Support justice-driven, accurate and transparent news — make a quick donation to Truthout today!

For most working Americans, paying their share of the taxes that fund Medicare is an unavoidable fact of life. It’s so automatic for many workers that they may not even realize it takes a bite out of every paycheck. In theory, everyone is required to contribute to the country’s health insurance program for seniors, no matter how poor or rich, from cashiers to CEOs.

Not on Wall Street. There, some of the most powerful people in finance found a way to opt out.

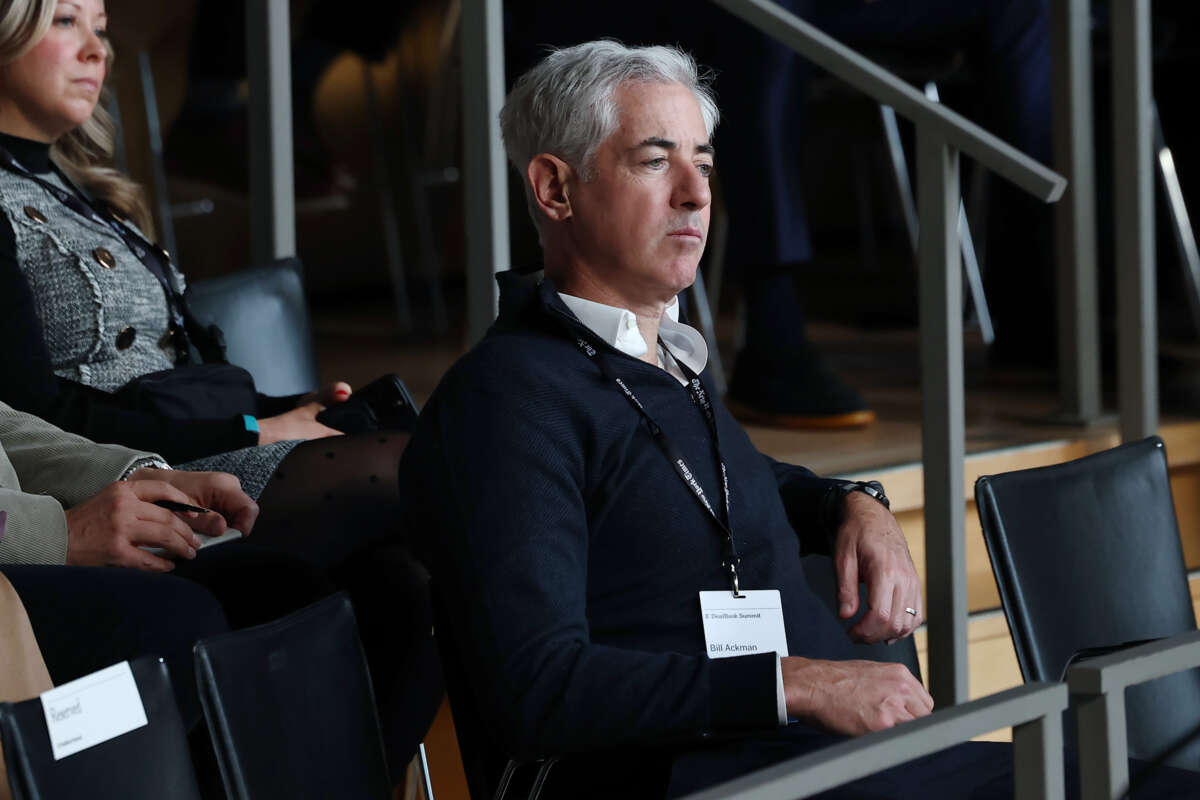

The trove of tax records behind ProPublica’s “Secret IRS Files” series contains plenty of examples of billionaire financiers who avoided Medicare tax despite earning huge amounts from their companies. In 2016, Steve Cohen, the owner of the New York Mets, paid $0. So did Stephen Schwarzman, head of the investment behemoth Blackstone. Bill Ackman, the headline-grabbing hedge fund manager, was able to shield almost all his income from the tax.

How do they do it? Business owners, like any self-employed person, whether they’re a freelance Uber driver or a hedge fund manager, have the responsibility to declare their self-employment earnings on their tax returns. Indeed, the vast majority of small-business owners have no choice but to do so and pay the same taxes that wage earners pay, including Medicare.

