Whenever the subject of state and local governments’ fiscal plight comes up here in the United States, conservatives engage in spittle-flecked denunciations of unions and their crazy pay packages.

Jonathan Cohn tells us in an online piece for The New Republic, published in August: “Conservatives say that excessive public employee pensions exemplify the greed of unions (which sought these generous benefits for public employees) and inefficiency of government (which agreed to pay them). If local and state governments are struggling financially, these conservatives say, they should figure out some way to reduce or revoke those promised benefits, rather than come to Washington and beg for help from the taxpayers.”

So, how much truth is there to the theory that massive pension liabilities and bloated benefits for public workers are increasing our financial woes? According to an analysis by John Schmitt at the Center of Economic and Policy Research, state and local employees are paid more, on average, than private-sector workers – about 13 percent more. But Mr. Schmitt’s data also shows that this is actually a false comparison: state and local workers are somewhat older than private-sector workers, and they are actually much better educated (about 23.5 percent have advanced college degrees, as opposed to 8.9 percent in the private sector). About half of all state and local workers are teachers and academic administrators – which means that they’re college-educated, at minimum.

Think about it: How many ambitious young people say, “My goal in life is to become a high school teacher – that would put me on easy street”?

It is true that in this country, police and firefighters get pretty generous pay packages, but they also pull people from burning buildings.

If you still believe, despite this evidence, that public workers are paid more than they should be, how big an issue is this, really, for state and municipal budgets?

If you still believe, despite this evidence, that public workers are paid more than they should be, how big an issue is this, really, for state and municipal budgets?

Click here to sign up for Truthout’s FREE daily email updates.

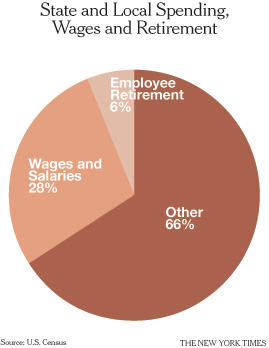

I looked at finance data from the U.S. Census and got the composition of nonfederal government spending shown in the graphic on this page. You’ll see two things. First, wages and retirement benefits don’t take up an unreasonably large piece of the pie. Second, subtracting a few percentage points either in pay or retirement benefits would not actually make a big difference.

In the end, this is a phony issue.

——————————————————————-

BACKSTORY: Dwindling Benefits

On Aug. 31, a judge in San Francisco cleared the way for an initiative that would save the city about $170 million – which, if passed by voters, would require city workers to pay more into their pensions and for health care. The Associated Press reported that the union representing the workers had sued to prevent this issue from being included on the November ballot, citing employees’ contractual rights.

Such legal challenges have given American conservatives some leverage in recent economic debates. They argue that unions have exacted overly generous entitlement packages for public-sector workers from weak local governments, and that the onus lies with these retirees to reduce their financial expectations – just as those working in the private sector have been forced to do.

The Pew Center on the States has released a study showing that by the end of 2008, state governments faced a $1 trillion shortfall in payouts. Some pension agreements guarantee these payouts, and in most states taxes have filled the gap.

In an effort to address this problem, Colorado passed a law this year reducing a guaranteed annual cost-of-living increase for state retirees. A group of pensioners affected by the change filed a lawsuit in hopes of reversing the legislation, maintaining that they should not be penalized for the bad decisions of the state’s pension fund managers.

Supporters point out that such plans were offered as incentives for workers’ public service, sometimes in place of Social Security benefits.

Copyright 2010 The New York Times.

Truthout has licensed this content. It may not be reproduced by any other source and is not covered by our Creative Commons license.

Paul Krugman joined The New York Times in 1999 as a columnist on the Op-Ed page and continues as a professor of economics and international affairs at Princeton University. He was awarded the Nobel in economic science in 2008.

Mr Krugman is the author or editor of 20 books and more than 200 papers in professional journals and edited volumes, including “The Return of Depression Economics” (2008) and “The Conscience of a Liberal” (2007).

Our most important fundraising appeal of the year

December is the most critical time of year for Truthout, because our nonprofit news is funded almost entirely by individual donations from readers like you. So before you navigate away, we ask that you take just a second to support Truthout with a tax-deductible donation.

This year is a little different. We are up against a far-reaching, wide-scale attack on press freedom coming from the Trump administration. 2025 was a year of frightening censorship, news industry corporate consolidation, and worsening financial conditions for progressive nonprofits across the board.

We can only resist Trump’s agenda by cultivating a strong base of support. The right-wing mediasphere is funded comfortably by billionaire owners and venture capitalist philanthropists. At Truthout, we have you.

We’ve set an ambitious target for our year-end campaign — a goal of $119,000 to keep up our fight against authoritarianism in 2026. Please take a meaningful action in this fight: make a one-time or monthly donation to Truthout before December 31. If you have the means, please dig deep.