As ThinkProgress Economy editor Pat Garofalo noted last week, GOP presidential hopeful Rep. Michelle Bachmann (R-Minnesota) has assembled a tax plan that would involve a massive corporate tax cut and tax increase on the working poor. Meanwhile, Bachmann would continue to cut taxes on the richest income-earners among us.

But Bachmann's plan would do even worse things than simply continuing to hand out tax cuts for the rich and corporations. As Dan Baneman of the Tax Policy Center found, Bachmann's proposal to repeal taxes on capital gains would actually remove 23,000 millionaires from the tax rolls altogether. Meanwhile, the Tax Policy Center's Howard Gleckman estimates that “this largess would add about $25 billion to the deficit in one year.”

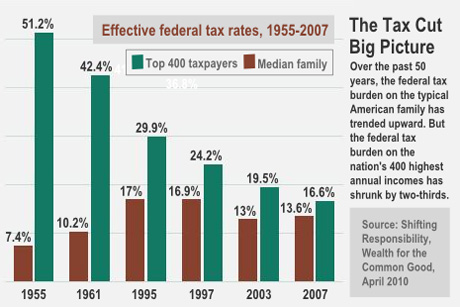

This is particularly shocking in light of the fact that the richest Americans are currently paying the some of the lowest effective tax rates in American history. As this chart from from Wealth for the Common Good shows, the top 400 taxpayers — who have more wealth than half of all Americans combined — are paying lower taxes than they have in a generation, as their tax responsibilities have slowly collapsed since the New Deal era as working families have been asked to pay more and more:

Although it is impossible to surmise their exact intentions, it appears that Bachmann's campaign is operating under the notion that the rich in America don't have it good enough and that expanding the deficit is not a problem — as long as you're continuing to cut taxes for the richest Americans.

Our most important fundraising appeal of the year

December is the most critical time of year for Truthout, because our nonprofit news is funded almost entirely by individual donations from readers like you. So before you navigate away, we ask that you take just a second to support Truthout with a tax-deductible donation.

This year is a little different. We are up against a far-reaching, wide-scale attack on press freedom coming from the Trump administration. 2025 was a year of frightening censorship, news industry corporate consolidation, and worsening financial conditions for progressive nonprofits across the board.

We can only resist Trump’s agenda by cultivating a strong base of support. The right-wing mediasphere is funded comfortably by billionaire owners and venture capitalist philanthropists. At Truthout, we have you.

We’ve set an ambitious target for our year-end campaign — a goal of $250,000 to keep up our fight against authoritarianism in 2026. Please take a meaningful action in this fight: make a one-time or monthly donation to Truthout before December 31. If you have the means, please dig deep.