But high-priced tax advisers, wielding a once-obscure bit of the tax code, found a way to make that obligation vanish. By carefully channeling profits through a company in a way that invokes that obscure provision, even a Steve Cohen, with a tax return showing he received hundreds of millions in profits from his hedge fund, can exempt that income from Medicare tax.

The three billionaires contacted for this article said they followed the law as written. They also pointed to the fact that they paid substantial income tax, which for them carries a much higher rate. Medicare tax is 2.9% for most people and 3.8% for high earners.

But these maneuvers by the rich hasten Medicare’s future crisis. Sometime in the 2030s, the program’s trust fund is due to run dry. Closing the loophole, along with eliminating other ways around the tax for wealthy business owners, could raise more than $250 billion over 10 years for Medicare, according to recent government estimates.

Over the past three years, ProPublica has mined the tax records of the rich to detail the many ways they avoid taxes. We’ve focused on basic structural features of the U.S. system that advantage them. We’ve uncovered maneuvers of questionable legality that seem to have escaped the notice of the IRS. The Medicare tax loophole occupies a gray area. The IRS definitely knows about it, but it’s unclear if the agency will be able to stop it.

The potential of the loophole first surfaced in the 1990s, and the IRS soon expressed the view that active business owners shouldn’t be allowed to exploit it. It was only in recent years, however, that the agency got tough. Today, the IRS continues to battle what it considers a serious abuse, waging a rare, long-shot campaign to prevent some of the nation’s wealthiest citizens from using the loophole.

The story of how America’s richest financiers avoid paying Medicare tax gives unique insight into the peculiar, messy way taxes work in the U.S. No one set out to create the loophole when it first entered the tax code in 1977. But a series of seemingly unrelated policy changes, together with a revolution in how American businesses are structured, conspired to deliver a major tax advantage to the wealthy. On Capitol Hill, interest groups have successfully defended that advantage, branding any effort to close the loophole as a tax hike on Main Street businesses.

Approaching its 50th birthday, the loophole, for now, lives on.

Fixing One Problem, Creating Another

Over the 2010s, years of budget cuts sliced deep into the IRS’ enforcement muscle. Audits, especially those of the wealthy and corporations, plummeted. In response, agency leaders decided to conduct a kind of triage and focus the IRS’ dwindling might on the most pressing and addressable problems. Among the agency’s early priorities was to curb the widespread use of the Medicare tax loophole.

Beginning in 2018, the agency began hunting for business owners who, in its view, were abusing the law. It launched over 80 audits aimed at hedge funds, private equity firms, consultancies and similar businesses. Cohen’s firm was just the sort of thing the agency was looking for.

Before Cohen became popular as the approachable, gap-toothed, sweater-wearing Mets-fan-in-chief, he was a controversial figure on Wall Street, the inspiration for the legal-risk-taking hedge fund lead character in the Showtime series “Billions.” Cohen made his fortune through his original hedge fund, SAC Capital, known for rapid-fire trades with a remarkable track record. In 2013, SAC pleaded guilty to five criminal counts of securities and wire fraud, agreeing to pay $1.8 billion in penalties and effectively shut itself down. Cohen was not personally charged. Turning the page, he soon formed a new hedge fund, Point72.

The IRS’ audit of Point72 focused on one thing: how the profits had flowed to Cohen. In 2015, his firm earned $125 million from clients, and the money was routed to him through Point72 Asset Management LP.

Those last two letters, which stand for limited partnership, were Cohen’s key to accessing the loophole.

For most of the last century, before hedge funds and private equity firms dominated Wall Street, limited partnerships played a very specific role. They allowed investors, as limited partners, to buy into a business — often oil drilling or real estate development — without the usual risks of ownership like being pursued for the business’s debts.

But by the 1970s, creative uses of limited partnerships proliferated. One variety caught Congress’ attention. Government employees were covered by public pensions and thus were not eligible for Social Security, but brokerages were pitching these employees on limited partnerships as a way around that. The government workers could buy a small share of a business and receive self-employment income that qualified them for future Social Security benefits.

The scheme was condemned by both parties. After all, Social Security was meant to reward people’s labor, not their investments. Only income earned by someone actively running a business should count toward Social Security.

The solution, Congress decided, was to exclude most income earned by limited partners. It wouldn’t count toward self-employment income and, as a result, wouldn’t be subject to self-employment tax, which goes to Social Security and Medicare. As part of a major 1977 Social Security reform bill, this soon became the law.

