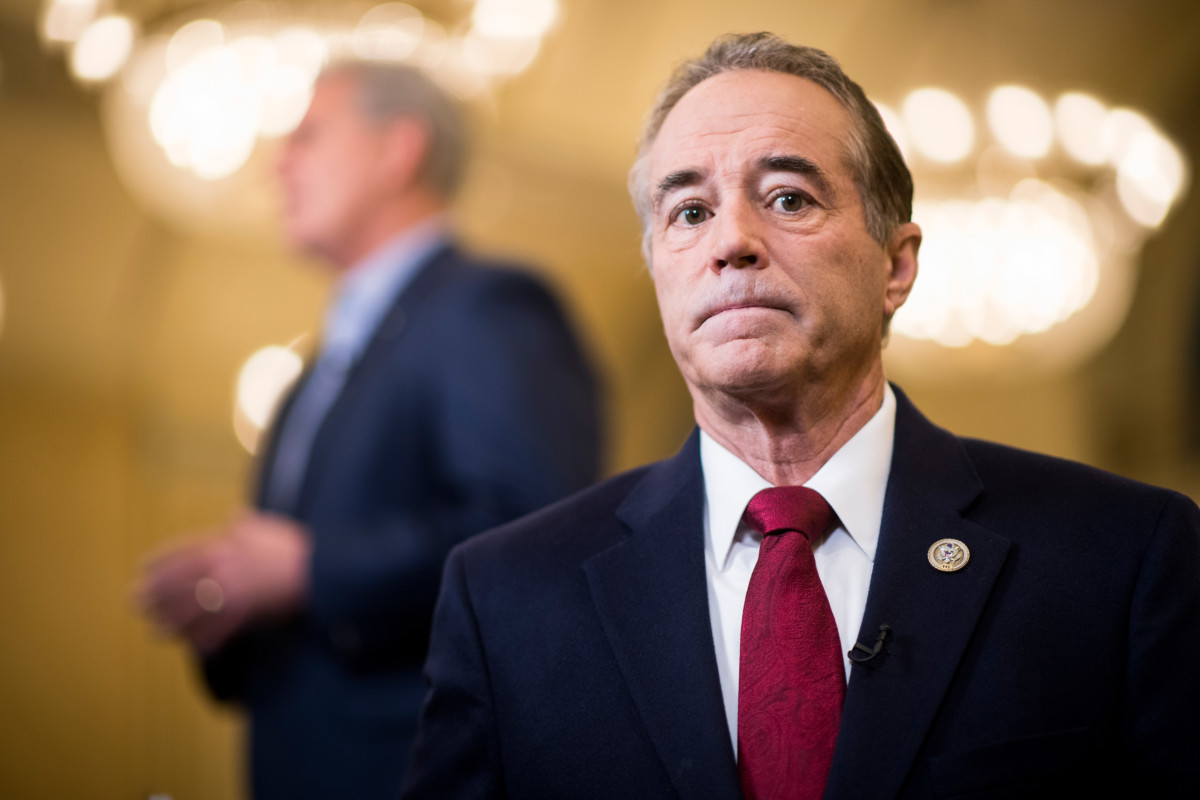

Rep. Chris Collins never stopped telling friends and family about his involvement with Innate Immunotherapeutics, a small Australian biotech company.

The New York Republican sat on Innate’s board and had invested millions in the company. His son owned Innate shares. So did numerous friends as well as Tom Price, a fellow congressman who became secretary of Health and Human Services in 2017.

“I talk about it all the time,” Collins once said of Innate to CNN.

He talked one time too many, according to federal prosecutors who on Wednesday charged him and two others with violating insider trading laws.

Collins leaked sensitive information about a failed clinical trial last year that quickly reached seven people who were able to dump Innate shares before the bad news got out, according to an indictment filed Wednesday in US District Court for the Southern District of New York.

“Congressman Collins had a legal obligation to keep that information secret until made available to the public,” said Geoffrey Berman, US attorney for the district. “Instead, he decided to commit a crime. He placed his family and friends above the public good.”

Collins, who pleaded not guilty, will “mount a vigorous defense to clear his good name,” his lawyers said in a prepared statement, noting that he didn’t sell any of his own Innate shares.

The indictment may be the first time a sitting member of Congress has been prosecuted for allegedly tipping inside stock information to others, ethics experts said.

“I’m not familiar with another instance,” said Donna Nagy, an Indiana University law professor and congressional ethics authority.

House Speaker Paul Ryan removed Collins from the powerful Energy and Commerce Committee on Wednesday and called for a new investigation by the House Ethics Committee. Last year, the panel began looking at evidence that Collins had previously “shared material, nonpublic information” on Innate.

Innate’s stock plunged to nearly zero in June 2017 after the company disclosed that its leading drug, intended to treat multiple sclerosis, had failed a key clinical test.

The news erased millions of dollars in wealth for Collins and many in his hometown of Buffalo and elsewhere whom he had recruited as investors. Innate shareholders included Buffalo business people, doctors, lobbyists and donors to his campaigns, Kaiser Health News reported last year.

A Politico reporter overheard Collins bragging on the phone in early 2017 “about how many millionaires I’ve made in Buffalo” apropos of Innate stock.

Collins had recommended Innate stock to Price while the former HHS secretary was still a congressman from Georgia. The two participated in an unusual, “private placement” in 2016 that awarded them Innate shares at a discount to the market price.

Unlike others, Price avoided the collapse in Innate stock because conflict-of-interest rules forced him to sell when he took over the reins at HHS in early 2017.

Sen. Ron Wyden, an Oregon Democrat who last year questioned the propriety of Collins’ and Price’s Innate investments, said the indictment shows “insiders getting special deals while working Americans are left in the dust.”

There was no indication in Wednesday’s indictment that Price, who resigned a few months later after Politico revealed he was taking private, chartered flights at taxpayer cost, was privy to inside information.

But seven people close to Collins were tipped off, prosecutors said, using the information to sell before the company announced the disappointing drug results. A few minutes after hearing from Innate’s CEO via email that the trial was a “clinical failure,” Collins called his son, Cameron, with the news, according to the indictment.

Cameron Collins quickly told four people, including his girlfriend and his girlfriend’s father, who told two others, according to a civil complaint filed Wednesday by the Securities and Exchange Commission. Shareholders receiving inside information and selling Innate shares were able to avoid total losses of $768,600, prosecutors said.

Innate shares plunged from 55 cents to a nickel after the company announced the clinical failure.

The government charged Chris Collins, his son and his son’s girlfriend’s father with 13 counts of securities fraud, wire fraud and false statements relating to the alleged scheme. Cameron Collins and Stephen Zarsky, the girlfriend’s father, also pleaded not guilty on Wednesday.

Our most important fundraising appeal of the year

December is the most critical time of year for Truthout, because our nonprofit news is funded almost entirely by individual donations from readers like you. So before you navigate away, we ask that you take just a second to support Truthout with a tax-deductible donation.

This year is a little different. We are up against a far-reaching, wide-scale attack on press freedom coming from the Trump administration. 2025 was a year of frightening censorship, news industry corporate consolidation, and worsening financial conditions for progressive nonprofits across the board.

We can only resist Trump’s agenda by cultivating a strong base of support. The right-wing mediasphere is funded comfortably by billionaire owners and venture capitalist philanthropists. At Truthout, we have you.

We’ve set an ambitious target for our year-end campaign — a goal of $180,000 to keep up our fight against authoritarianism in 2026. Please take a meaningful action in this fight: make a one-time or monthly donation to Truthout before December 31. If you have the means, please dig deep.