Did you know that Truthout is a nonprofit and independently funded by readers like you? If you value what we do, please support our work with a donation.

When new Congressional phenom Alexandria Ocasio-Cortez recently floated a 70 percent marginal tax rate to help pay for the Green New Deal, the panicked response from Americans exposed an important truth: most people don’t understand how tax rates work, and the wealthy are exploiting that lack of knowledge.

Incorrect Assumptions

Admittedly, it seems like an alarming suggestion for those of us who don’t get what she’s talking about. It’s easy to assume that she means all of us will be losing 70 percent of our income and if you earn about $40,000, keeping only $12,000 isn’t going to pay for food and rent. However, a 70 percent marginal tax rate would only apply to the richest of the rich.

Still, even if you get that she means that rate would apply only to the wealthy, a lot of people erroneously figure that system is unfair. “If millionaires are taxed at 70 percent, while hundred thousand-aires are taxed less, wouldn’t it be possible for someone who makes a little over a million dollars to end up with less money than someone with a smaller salary?!” Actually, no, because that’s not how marginal tax rates work.

Marginal Tax Rates: A Primer

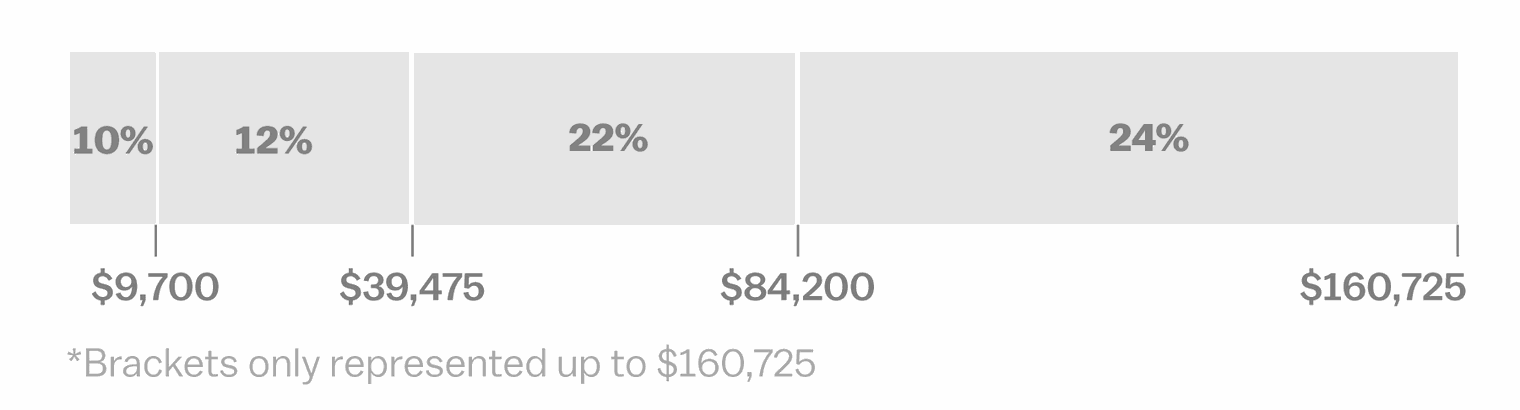

While tax brackets do stipulate that people who make over x dollars get taxed at a higher rate, taxpayers pay the smaller rates along the way. In short, you pay the lowest tax rate for all the money you’ve earned up to the limit of the first bracket, the next highest rate on all the money you’ve earned above the first bracket up to the limit on the second bracket and so on as necessary.

Vox uses 2019’s US tax brackets as an example:

If your family earns the average household income of about $73,000, that means you’d have $9,700 taxed at 10 percent, another $29,775 taxed at 12 percent and the remaining $33,543 taxed at 22 percent.

Importantly, if someone were to get a raise and push the household income just above $84,200, it doesn’t mean suddenly all of the money you earn is taxed at 24 percent, but just that little bit extra above the first $84,200. So NO, you can’t lose more money by earning more.

Is 70 Percent Even Radical?

Not really. Ocasio-Cortez said she backs a percent marginal tax rate instituted for people earning $10 million in a single year, which wouldn’t even apply to most millionaires — we’re talking roughly 1 percent OF the top 1 percent.

At points, the US’s top tax margin has been as high as 90 percent, and it was at the 70 percent mark Ocasio-Cortez endorsed as recently as the 1980s. With our highest tax margin currently at 37 percent, we actually have one of the lowest such rates in American history, so let’s not act like it’s outrageous or economy-crushing to suggest that it return to something fairer.

A Deliberate Misinformation Campaign

The rich and powerful are using the semi-complicated nature of marginal tax rates to pull the wool over Americans’ eyes. GOP Minority Whip Rep. Steve Scalise tweeted that Ocasio-Cortez’s proposal would “take away 70% of your income and give it to leftist fantasy programs,” preying upon people’s assumptions that they, too, would be taxed at 70 percent. Additionally, GOP Strategist Grover Norquist ludicrously compared a 70 percent tax rate to slavery.

But unless you’re one of the ~2,000 Americans who make $10 million+ a year, that doesn’t apply to you — and even if it were you, again, that’s 70 percent on everything you make OVER $10 million, you greedy so-and-so.

Let’s not forget that it’s the rich and powerful who wrote these tax laws. Naturally, they wrote them to benefit themselves and they don’t want the lower and middle classes to recognize how much of a raw deal they’re getting. Don’t let them fool you into thinking a much larger marginal tax rate is outrageous, unfeasible or irresponsible.

A terrifying moment. We appeal for your support.

In the last weeks, we have witnessed an authoritarian assault on communities in Minnesota and across the nation.

The need for truthful, grassroots reporting is urgent at this cataclysmic historical moment. Yet, Trump-aligned billionaires and other allies have taken over many legacy media outlets — the culmination of a decades-long campaign to place control of the narrative into the hands of the political right.

We refuse to let Trump’s blatant propaganda machine go unchecked. Untethered to corporate ownership or advertisers, Truthout remains fearless in our reporting and our determination to use journalism as a tool for justice.

But we need your help just to fund our basic expenses. Over 80 percent of Truthout’s funding comes from small individual donations from our community of readers, and over a third of our total budget is supported by recurring monthly donors.

Truthout has launched a fundraiser to add 500 new monthly donors in the next 9 days. Whether you can make a small monthly donation or a larger one-time gift, Truthout only works with your support.