It seemed like an easy fix. At the time, limited partners were, as a rule, passive investors. The line between the two types of partners that made up a limited partnership was real: General partners ran the business, and limited partners didn’t.

“Limited partners were historically forbidden under state law from getting too involved in the business,” said Susan Hamill, professor of law at the University of Alabama. “If they got involved at all, they would simply be treated as general partners, and the liability shield would be stripped away from them.”

Lawmakers assumed things would continue as they’d always been. They didn’t. The 1977 law, it turned out, had passed at the dawn of a new age, one where limited liability became standard for business owners, not a special condition with strings attached.

A new business structure, the limited liability company, exploded in popularity in the ’90s. LLCs limited the legal liability of all owners regardless of their role. Limited partnerships morphed into something that functioned similarly. After the change, the fact that someone was a limited partner said nothing about what they did for the business. They could be the CEO or a passive investor. It became common for owners to serve as both limited and general partners.

In this new world, the 1977 law was no longer a narrow exclusion. It was a broad grant of tax avoidance to anyone with a canny tax adviser.

Point72 Asset Management LP was part of the trend.

To take advantage of the loophole, Cohen needed to channel his firm’s profits through a limited partner before the money reached him.

One obstacle, it might seem, was that Cohen was one person. How could he partner with himself? That part was simple. A partnership requires at least two partners, but they can be companies or people. Cohen created two business entities, each wholly owned by him. One became the limited partner, the other the general partner.

Over 2015 and 2016, Point72 Asset Management earned $344 million in profits; 99.98% of that went to the limited partner and was declared exempt from Medicare tax. While those profits were subject to the 40% income tax rate (as much as $136 million in tax), Cohen’s returns showed $0 in self-employment income both years, helping him avoid up to $11 million in Medicare tax.

The IRS audited those returns and determined that the full $344 million was self-employment income. Last year, Point72 challenged that finding in court in a case that continues to this day. A spokesperson for Cohen declined to comment, citing the ongoing litigation.

“A Nasty Little Tax Increase”

Almost as soon as LLCs began their rapid spread, IRS officials recognized the possibility of widespread avoidance of self-employment tax. The problem became more urgent after 1993. Since its beginning, Medicare tax had, like Social Security, been capped. But Congress, in need of more revenues to support Medicare, eliminated the cap. Suddenly, avoiding Medicare tax might save a business owner millions of dollars instead of, in 1993, under $4,000.

In 1997, the IRS proposed a rule that would dictate how the 1977 law should be interpreted. A limited partner would mean essentially what it had meant back in 1977, when the term described passive investors. People who worked more than 500 hours (about three months) annually for the business could not be a limited partner under Section 1402(a)(13), the loophole’s place in the tax code.

IRS rule proposals are usually soporific affairs closely watched only by tax practitioners. But in early April 1997, fax machines in Republican congressional offices spat out a message that ended this rule’s obscurity.

The IRS was about “to slip through a nasty little tax increase on America’s partnerships,” the memo read. It was from Steve Forbes, the millionaire magazine publisher and 1996 Republican presidential candidate. He’d centered his self-funded campaign around the idea of a “flat tax,” under which he promised “the IRS would be RIP.” Now he was rallying his party against what he called a “stealth tax increase.”

His message reached Rush Limbaugh, the conservative radio host, who was then at the height of his influence. Soon after Limbaugh mentioned Forbes’ faxed memo on his nationally syndicated show, Speaker of the House Newt Gingrich, a Georgia Republican, called in.

Congress would “intervene directly,” Gingrich promised. “And as you yourself pointed out earlier, we didn’t get elected to raise taxes. We got elected to lower taxes and simplify them and to end the IRS as we know it,” he said.

“Now, folks, that is fast action,” Limbaugh boasted.

A coalition of powerful trade groups hurriedly formed to pressure Congress to follow through on Gingrich’s vow. The rule change would raise taxes by more than $1 billion over the following decade, they estimated, and must be stopped.

The coalition represented businesses that were both small and decidedly not small (among the members were the U.S. Chamber of Commerce and the Securities Industry Association). But their message emphasized the rule’s impact on the “small business community.”

In fact, most small-business owners already paid Medicare and Social Security taxes. Then, as now, the most common form of small business was the simple sole proprietorship, taxspeak for a business with a single, human owner.

