together rake in billions of dollars annually by underwriting the global buildout of oil and gas pipelines, offshore drilling, Liquefied Natural Gas (LNG) export terminals and other fossil fuel operations. These insurers also have tens of billions of dollars invested in fossil fuels. The insurance industry is a major culprit — not a hapless victim — of the extreme weather that is now endangering its own business model and creating personal catastrophes for ordinary homeowners.

“It’s really this vicious hypocritical cycle of insurers propping up climate change and then taking away home insurance or hiking up the prices,” Helen Humphreys, communications coordinator for Connecticut Citizen Action Group, which is campaigning around fossil fuel insurers, told Truthout.

Organizers from New England to the Gulf Coast are working tirelessly to hold insurers to account, demanding they stop underwriting new fossil fuel projects and phase out insurance for current ones, and supporting legislation, especially at the state level, to drive a wedge between dirty energy companies and the insurers that prop up their oil, gas and coal operations.

“An Important Cog in the Fossil Fuel Industry Machine”

Extreme weather events like hurricanes, flooding and wildfires, intensified by climate change, are creating a major problem for insurance companies, which are increasingly paying out more in damage payments than they are receiving in premium payments. In 2023, for example, insurers lost money on homeowner coverage in 18 states, as compared to eight states in 2013; some insurance companies are abandoning entire regions, drastically reducing their coverage in risky states like Florida and California.

Insurers raised their rates for homeowners’ coverage by double digits in 2023, and some states have seen astronomical rises in premiums. Between 2018 and 2023, homeowners’ insurance costs skyrocketed by 42.2 percent in Oklahoma, 43.2 percent in Florida and 48.6 percent in Nebraska, just to name a few.

“When you think about climate change, insurance isn’t always the first thing that comes to mind,” said Humphreys. “Insurance companies are an incredibly important cog in the fossil fuel industry machine. Without insurance, fossil fuel projects cannot move forward.”

Insurance companies provide coverage for fossil fuel infrastructure that could otherwise not receive permits to be built or operate or attract investors. Insure Our Future, a campaign made up of environmental, consumer protection and grassroots groups, recently estimated that Liberty Mutual takes in $500 million in annual premium payments from insuring fossil fuels, while AIG took in $550 million, Farmers took in $600 million and Chubb took in $700 million.

The insurance industry is a major culprit — not a hapless victim — of the extreme weather that is now endangering its own business model and creating personal catastrophes for ordinary homeowners.

The Gulf Coast is a major hub for LNG export terminals, all of which are enabled by nearly three dozen insurance companies like AIG, Chubb, Liberty Mutual and Lloyd’s of London.

“The insurance industry is a major financial pillar for the fossil fuel industry that enables expansion of fossil fuel infrastructure around the world by providing the coverage to build and operate infrastructure,” Mary Sweeters, a senior strategist with the Insure Our Future campaign, told Truthout. “Without insurance, those projects won’t get financing, or it will be very difficult for them to, or they may not get necessary permits in some jurisdictions.”

“A Systemic Risk to the Global Financial Sector”

Insurance companies are also major investors — through pooling and investing the premiums they collect — in fossil fuel companies. Earlier this year, for example, AIG disclosed it has nearly $117 million invested in ExxonMobil, $83 million in Chevron and $46 million in ConocoPhillips, with tens of millions invested in other companies like Phillips 66, Pioneer Natural Resources and EOG Resources.

All told, Insure Our Future estimates that just six companies — AIG, Chubb, Liberty Mutual, Tokio Marine, State Farm and Berkshire Hathaway — have over $81.3 billion invested in fossil fuels.

Humphreys says this “cycle of property and casualty insurance companies investing in fossil fuel projects” plays a major role in driving climate change. “Climate change happens, and there are these natural disasters, and now homeowners are losing their homeowners’ insurance because it’s too risky to underwrite houses in California because of wildfires, or in Florida because of hurricanes,” she said.

In California, insurers like Berkshire Hathaway, Farmers Insurance, State Farm and Nationwide have announced tens of thousands of home insurance nonrenewals and are scaling back new coverage in the state because of wildfires. In April, Insure Our Future published a briefing showing these were among a “dirty dozen” group of insurers who have $113 billion invested in fossil fuels and oversee $3.6 billion in underwriting income from fossil fuels as they pull back from coverage in California.

The insurance industry’s scaling back of home insurance coverage also threatens global financial stability. Home values collapse when homes are uninsurable, and mass foreclosures could lead to banks acquiring growing amounts of risky properties. “This is something that people should understand as potentially a much broader systemic risk to the global financial sector,” said Sweeters.

