I am trying to get up to speed on the impact of the oil price plunge, and one of the more important stories is unfolding in President Vladimir Putin’s Russia.

Obviously, Russia’s recent problems stem from other things besides oil prices, namely the situation in Ukraine and the fallout thereof.

Still, it’s pretty striking just how fast the financial situation seems to be unraveling. The bond vigilantes aren’t invisible in Moscow – 10-year interest rates, which were below 8 percent early this year, hit 12.67 percent recently.

The question one might ask is: Why is Russia so vulnerable? The country has, after all, run large current surpluses over time. And overall, it’s a creditor, not a debtor, nation. But Russia has a lot of external debts all the same, reflecting private sector borrowing – and foreign currency reserves are dropping fast, thanks, in part, to private capital flight.

This reminds me of one of the corners of the Latin American debt crisis in the 1980s, which preoccupied me during my year in Washington back in 1982-83. Venezuela then, like Russia now, was a petro-economy that had consistently run external surpluses. But it was nonetheless a vulnerable debtor because all those external surpluses (and more) had, in effect, been recycled into overseas assets owned by the corrupt elite.

Of course, Venezuela didn’t have nukes.

A Note on Oil Prices and the US Economy

I may be doing some media interviews soon where people will ask me about what the plunge in oil prices means for the American economy, so I thought I’d spend a bit of time figuring out what, if anything, I might say that’s interesting. And it does seem to me that there’s a bit more to the story than a casual pass might suggest.

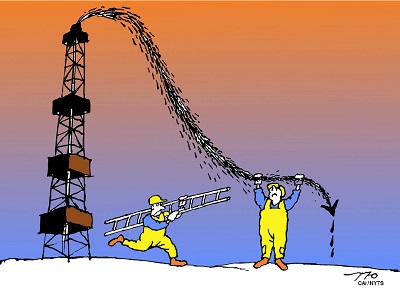

The big news before the plunge was, of course, hydraulic fracturing, or fracking, which has abruptly reversed the long slide in domestic production. You might think that this surge in production, by reducing imports, has left the United States relatively insulated from oil shocks. But we need to remember that on the eve of the latest plunge, real oil prices were very high by historical standards, and that oil imports as a share of gross domestic product remained quite high.

So the economic impact of falling oil prices might be bigger than you think. At the same time, shale development has in some important ways arguably changed the nature of that impact. Because we once again have a significant domestic oil industry, falling prices now create losers as well as winners in the United States. The gains from falling prices exceed the losses, and if the marginal propensity to spend is similar, that should tell the tale for aggregate demand. In fact, in the old days when domestic oil largely meant Texas billionaires and all that, it was reasonable to argue that internal redistribution further increased demand when oil fell.

But fracking means that some of the producers are very different; among other things, they’re engaged in a lot of investment spending. So you could make the case that falling oil is less expansionary than it used to be, and even, possibly, that it’s contractionary.

This is just an, um, crude first pass. But there may be more going on here than the pure terms of trade effect.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $50,000 in the next 9 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.