By July, the coalition had prevailed. A short provision of a major bill, the Taxpayer Relief Act of 1997, forbade the IRS from issuing any new rule “with respect to the definition of a limited partner” in the next year.

The IRS had been roundly rebuffed. It would be almost two decades before the agency would seriously consider trying again.

In the meantime, the options for business owners to skirt Medicare tax multiplied. New forms of partnerships arose, and the subchapter S corporation, which offered its own loophole around Medicare tax, emerged as an even more popular vehicle. The breadth of the tax avoidance meant that opposition to closing those loopholes would be even fiercer the next time there was a major threat.

“100% Political Fear”

In early 2010, President Barack Obama’s administration and a Democratic Congress were struggling to pass the Affordable Care Act when they hit on a way to help fund it. The proposal boiled down to an expansion of Medicare tax. Whereas before it had only applied to income from work, now, for high earners, it would extend to investment income like dividends and capital gains. The rate would also go from 2.9% to 3.8%.

But, while new forms of income would now be subject to the tax, the proposal intentionally left huge gaps. It wouldn’t touch the ability of business owners to use loopholes to avoid Medicare tax and would even limit their exposure to the new tax on investment income.

Why create a new, complicated tax that favored some forms of income over others, asked Jason Furman, then a member of Obama’s National Economic Council. In a meeting with Obama and his advisers, Furman advocated for a simple, uniform version of the tax that would also close the loophole, he said. The president agreed on the merits, Furman said. But arousing the opposition of the business lobby could endanger the whole bill. It wasn’t worth the risk. “It was 100% political fear,” Furman said.

A monumental health care reform effort like the ACA was already controversial, and members of Congress were looking to get it passed, said Robert Andrews, a former New Jersey Democratic representative and lead negotiator on the bill. They chose the funding option “with the least political risk,” he said.

“This was an ugly compromise, and I think we knew it was an ugly compromise and worth it for the greater good,” Furman said.

Pushing Around the Edges

As the years passed and no legislative fix came, the IRS vacillated on what to do about the limited partner loophole. The Treasury Department decides which tax regulations to pursue, and under the Bush and then the Obama administration, there wasn’t appetite for another bruising fight over a new rule. At the same time, IRS officials decided they couldn’t ignore what they viewed as widespread abuse of Section 1402(a)(13).

They decided on a middle path, said Curt Wilson, who in 2008 became the senior IRS attorney overseeing partnership issues. “We looked for places where we could push around the edges, so to speak,” he said.

This wasn’t a crusade. But in audits, when the opportunity presented itself, the agency cracked down on what it saw as abuse of the loophole. Agents focused on some of the newer forms of partnerships that had sprouted since 1977. LLCs were the prime target.

“We were looking at hedge funds, private equity firms, things like that where there were big dollars,” Wilson said. The goal was to make a splash with a precedent-setting case.

Landing that big case proved elusive. Instead of fighting it out in court, taxpayers were content to privately settle the audits with the IRS’ appeals division, Wilson said. The IRS did its best to send a message, releasing an advisory letter in 2014 to a hedge fund that said the fund’s LLC members didn’t qualify as limited partners. But that wasn’t a binding rule, and it fell short of a headline-grabbing court decision.

What’s more, the IRS risked playing Whac-A-Mole. Even if the agency succeeded in dissuading taxpayers from using the loophole with LLCs, business owners could simply register their business as a limited partnership instead. As the granddaddy of partnerships with limited liability, the LP, the original limited partnership, offered taxpayers the strongest claim for invoking the loophole.

ProPublica’s database of IRS data includes the tax returns of thousands of wealthy business owners through 2018. These titans of capitalism, despite huge flows of ordinary income, often reported remarkably little self-employment income in the 2010s. The LP appears to have been their favored variety of partnership.

In 2017, Bill Ackman earned $413 million in income through an LP operated by the hedge fund he manages, Pershing Square, famous for taking activist stances in companies. As was typical in other years, Ackman reported self-employment income of $4.7 million, a small fraction of his total business earnings. The difference meant he paid $142,000 in self-employment tax instead of more than $13 million.

In a statement, a spokesperson said: “Mr. Ackman has followed the advice of his tax advisors whose interpretation of the law has been the industry standard since 1977. Should the law change, Mr. Ackman will of course adjust his tax payments accordingly.”

