Honest, paywall-free news is rare. Please support our boldly independent journalism with a donation of any size.

At least 37 members of Congress and their families traded defense stocks in 2024, using a list of the top 100 Pentagon contractors compiled annually by Defense Security Monitor.

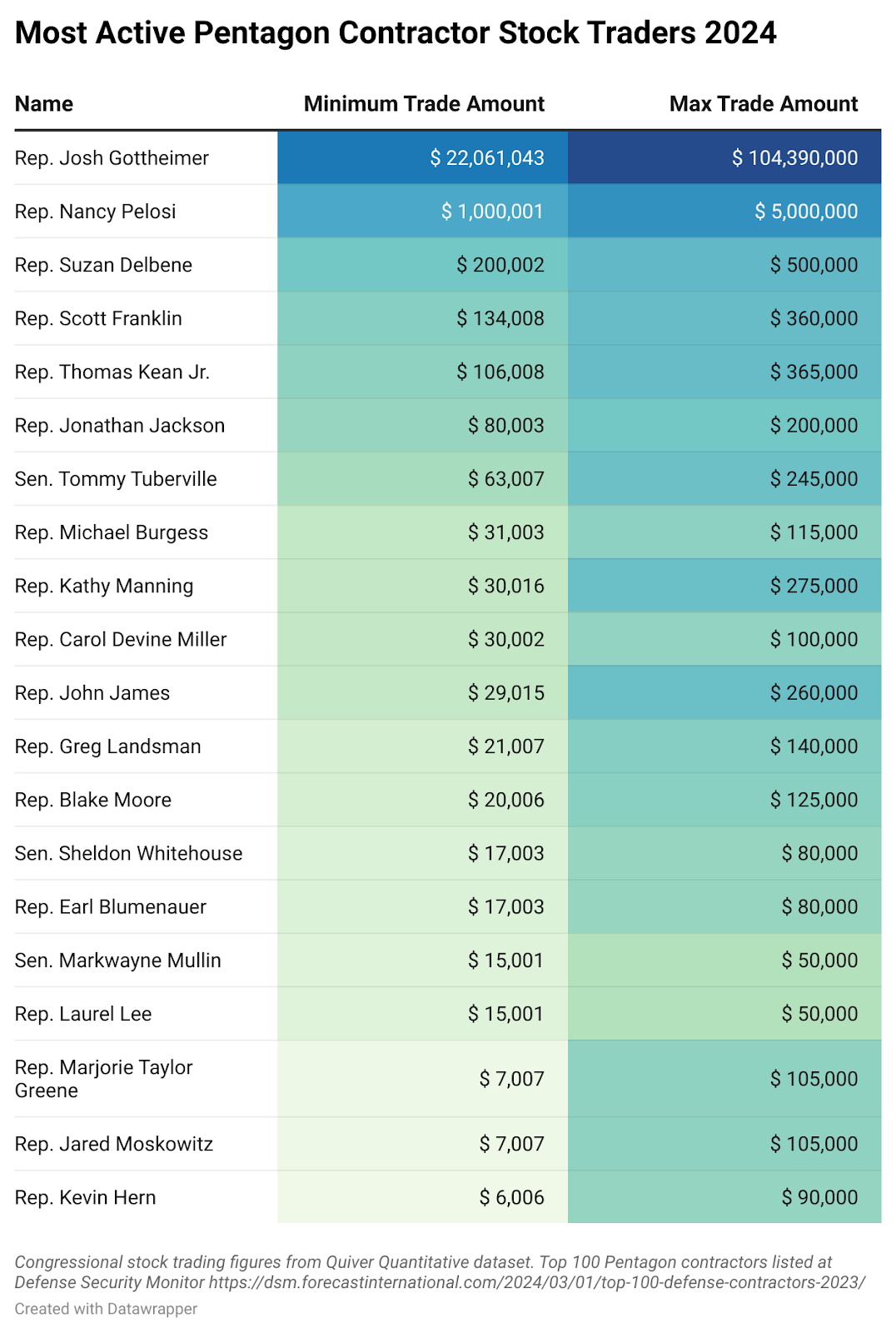

A Responsible Statecraft analysis of data from investment research platform Quiver Quantitative shows that these lawmakers traded between $24 million and $113 million worth of Pentagon contractor stocks this year (lawmakers merely have to provide a range for stock trading disclosures).

Eight of these members even simultaneously held positions on the Armed Services and Foreign Affairs Committees, the committees overseeing defense policy and foreign relations. Members of Congress that oversee the annual defense bill and are privy to intelligence briefings have an upper hand in predicting future stock prices.

