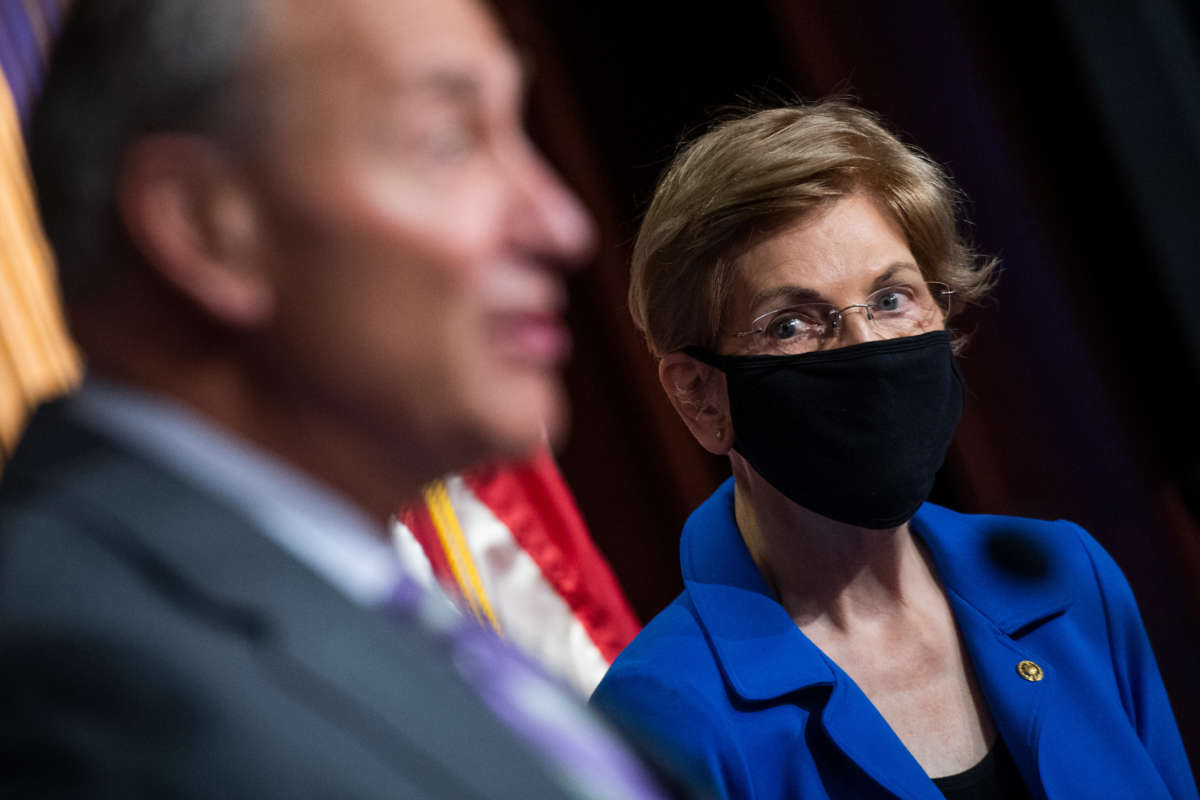

On Tuesday, among a slate of other committee assignment announcements, Senate Majority Leader Chuck Schumer told reporters that Sen. Elizabeth Warren is going to be trading her spot on the Senate Committee on Health, Education, Labor and Pensions for a spot on the coveted Finance Committee. Her first priority, she said, will be to implement a wealth tax.

“I’m very pleased to join the Finance Committee, where I’ll continue to fight on behalf of working families and press giant corporations, the wealthy, and the well-connected to finally pay their fair share in taxes,” Warren said in a statement. “I look forward to being a progressive voice at the table to secure meaningful relief and lasting economic security for struggling families.”

Her “first order of business,” she tweeted on Tuesday, will be to implement a wealth tax on people with assets worth over $50 million. “It is time to make the ultra-rich pay their fair share.”

As she outlined on Twitter, her plan is to implement a 2 percent wealth tax on assets worth over $50 million and an additional percentage on wealth over $1 billion. This is similar to the wealth tax that Warren touted during her 2020 presidential campaign and represents, as The New York Times wrote, “a more substantial rethinking of the federal government’s approach to taxation than anything a major presidential candidate has proposed in recent memory.” Sen. Bernie Sanders also proposed a wealth tax on the campaign trail that was more drastic than Warren’s.

The United States currently does not have a wealth tax, preferring the income tax model that Americans live with today. A wealth tax is a tax on an individual’s net worth instead of their earnings. As Warren points out, an heir worth $500 million but making only $50,000 a year, and a person in debt making the same amount, pay similar federal taxes under the current system. An estimated 75,000 American households would be affected by Warren’s proposal.

Consider two people:

– An heir with $500 million worth of yachts and jewelry and art

– A public school teacher with no savings in the bankThey both bring home $50,000/year. And they both pay the same amount in federal taxes.

That’s a system that is rigged for the top.

— Elizabeth Warren (@ewarren) February 3, 2021

Prominent economists have said that a wealth tax is a good way to help curb inequality and redistribute wealth, especially as the wealthy have only gotten richer during the pandemic while millions have lost their jobs. The extra income for the government could go toward paying for measures to help lower- and middle-class Americans, say the tax’s proponents.

“We could provide universal child care and universal preschool” with the 2 percent wealth tax, Warren said on MSNBC. “We could make post-high school education — two-year college, four-year college, technical school — tuition-free. We could cancel a huge amount of student loan debt.” Progressive lawmakers and activists have argued in past years that raising taxes on the ultra-wealthy could help pay for the expanded social programs that they propose.

Polls show wide and enthusiastic support for a wealth tax among the American public. Other countries have tried a wealth tax that the governments later retracted, but some argue that we can learn from their mistakes and do it right in the U.S.

For instance, some Europeans simply moved to another country to avoid the wealth tax in their own countries. However, “The situation in the United States is different,” write Gabriel Zucman and Emmanuel Saez in The Washington Post. “The only way to escape the IRS is to renounce citizenship, an extreme move that in both Warren’s and Sanders’s plans would trigger a large exit tax of 40 percent on net worth.” (It is yet unclear if Warren currently plans to implement an exit tax, but it is still outlined as part of the wealth tax plan on her website.

The Senate Finance Committee oversees taxes, trade, spending, and programs like Medicare and Medicaid, making it a powerful force in the federal government. In this position, Warren will have a bigger voice on these issues.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. We have hours left to raise the $12,0000 still needed to ensure Truthout remains safe, strong, and free. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.