In 2018, at least $143 million flowed via a Blackstone LP to Stephen Schwarzman, the firm’s CEO. As in years past, he exempted the income from Medicare tax. Schwarzman, who sits atop an investment firm with over $1 trillion in assets, reported no self-employment income at all in five of the seven years between 2012 and 2018.

“Mr. Schwarzman is one of the largest individual taxpayers in the country and fully complies with all tax rules,” a spokesperson said.

Attacking Head-On

The IRS’ announcement of its audit campaign in 2018 meant the agency would stop pushing around the edges and unleash a frontal assault: Its audits would target not just the newer form of partnerships but also LPs.

This time, after years of audits and appeals within the IRS, the agency finally got its splashy court case. Many taxpayers chose to settle, but Cohen’s partnership and at least five others took their cases to tax court, the first in 2022. All argued they were following the law.

Soroban Capital, a hedge fund, was audited after converting to an LP from an LLC. Demonstrating the gulf between owners and employees, Soroban’s three partners collected $142 million in income over the two years of the audit, while paying a total of $74 million in salaries and wages (subject to Medicare tax) to the fund’s staff.

Soroban’s founder, Eric Mandelblatt, was once an employee. His compensation from Goldman Sachs cost him $128,000 in Medicare tax one year, according to ProPublica’s IRS database. After he started his own hedge fund and began earning tens of millions more, his Medicare tax bill never exceeded a third of that, the records show. Soroban did not respond to requests for comment.

In 2023, the IRS won a major tax court decision against Soroban. The “limited partner exception of I.R.C. § 1402(a)(13) does not apply to a partner who is limited in name only,” the court said, because Congress had only intended to “exclude earnings from a mere investment.” A “functional analysis,” the court said, was needed to determine whether a partner was really “limited.”

With the Soroban decision, the loophole entered a new stage in its history. It’s the most serious challenge since 1997 when, protected by Congress, the loophole emerged not only unscathed but stronger. This time, it’s up to the federal judges who will be reviewing appeals of the tax court’s rulings in the IRS’ cases.

One of the audit targets, Sirius Solutions, a consultancy, has already sought a more sympathetic venue than the U.S. Tax Court. Last summer, it turned to the 5th U.S. Circuit Court of Appeals, known for its conservative bent. Industry groups representing the hedge fund and real estate industry have filed amicus briefs. Tax law experts told ProPublica they are skeptical the IRS’ position will ultimately prevail.

Still, amid this uncertainty, the Treasury Department and IRS last year announced plans to start work on a regulation for Section 1402(a)(13). It’s a process that could take years if it isn’t halted by the incoming administration. If a new rule is finally released, it might again face a hostile Congress. It would also be subject to challenge in the courts.

As has always been the case, the simplest solution is for Congress to change the law. Democrats will keep trying, said a former senior congressional aide, especially when they propose some new expensive initiative and need ways to pay for it.

Including a fix for the Medicare tax loopholes is “a beautiful pay-for,” he said. “It’s real money, and there are not a lot of options sitting around that are this obvious and relatively straightforward technically.”

The last attempt came a couple years ago, when Democrats needed to cover the cost of their $2.4 trillion climate bill. Build Back Better, as it was initially called, passed the House with a provision similar to Furman’s gap-plugging tax. The proposal was estimated to raise $252 billion over 10 years.

But the bill stalled in the Senate, where Democrats needed every vote. In the summer of 2022, negotiations suddenly approached consensus on a new, slimmer bill, soon dubbed the Inflation Reduction Act. The gap-plugging tax was part of the mix.

As they had 25 years before, business groups quickly rallied. Several dozen trade groups co-signed a letter to congressional leaders. The National Federation of Independent Business launched radio ads. “Now Congress is considering a brand-new tax on West Virginia small businesses, an additional tax wrongly characterized as the closing of a loophole,” ran one ad targeting Sen. Joe Manchin, one of the two key swing votes.

When a deal was finally announced on the bill, the proposal was gone. There had been other, less politically dangerous options to raise revenue.

Speaking against the authoritarian crackdown

In the midst of a nationwide attack on civil liberties, Truthout urgently needs your help.

Journalism is a critical tool in the fight against Trump and his extremist agenda. The right wing knows this — that’s why they’ve taken over many legacy media publications.

But we won’t let truth be replaced by propaganda. As the Trump administration works to silence dissent, please support nonprofit independent journalism. Truthout is almost entirely funded by individual giving, so a one-time or monthly donation goes a long way. Click below to sustain our work.