But who traded the most defense stock this year?

That distinction goes to Rep. Josh Gottheimer (D-N.J.). Gottheimer may have faked his Spotify Wrapped — fabricating an image to make him look like a Bruce Springsteen superfan — but he can’t fake his way out of being crowned the most avid trader in Congress.

Gottheimer traded at least $22 million worth of stock of the top 100 Pentagon contractors, including Microsoft, Northrop Grumman, and IBM. Microsoft — which received $414 million from the Department of Defense in 2023 for software and cloud computing services — accounted for the vast majority of his trades. Gottheimer simultaneously holds positions on the Permanent Select Committee on Intelligence, and the National Security subcommittee in the Committee on Financial Services. Gottheimer says his trades are made by a third-party financial firm; “I literally have no idea what they do,” he stated in a 2022 CNBC interview. Given Springsteen’s lifelong skepticism of the military-industrial complex, I’m not sure the Boss himself would approve.

The second most active defense stock trader was Speaker Emerita Rep. Nancy Pelosi (D-Calif.), who sold over $1 million worth of Microsoft stock in late July. The FTC opened a wide-ranging anti-trust investigation into Microsoft in November.

The timing of Pelosi’s Microsoft trades in the past have garnered attention, too; in March 2021, she bought Microsoft call options less than two weeks before the Army announced a $22 billion contract with the software company to supply augmented reality headsets.

Pelosi had the most profitable 2024 of any lawmaker, netting an estimated $38.6 million from all stock trading activity, according to Quiver Quantitative.

Rep. Tom Kean Jr., who comes in at number five for defense stock trading, traded between $106,000 and $365,000 worth of defense stock while sitting on the House Foreign Affairs Committee. Kean Jr. exchanged Jacobs stocks after a merger with Ammentum in September.

At number six, Rep. Jonathon Jackson (D-Ill) traded between $80,003 and $200,000 worth of Pentagon contractor stock, including snapping up as much as $50,000 worth of General Dynamics stock while sitting on the House Foreign Affairs Committee.

Sen. Tommy Tuberville (R-Ala) was the seventh-most active defense stock trader. Despite his perch on the Senate Armed Services Committee, Tuberville disclosed between $63,007 and $245,000 worth of trading in defense stocks this year, selling stakes in IBM, Honeywell, and Accenture, among others. Last September, Tuberville — who owns up to 50,000 in Lockheed Martin stock — participated in an committee hearing on defense innovation headlined by Lockheed CEO James Taiclet.

Tuberville has said that limiting lawmakers’ ability to trade stocks would be “ridiculous” and that “it would really cut back on the amount of people that would want to come up here and serve.”

What about lawmakers who embrace the buy-and-hold strategy, rather than actively trading? In September, Sludge’s David Moore published an investigation that found that lawmakers may own as much as $10.9 million in defense company stock.

Moore also found that Honeywell — which provides sensors and guiding devices to assist the Israeli military in airstrikes in Gaza — is the most commonly-held defense company stock, followed by RTX (formerly known as Raytheon).

During a hearing in June of this year, Rep. Pat Fallon (R-Texas) held up to $250,000 worth of Boeing stock while questioning Navy officials during a hearing about repeated crashes of the V-22 Osprey, a tilt-rotor helicopter made by Bell and Boeing. Rep. Fallon left in the middle of the hearing, shaking hands with family members of Osprey crash victims on the way out.

If Congress wants to wash itself of conflicts of interest it can start by passing a stock trading ban. The Ending Trading and Holdings in Congressional Stocks Act, or ETHICS Act, would prohibit Members of Congress from trading individual stocks. “Lawmakers like me, we’re kind of like umpires in a baseball game, we call balls and strikes. And you definitely don’t let umpires bet on the outcome of the game,” said Sen. Jon Ossoff (D-GA), who introduced the bill alongside three other Senators. The ETHICS Act passed the Senate Committee on Homeland Security and Government Affairs in July but has not yet had a full Senate vote.President Joe Biden announced his support of a stock trading ban this week. “I don’t know how you look your constituents in the eye and know, because the job they gave you, gave you an inside track to make more money,” said Biden.

Media that fights fascism

Truthout is funded almost entirely by readers — that’s why we can speak truth to power and cut against the mainstream narrative. But independent journalists at Truthout face mounting political repression under Trump.

We rely on your support to survive McCarthyist censorship. Please make a tax-deductible one-time or monthly donation.