Did you know that Truthout is a nonprofit and independently funded by readers like you? If you value what we do, please support our work with a donation.

Two weeks ago it was announced that the U.S. has the highest corporate tax rate in the world sparking furious debate from Fox News types concerned about corporate well being. At RAN, we decided to dig a little deeper to see whether the corporate tax rate really is unfairly penalizing multi billion dollar corporations. Our discovery? The actual corporate tax rate may not matter when corporations don’t pay anything close to it anyway.

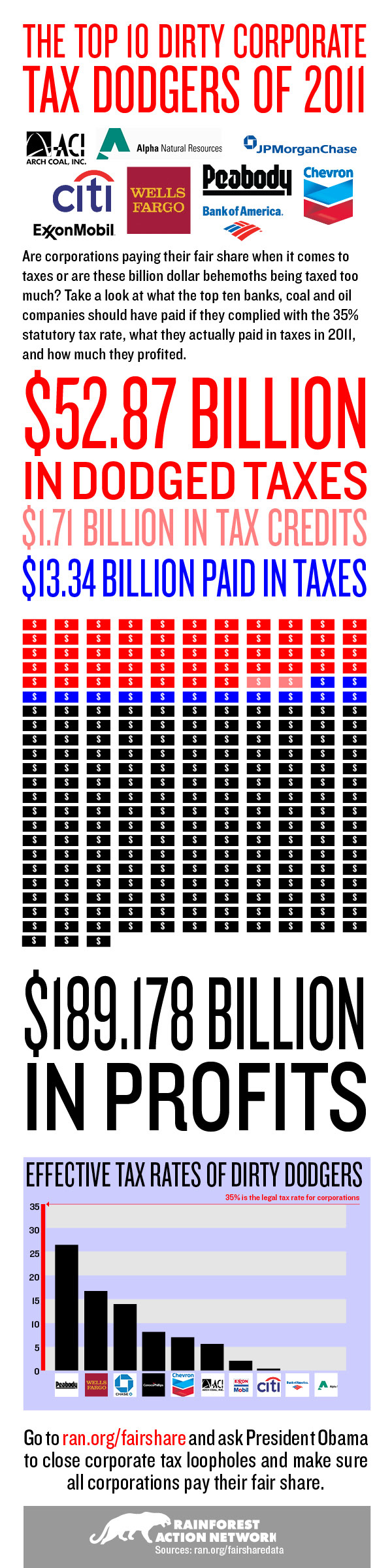

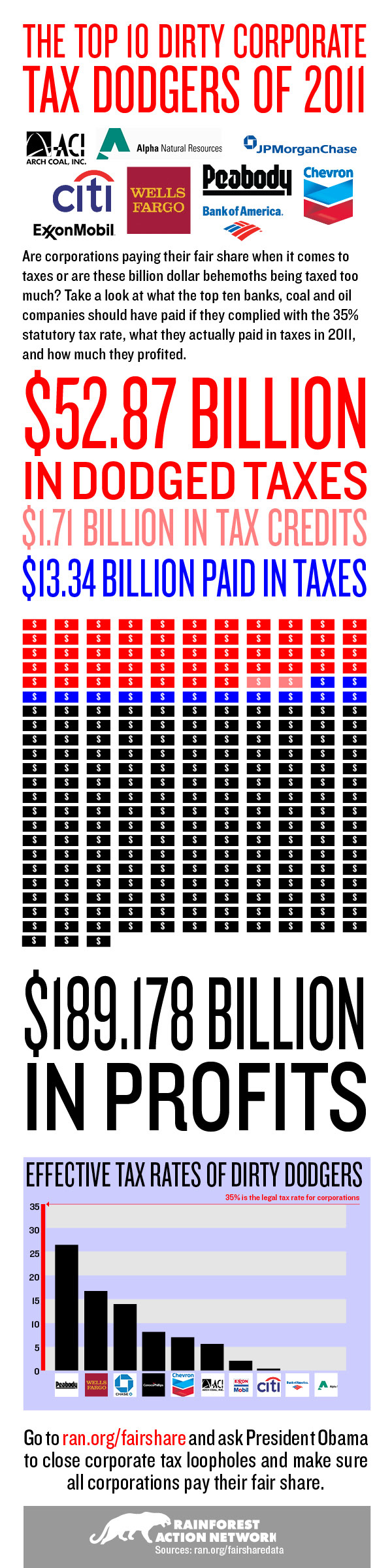

RAN’s new “Top 10 Dirty Corporate Tax Dodgers of 2011” infographic reviewed top bank, oil and coal companies: Bank of America, Citi, JPMorganChase, Wells Fargo, Chevron, Exxon, ConocoPhillips, Arch Coal, Alpha Natural Resources and Peabody Energy. We found that none of these ten companies paid anything close to the 35% corporate tax rate. In fact, Bank of America and Alpha Natural Resources paid no taxes at all.

Collectively, these ten corporations made a profit of $189.178 billion while only paying $13.34 billion in taxes in 2011. If they had paid the 35% corporate tax rate it would have put $52.87 billion back into the economy. It begs the question, what do the rest of us get while the government allows big business to game the system?

Here’s a bit more of the wonky details from U.S. News and World Report:

“The real issue lies in understanding the huge gap between the “nominal rate” (the list price) and the “real rate” (the tax rate that most companies actually pay.) These two rates diverge widely. The nominal federal tax rate on the largest corporations is now 35 percent. State taxes, on average, bump this to 39.2 percent. This nominal rate ranks as the highest among developed countries. However, no major company really pays the nominal rate. Big companies enjoy a huge buffet of credits, shelters, deductions, and other preferences that reduce their rate to an average of 13 percent. Many profitable companies pay no federal income tax at all. Regardless of our nominal rate, our real corporate tax rate is among the lowest.”

The ten banks, oil and coal companies that RAN researched are responsible for foreclosing on millions of people’s homes and polluting our air, water and climate. At the same time, we found that they pay next to nothing into a tax system that provides the very services that protect the homeless, the sick and our environment.

Bottom-line, these dirty corporations don’t need any more handouts, bailouts, or subsidies. Our country does not have a money problem; it has a priorities problem. We’re subsidizing and bailing out multi billion dollar businesses at the expense of everything else: our economy, our climate, our health, and our future.

Here’s two things you can do about:

1. Tell President Obama; it’s time corporate tax dodgers pay their fair share!

2. Join the 99%Power in taking direct action with thousands upon thousands to shine a light on the exact corporate actors who created this historically unjust economy. Under the banner of 99% Power, there will be more demonstrations leading up to and at corporate shareholder meetings this Spring than at any point in American history.

Press freedom is under attack

As Trump cracks down on political speech, independent media is increasingly necessary.

Truthout produces reporting you won’t see in the mainstream: journalism from the frontlines of global conflict, interviews with grassroots movement leaders, high-quality legal analysis and more.

Our work is possible thanks to reader support. Help Truthout catalyze change and social justice — make a tax-deductible monthly or one-time donation today.