With the U.S. careening toward a default crisis that they manufactured, House Republicans are reportedly crafting a major tax cut package that would overwhelmingly benefit the rich and corporations while blowing a multitrillion-dollar hole in the federal deficit.

The fresh push for tax cuts, according to Rep. Ilhan Omar (D-Minn.), further shows that “this hostage crisis has never been about deficits for the GOP.”

“It has always been about wealth transfer — taking away food and healthcare from the poor and middle class to give away $3 trillion more in tax cuts to their rich friends,” Omar, the deputy chair of the Congressional Progressive Caucus, tweeted Tuesday.

Politico reported earlier this week that Republicans on the House Ways and Means Committee hope to finish work on their emerging tax legislation by June 16, just over two weeks after the so-called “X-date” — the day on which the Treasury Department expects the federal government to run out of money to cover its obligations unless Congress raises the debt limit or President Joe Biden acts unilaterally.

“Key parts of the [tax cut] package… will likely include a full restoration of research and development deductions, full bonus depreciation, removing caps on business interest expensing, and a doubling of the $1.08 million limitation on the section 179 deduction (which, like bonus depreciation, allows a company to deduct an asset’s cost up-front),” Politico noted.

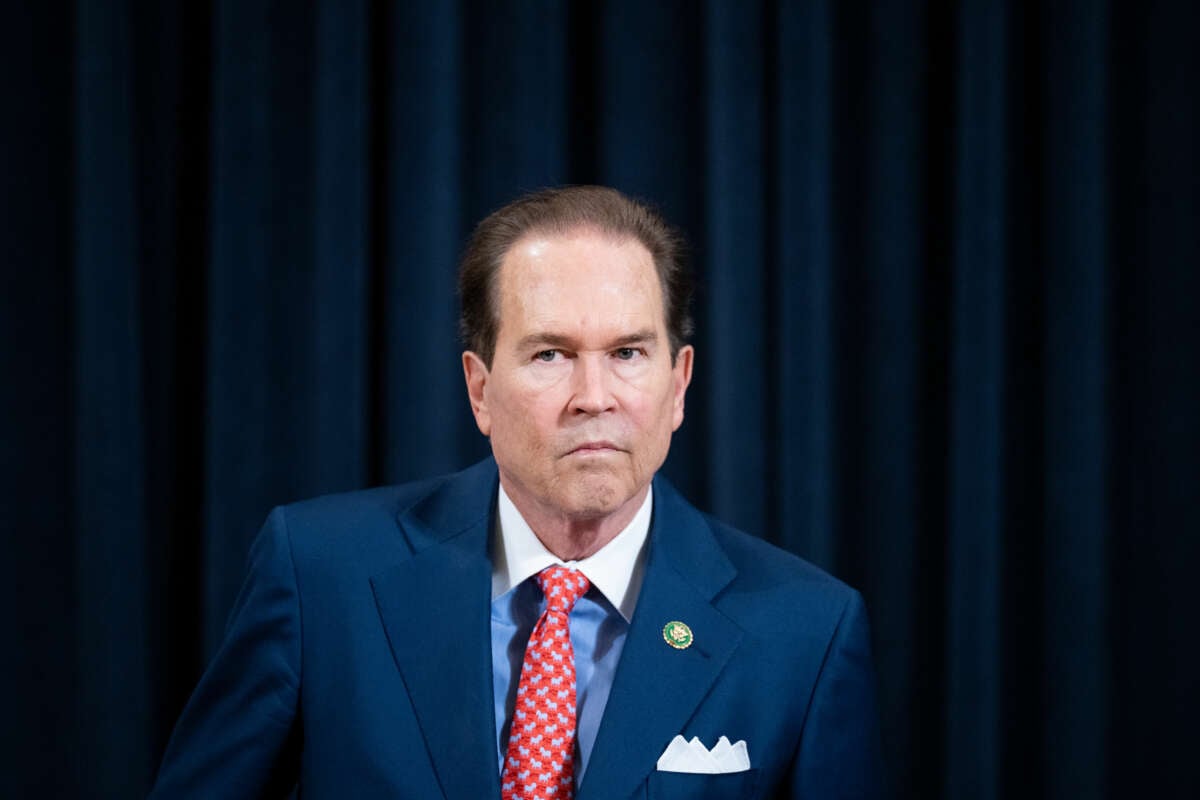

The outlet added that Rep. Vern Buchanan’s (R-Fla.) legislation aimed at making the 2017 Trump-GOP tax cuts for individuals and some businesses permanent “also has a strong likelihood of getting marked up in a broader package.” The bill, known as the TCJA Permanency Act, currently has nearly 100 Republican co-sponsors in the House.

Buchanan, one of the wealthiest members of Congress, personally benefited from the 2017 tax law that he’s working to extend.

“Republicans are holding our economy hostage because they want to cut programs for working families,” Sen. Tina Smith (D-Minn.) said Tuesday. “Their next big move? Massive tax cuts for their rich corporate buddies. They may call it fiscal responsibility — I call it extortion.”

The Congressional Budget Office (CBO) estimated last week that extending the individual provisions of the 2017 tax cuts — which are currently set to expire in 2025 — would add $2.5 trillion to the deficit over the next decade. The original law made the cut to the corporate tax rate from 35% to 21% permanent.

“The hypocrisy of Republicans in Washington is truly breathtaking,” Sen. Bernie Sanders (I-Vt.) wrote in a Fox News op-ed on Wednesday. “Over and over again, we hear from the Republican leadership about how deeply concerned they are about the large deficit and national debt that we have. Really?”

“If that’s the case,” Sanders asked, “why are they pushing for an extension of the Trump tax breaks that disproportionately benefit the wealthy and large corporations and would increase the federal deficit by $3.5 trillion?”

The Institute on Taxation and Economic Policy (ITEP) estimated earlier this month that just 1% of the benefits of the TCJA Permanency Act would go to the poorest fifth of Americans.

The richest fifth, by contrast, would receive nearly two-thirds of the tax benefits, ITEP found.

“The average tax cut for the richest 1%,” the organization noted, “would be 25 times that of the middle 20% and more than 250 times that of the bottom 20% of Americans.”

Republicans are preparing to launch their push for new tax cuts as they continue to hold the U.S. and global economies hostage in pursuit of steep federal spending reductions, all under the guise of lowering the deficit.

“We’re not going to raise taxes,” House Speaker Kevin McCarthy (R-Calif.) said earlier this week. “It’s a spending problem.”

But research published in March by the Center for American Progress (CAP) found that the GOP austerity crusade “does not address the true cause of rising debt” — tax cuts.

“Tax cuts initially enacted during Republican trifectas in the past 25 years slashed taxes disproportionately for the wealthy and profitable corporations, severely reducing federal revenues,” noted Bobby Kogan, CAP’s senior director of federal budget policy. “In fact, relative to earlier projections, spending is down, not up. But revenues are down significantly more.”

“If not for the Bush tax cuts and their extensions — as well as the Trump tax cuts — revenues would be on track to keep pace with spending indefinitely, and the debt ratio (debt as a percentage of the economy) would be declining,” Kogan observed. “Instead, these tax cuts have added $10 trillion to the debt since their enactment and are responsible for 57% of the increase in the debt ratio since 2001.”

Media that fights fascism

Truthout is funded almost entirely by readers — that’s why we can speak truth to power and cut against the mainstream narrative. But independent journalists at Truthout face mounting political repression under Trump.

We rely on your support to survive McCarthyist censorship. Please make a tax-deductible one-time or monthly donation.