Rising home insurance costs are devastating for homeowners and renters in other ways. More than a quarter of U.S. homeowners say they’re financially unprepared for extreme weather events. This comes against the backdrop of an intensifying national housing crisis, with shortages of affordable housing, skyrocketing rental costs and record levels of homelessness. At a time when half of all renters are “cost-burdened,” paying more than 30 percent of their income in rent, landlords say rising insurance costs are by far their biggest growing expense, and that they are raising rents on tenants to compensate.

Moreover, as reporter Adam Mahoney explains, the scaling back of insurance coverage, and its rising costs for customers, is disproportionately impacting Black households, which are already less likely to have property insurance than the wider population and more likely to face flood damage than white households. Mahoney notes that much of this is the rooted in racist New Deal era red-lining policies that “left only the undesirable and toxic neighborhoods” for Black residents. Black rural homeowners in southern states like Alabama and Louisiana are being especially hard hit by flooding and extreme weather.

Many of the fossil fuel operations that insurers underwrite, especially oil and gas pipelines like the Trans Mountain and Dakota Access Pipelines, also threaten Indigenous rights. The Rainforest Action Network has said that no global insurer has developed a strong policy on free, prior and informed consent — the right of Indigenous communities to allow or withhold consent around projects that impact their land and resources, as put forth in the UN Declaration on the Rights of Indigenous Peoples — and that most insurers have ignored request to meet with Indigenous communities.

Campaigning in the “Insurance Capital of the World”

Organizers have been working tirelessly to stop the insurance industry from underwriting new oil, gas and coal infrastructure and pushing to phase out existing coverage.

In Connecticut, sometimes called the “insurance capital of the world,” thanks to the number of insurance companies headquartered there, Connecticut Citizen Action Group is working with others to pass a state bill to create a climate fund to support residents impacted by extreme weather. The fund would be financed by taxing insurance policies issued in the state “in relation to fossil fuel projects.”

“Insurance companies and fossil fuel companies should not be able to externalize their costs on to taxpayers,” Connecticut Citizen Action Group Executive Director Tom Swan told Truthout.

Swan said the bill received “a pretty favorable response in a bunch of different quarters,” and a version of it made it out of the Connecticut General Assembly Environment Committee, though it was not voted on during the legislative session and must be introduced again.

Among the insurance companies with a major presence in Connecticut is W.R. Berkley, headquartered in Greenwich, which received one of the lowest scores on Insure Our Future’s scorecard. Travelers, another insurance company with a major presence in Connecticut, has also been a focus of activists. In April, Connecticut Citizen Action Group attended Travelers’s annual shareholder meeting in Hartford to press the insurance giant on its fossil fuel ties. Students at campuses like the University of Connecticut and University of Hartford have been plugging into the fight against fossil fuel insurers in the state.

Organizers in other states are also targeting the insurance industry’s fossil fuel ties. In New York, a new campaign is supporting the Insure Our Communities Bill aimed at banning insurers from underwriting new fossil fuel projects and setting up new protections for homeowners facing extreme weather disasters.

At the federal level, the Senate Banking Committee has launched an investigation into seven major insurers over their underwriting of and investing in fossil fuel projects.

There have been small steps forward. According to data that Insure Our Future provided to Truthout, 46 global insurers have committed to ending or restricting insurance for coal and 18 have committed to doing the same for oil and gas production. But many insurers still remain committed to underwriting everything from LNG exports to oil pipelines.

“We Live With It Every Single Day”

When Hurricane Helene made landfall, colliding into the Florida Panhandle, it was yet another instance of extreme weather impacting the Gulf Coast — and when it comes to the operations and buildout of fossil fuel infrastructure, the Gulf Coast may be ground zero.

Some of these Gulf Coast residents are also fighting to hold the insurance industry to account.

Melanie Oldham is a longtime resident of Freeport, Texas, a coastal city of 12,000 people around 50 miles south of Houston. Freeport is part of Brazoria County, home to numerous petrochemical plants and other fossil fuel infrastructure, including Freeport LNG, the second-largest LNG export terminal in the U.S.

In 2008, Oldham founded a group, Better Brazoria: Clean Air & Clean Water, to organize for environmental justice in the county. She says the fossil fuel industry’s operations have degraded beaches, gobbled up tax breaks and caused severe health issues for Freeport’s residents, who are overwhelmingly Latinx and Black, and close to one-fifth of whom live in poverty.

Oldham said Freeport is treated like a sacrifice zone, with high rates of cancer and other illnesses. “We live with it every single day,” she told Truthout. “People are literally sick and dying in our communities every single day.”

In 2022, there was a massive explosion at the Freeport LNG plant. It reopened in 2023, but Oldham fears that the issues that caused the explosion, such as poor maintenance and worker fatigue, persist and that more disasters are waiting to happen. Freeport LNG recently saw its credit rating downgraded into junk territory by Fitch Ratings for presenting a “substantial credit risk” to lenders and investors.

