Support justice-driven, accurate and transparent news — make a quick donation to Truthout today!

The International Monetary Fund (IMF) in spite of all the talk about reform is pushing for fiscal adjustment around the world. The IMF argues overheating in the developing world, particularly in China and Latin America, and excessive debt accumulation in the developed world requires fiscal adjustment to reduce the risks of inflation and debt default.

The IMF has suggested in their last Regional Economic Outlook Report that the Latin American economies that have recovered swiftly from the global financial crisis may be at risk of overheating. According to the report:

“Overheating risks stand out in much of Latin America. Growth is moderating from fast rates last year, but remains above trend. Domestic demand has been growing even faster, pushed not only by favorable external conditions but also by macroeconomic policies that have been quite stimulative and are only gradually normalizing. Early signs of overheating pressures and possible excesses are appearing in several realms.”

Their recommendation, in particular for South America, is that macroeconomic policies should be tightened. The IMF’s concern is that inflation is trending up, and they believe that this reflects both excess demand, and higher commodity prices. The question is whether it is correct to suggest that the Latin American economies are beyond their potential output levels, and that inflation is caused by excess monetary demand, that is, ‘too much money chasing too few goods.’

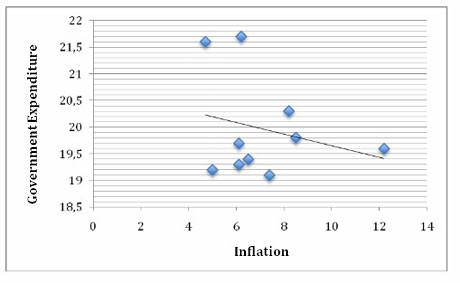

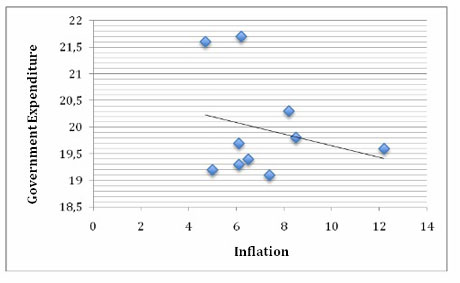

There are several ways to evaluate whether the economy is overheating. For example, one could look at the correlation between fiscal expenditures, and inflation. The figure below shows the correlation between average government expenditure and inflation for the whole Latin American region in the last decade. Note that higher government expenditures are negatively correlated with inflation. The evidence for the inflationary effects of fiscal policy is weak, at best. Even though public spending increased during the crisis, public debt levels in domestic currency in the region have fallen during the last decade, indicating sustainable fiscal policy.

Another way is also to take a look at the other components of aggregate demand including consumption and investment. The available data for the larger countries of the region show that while both consumption and gross fixed investment increased significantly in 2010, they are expected to tamper off in the medium run signaling that there are no urgent demand pressures.

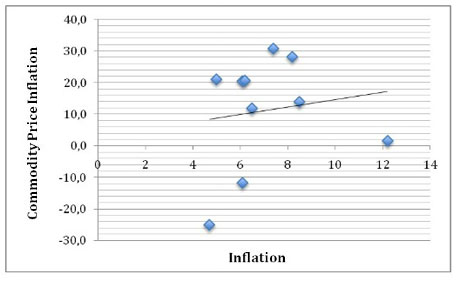

In addition there is ample evidence that the inflationary pressures in developing countries and elsewhere are related to higher prices of commodities, i.e., cost considerations, rather than demand pressures. The graph bellows shows the positive correlation (again for Latin America as a whole for the same period) of consumer prices and commodity prices. In addition a substantial portion of this increase responds to higher food prices due to natural related phenomenon in some of the main producers of staple food.

Yet a more detailed level of analysis shows that the whole inflation story is somewhat more complex. In the case of Latin America, higher commodity prices have been associated with rising domestic prices, but also with increased exchange rate appreciation. In other words, commodity prices increase internal prices due to higher costs, but at the same time they have the opposite effect because exchange rate appreciation makes foreign goods and inputs cheaper. In this sense, higher commodity prices have turned to be at the same time a curse and a blessing for inflation control.

Finally, in spite of IMF analyses, most forecasts for the region show that the Latin American regional rate of inflation, which stood at 7.3% annually on average in 2010, is expected to remain at that level for 2011 and 2012. With the exception of Argentina and Venezuela, the rate of inflation for all other countries is expected to stay at the one digit level with independence of the national monetary regimes. In those two countries the real exchange rate has been more devalued (in the case of Venezuela the black market exchange rate) leading to higher prices of imported goods.

The current situation in Latin America is unusual. Normally in the past rising domestic prices were associated with an external fall in the value of money. This inflation and was incorrectly considered key symptom of excess demand. Yet this hardly corresponds to the current reality, which is one of a temperate fall in the domestic value of national currency accompanied with a rise of the external value of currency. This can hardly be called overheating.

* Some of the results are based on joint work with Esteban Pérez Caldentey.

Media that fights fascism

Truthout is funded almost entirely by readers — that’s why we can speak truth to power and cut against the mainstream narrative. But independent journalists at Truthout face mounting political repression under Trump.

We rely on your support to survive McCarthyist censorship. Please make a tax-deductible one-time or monthly donation.