Honest, paywall-free news is rare. Please support our boldly independent journalism with a donation of any size.

As of today the idea that Greece might be better off leaving the euro and renegotiating its debt is considered by many to be unthinkable. Instead, the country is embarking upon a program of “internal devaluation” – in which it keeps the euro and lowers its real exchange rate by creating enough unemployment to drive down the country’s wages and prices.

Let’s compare this process to two other countries that have tried it – one which abandoned it after three and a half years – Argentina – and one that is continuing it – Latvia.

First, Greece: Figure 1 shows the IMF’s April 2010 projections for real (inflation-adjusted) GDP. Note that in 2015, Greece still does not reach its pre-crisis (2008) level of GDP. However, these projections are already out of date; the current projections from the Greek finance ministry show a 4 percent decline for 2010, whereas the IMF’s projections had only shown a 2 percent drop. Moreover, it will most likely be worse; when Latvia began its “internal devaluation” in 2008, the IMF projected a 5% drop in GDP for 2009; it came in at more than 18 percent. Result: Greece will probably need at least eight or nine years, if things go well under the current program, to reach pre-crisis output.

Figure 1

Graph – Greece Source for figures 1 and 2: IMF International Financial Statistics and World Economic Outlook

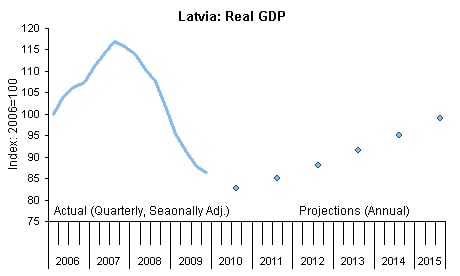

Second, Latvia: As can be seen in Figure 2, Latvia – which set a world-historic record in 2008-2009 by losing more than 25% of GDP – is not expected to reach even its 2006 level of GDP in 2015. And in 2015, it is still 16% below its pre-crisis peak in 2007. Result: well over a decade to return to pre-crisis GDP, barring unforeseen negative events.

Figure 2

Graph – Latvia

Third, Argentina: Figure 3 shows Argentina’s recession beginning in the middle of 1998. Argentina tried the “internal devaluation” process – its currency was pegged at 1 to 1 to the dollar – until the end of 2001, leading to an economic and financial collapse. In December 2001-January 2002, the government defaulted on its debt and abandoned the fixed exchange rate. Result: after the default/devaluation, the economy continued to shrink for just one quarter (first quarter 2002). It then grew and passed up its pre-crisis peak within three years of the default and devaluation, with real (inflation-adjusted) growth of 63 percent over six years.

Figure 3

Graph – Argentina

Source: Instituto Nacional de Estadística y Censos, República Argentina

Conclusion: before making a commitment to indefinite recession and slow recovery, including many years of high unemployment and other social costs, Greece may want to consider the alternatives. They may be less painful and allow for a speedier, more robust economic recovery.

This column was previously published by The Guardian Unlimited.

A terrifying moment. We appeal for your support.

In the last weeks, we have witnessed an authoritarian assault on communities in Minnesota and across the nation.

The need for truthful, grassroots reporting is urgent at this cataclysmic historical moment. Yet, Trump-aligned billionaires and other allies have taken over many legacy media outlets — the culmination of a decades-long campaign to place control of the narrative into the hands of the political right.

We refuse to let Trump’s blatant propaganda machine go unchecked. Untethered to corporate ownership or advertisers, Truthout remains fearless in our reporting and our determination to use journalism as a tool for justice.

But we need your help just to fund our basic expenses. Over 80 percent of Truthout’s funding comes from small individual donations from our community of readers, and over a third of our total budget is supported by recurring monthly donors.

Truthout’s fundraiser ends tonight! We have a goal to add 122 new monthly donors before midnight. Whether you can make a small monthly donation or a larger one-time gift, Truthout only works with your support.