It’s time for a euro update. (I’ve been pretty focused on the American election, since it is, after all, my country; but am still keeping an eye on the other side of the pond.)

The basic story of the euro crisis remains the same: It’s essentially a balance of payments crisis that has been misinterpreted as a fiscal crisis, and the key question is whether internal devaluation is really workable.

What?

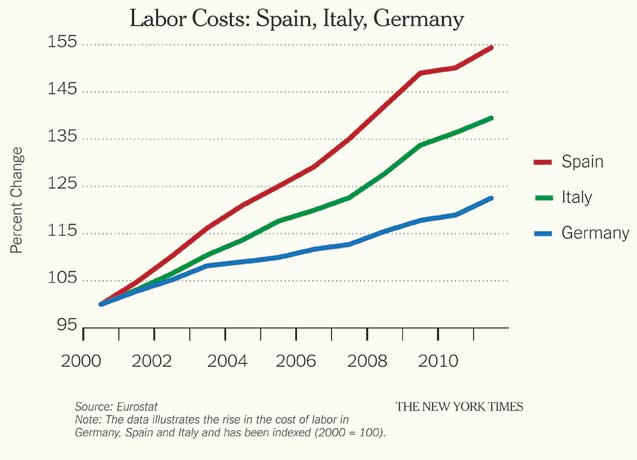

O.K.: the roots of the euro crisis lie not in government profligacy but in huge capital flows from core countries (mainly Germany) to the euro zone periphery during the good years. These capital flows fueled a peripheral boom, along with sharply rising wages and prices in the GIPSI countries (Greece, Ireland, Portugal, Spain, Italy) relative to Germany (as shown on the chart on this page).

Then the music stopped. The combination of deeply depressed peripheral economies (which meant surging budget deficits) and fears of a euro crackup turned this into an attack on peripheral-government bonds. But the root remains the balance of payments/cost problem. And any resolution must involve getting costs and prices back in line.

This is the context in which we have to see Mario Draghi’s actions. Twice now — first with the long-term refinancing operations last fall, then in September with the plan to buy sovereign debt — the president of the European Central Bank has stepped in to limit runaway bond yields, short-circuiting a possible financial “death spiral” of falling bond prices, collapsing banks and high-speed capital flight.

Good for him. But you still need internal devaluation: a sharp fall in costs and prices relative to the core. And that’s a slow, painful process.

Where does austerity fit into this story? Mostly it doesn’t. Shaving an extra couple of points off the structural deficit will make very little difference to long-run solvency, nor will it do much to accelerate the pace of internal devaluation.

It will, however, depress employment even further and inflict a lot of direct suffering too, through cuts in social programs.

Why do it, then? Partly it’s because Europe is still operating on the false theory that this is essentially a fiscal issue; partly it’s to assuage the Germans, who remain convinced that those lazy southern Europeans are getting away with something. In effect, the policy is to inflict pain for the sake of inflicting pain.

Which brings us to the question: Can this go on? When will the people of the afflicted economies say that they can bear no more?

The news from Spain, with vast protests and talk of secession, suggests that this moment may be approaching fast. Also, while Greece has long since ceased to be the epicenter, things seem to be breaking down there, too.

I really do think Mr. Draghi has done very well. But he can’t make internal devaluation work on his own, and he can’t save Europe if its leaders continue to think that gratuitous infliction of pain is sound policy.

Capital Flows to the GIPSIs

A correspondent asks a good question: When I say that lots of money flowed into Spain and other peripheral economies during the bubble years, what kinds of capital flow are we talking about?

In brief, you should think of it as largely taking the form of bank-to-bank lending. For example, the German Landesbanken bought covered bonds issued by Spanish cajas; the cajas in turn used the money to finance real estate purchases. Other forms of cross-border investment, like direct investment by corporations, were a fairly minor feature. That’s also why the flip side of those capital flows was a sharp rise in Spanish private-sector debt.

I’d like to post a good chart, but I haven’t found a clean presentation of the data. If anyone knows how to do this, let me know! But the basic story seems clear.

And by the way, this makes it quite clear that to the extent that you want to talk about irresponsible behavior, it was really a collaborative, trans-European project.

German bankers knew what the Spanish banks were doing, and in fact took on quite a bit of the risk directly by accepting real estate as collateral.

24 Hours Left: All gifts to Truthout now matched!

From now until the end of the year, all donations to Truthout will be matched dollar for dollar up to $18,000! Thanks to a generous supporter, your one-time gift today will be matched immediately. As well, your monthly donation will be matched for the whole first year, doubling your impact.

We have just 24 hours left to raise $18,000 and receive the full match.

This matching gift comes at a critical time. As Trump attempts to silence dissenting voices and oppositional nonprofits, reader support is our best defense against the right-wing agenda.

Help Truthout confront Trump’s fascism in 2026, and have your donation matched now!