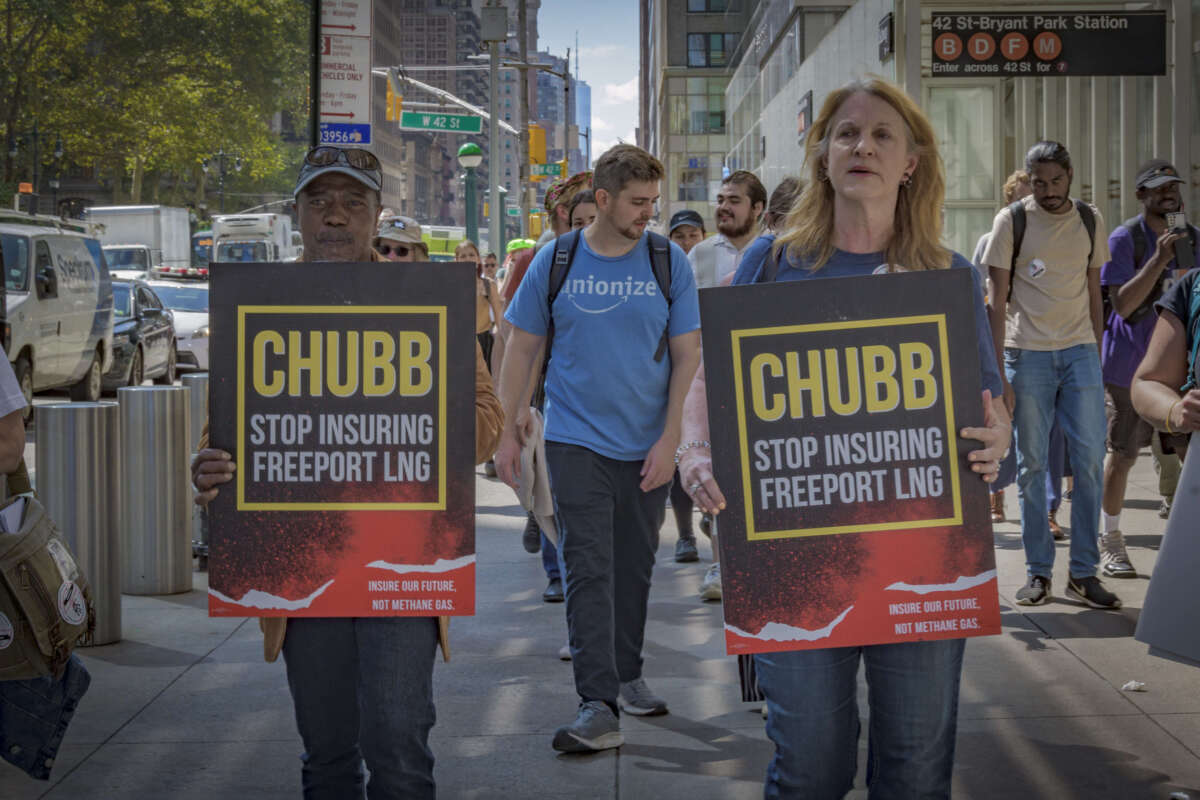

Better Brazoria has joined up with other groups to campaign for insurance companies to ditch their underwriting of fossil fuel infrastructure on the Gulf Coast. Oldham has met with insurers like Chubb, who pulled out of insuring the Rio Grande LNG facility but still insures Freeport LNG. They’re trying to convince Chubb of the risks involved in insuring the Gulf Coast LNG export terminals.

“We want them to quit insuring these dangerous fossil fuel companies,” she said. “They could choose to insure renewable energy versus insuring these dangerous, risky oil and gas export projects.”

Oldham told Truthout that home and property insurance prices around Freeport are going “sky high” as extreme weather events continue. Homeowners’ insurance costs rose nearly 60 percent across Texas from 2018 to 2023. And yet, she says, insurance companies “keep insuring these darn LNGs that are all built right on the coast.”

“It’s their business to analyze risk, so why do they keep insuring Freeport LNG?” she said. “Why are they dropping our insurance, people who have homes on the coast, but they continue to insure these dangerous, risky LNG plants?”

Press freedom is under attack

As Trump cracks down on political speech, independent media is increasingly necessary.

Truthout produces reporting you won’t see in the mainstream: journalism from the frontlines of global conflict, interviews with grassroots movement leaders, high-quality legal analysis and more.

Our work is possible thanks to reader support. Help Truthout catalyze change and social justice — make a tax-deductible monthly or one-time donation today.