Washington – An annual survey released Thursday finds that workers are paying, on average, about $482 more for job-based family health insurance this year as companies force employees to shoulder more of the burden of health care costs.

The premium hike, up 14 percent from last year, means that workers are paying nearly all of a $495 increase in the average cost of family coverage this year.

Employers’ contributions to family coverage showed no increase at all in 2010, according to the Employer Health Benefits Survey by the Kaiser Family Foundation and the Health Research & Educational Trust.

Drew Altman, the president and CEO of the Kaiser Family Foundation, said it was the first time he could remember employers moving so boldly to shift health costs to workers.

“Added health costs for workers means added economic insecurity for working people in tough times,” Altman said. He called the move a “recession survival tactic” for struggling employers, who provide coverage for about 157 million Americans.

“It speaks to the pressure that companies are under from the recession,” he said.

Over the last five years, workers’ share of premiums has increased by $1,300, or 47 percent, Altman said, while overall coverage costs are up 27 percent. Over the same period, wages climbed 18 percent and general inflation rose 12 percent. With health coverage costs growing faster than wages and inflation are, weary consumers can’t seem to catch a break.

“If premiums and costs continue to be shifted to consumers, households will face difficult choices, like forgoing needed care, or re-examining how they can best care for their families,” said Maulik Joshi, the president of Health Research & Educational Trust.

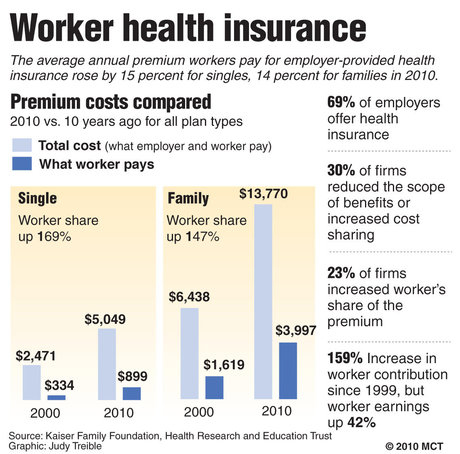

Family coverage now costs an average of $13,770 a year, up 3 percent from 2009, the survey found. Employers still absorb the bulk of the costs, paying an average of $9,773 toward the full premium amount. Workers typically pay about 27 percent of the cost for family coverage, but this year they’re paying about 30 percent, or an average of $3,997. That’s up from an average of $3,515 last year.

Workers with individual coverage are in the same boat. Their average annual premiums spiked more than 15 percent this year — from $779 to $899 — even though the average overall cost for single coverage rose only 5 percent, from $4,824 in 2009 to $5,049 this year. Workers typically pay about 19 percent of the total premium for single coverage.

Even as they pay more, workers are getting fewer benefits. The survey found that 30 percent of employers reduced benefits or increased out-of-pocket costs, while 23 percent raised premiums. Employers also are raising annual deductibles.

Twenty-seven percent of covered workers pay annual deductibles of at least $1,000 before their coverage kicks in. At firms with fewer than 200 employees, it’s 46 percent, the survey found.

“Insurance is getting stingier and less comprehensive every year,” Altman said.

As benefits manager for Turning Point Community Programs, a nonprofit mental health agency in Sacramento, Calif., Felicia Parrera tries to contain health costs and provide solid coverage for 220 or so health plan members.

This plan year, the agency increased employees’ co-payments for routine office visits, hospitalizations and outpatient surgeries, Parrera said.

It also dropped a little-used benefit that covered the cost of infertility drugs. The move saved all plan participants about $15 off their monthly premiums.

“We’ve had to lose some of the richness in our plan to help keep the cost down,” Parrera said.

Turning Point pays a flat rate of $350 per month toward employee coverage that averages $1,450 a month for families and $470 per month for individuals. The agency hasn’t increased its share of the payments in about five years, while employee contributions have grown 15 to 18 percent for each of the last five years, Parrera said.

Employer-sponsored insurance covers roughly 157 million Americans, down from 159 million last year.

The percentage of companies that offer health benefits increased from 60 percent last year to 69 percent this year, mainly because of an unusual 13 percent increase in coverage offered by employers that have three to nine workers. It’s unclear what prompted the large increase, but the report indicates that a surge in new insurance offerings was unlikely given the economy. The report suggests that many firms that didn’t offer coverage may not have survived the recession, leaving a higher percentage of firms that offer insurance.

ON THE WEB

Angry, shocked, overwhelmed? Take action: Support independent media.

We’ve borne witness to a chaotic first few months in Trump’s presidency.

Over the last months, each executive order has delivered shock and bewilderment — a core part of a strategy to make the right-wing turn feel inevitable and overwhelming. But, as organizer Sandra Avalos implored us to remember in Truthout last November, “Together, we are more powerful than Trump.”

Indeed, the Trump administration is pushing through executive orders, but — as we’ve reported at Truthout — many are in legal limbo and face court challenges from unions and civil rights groups. Efforts to quash anti-racist teaching and DEI programs are stalled by education faculty, staff, and students refusing to comply. And communities across the country are coming together to raise the alarm on ICE raids, inform neighbors of their civil rights, and protect each other in moving shows of solidarity.

It will be a long fight ahead. And as nonprofit movement media, Truthout plans to be there documenting and uplifting resistance.

As we undertake this life-sustaining work, we appeal for your support. Please, if you find value in what we do, join our community of sustainers by making a monthly or one-time gift.