Another top Trump administration official is in hot water over apparent ethics violations.

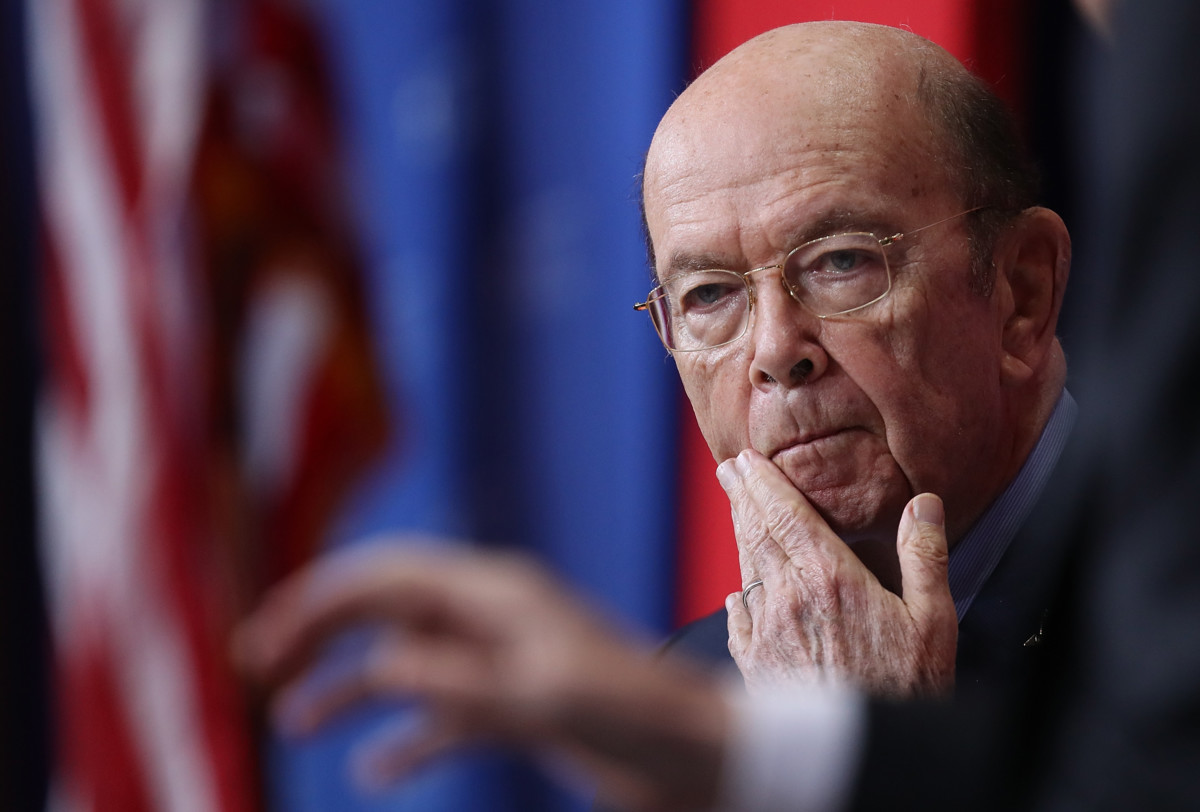

The Senate Finance Committee’s ranking Democrat asked the Department of Justice on Monday to formally investigate whether a series of “questionable” stock trades by President Trump’s commerce secretary, Wilbur Ross, violated federal law. Ross has faced public scrutiny for keeping investments in firms linked to the Chinese government and Russian President Vladimir Putin’s inner circle since taking office.

In a letter filed with the Justice Department, Sen. Ron Wyden (D-Oregon) pointed to a stinging correspondence between Ross and the US Office of Government Ethics last week. The government’s top ethics official warned the wealthy investor that certain stock holdings and trades had violated his ethics agreement and “created the potential for a serious criminal violation.” In addition, financial disclosures made to the Office of Government Ethics contained “various omissions and inaccurate statements” that could erode public trust in the government.

The questions hanging over Ross could create another ethics headache for an administration already plagued by scandals. According to investigative reports by Forbes and The New York Times, Ross held on to investments that presented apparent conflicts of interest after taking office last year, including shares in Navigator Holdings, a shipping firm tied to the Kremlin. Last October, Ross short-sold shares of the company as New York Times reporters prepared to publish a potentially negative article exposing the holdings, putting the commerce secretary in a position to profit even as the firm’s stock price fell.

In November, Ross submitted a sworn statement promising federal officials that he had sold all the stocks that he had committed to divesting when taking office, only to later disclose that he had held onto $20 million worth of shares in his former employer, the financial firm Invesco, before selling them in December for a handsome return.

Ross also held short positions on holdings in other firms from which he had promised to divest and generally failed to meet divestment requirements by deadlines set in his ethics agreement, according to Office of Government Ethics Director David Apol’s letter to Ross.

Wyden launched his own probe of Ross’s investments earlier this year and told the Justice Department this week that Ross’s response to inquiries from his office “did not adequately justify the activities in question.”

“The top federal ethics watchdog confirmed what anyone with eyes and ears already knew: Wilbur Ross’ stock trades seriously compromised his ability to act in America’s best interests, and may have broken the law,” Wyden said in a statement.

In a brief statement in response to Apol’s letter, Ross announced last week that he had sold off all of his private equity holdings in order to “maintain public trust.” He also claimed to have made “inadvertent errors” in completing the divestments required by his ethics agreement and disclosing them to ethics officials.

“My investments were complex and included hundreds of items,” Ross said in a statement released by the Commerce Department on Thursday. “I self-reported each error, and worked diligently with my department’s ethics officials to make sure I avoided any conflicts of interest.”

Whether Ross made “inadvertent” mistakes or intentionally lied to federal officials could determine whether the commerce secretary broke the law by making inaccurate statements to federal officials. Apol advised Ross that the Office of Government Ethics has no information to contradict his claims that the inaccuracies and omissions in his disclosures were “inadvertent,” and a Department of Commerce official reviewed Ross’s daily “calendars, briefing books and correspondence” for potential financial conflicts of interest and found none.

However, Forbes reporter Dan Alexander cast doubt on this internal review last week with a detailed report revealing that the commerce secretary has held dozens of meetings with companies that helped him build his personal fortune, all while serving within the Trump administration:

Last March, his calendar lists a meeting with the CEO of Boeing, a company in which Ross’ wife held nearly $3 million worth of stock. In April, his schedule includes another with Minister Ali Shareef Al Emadi, who serves on the board of Qatar Investment Authority, a sovereign wealth fund that pumped money into one of Ross’ private equity vehicles. In July, September and October, Ross’ agenda lists talks with Bill Ford, executive chairman of Ford Motor Company, which called a business Ross partly owned a “top performing global supplier.” And so on, and so on.

Wyden, meanwhile, continues to press for a formal investigation, pointing to Apol’s letter indicating that Ross could have put himself in a potentially criminal position. “In light of this report, the Justice Department should conduct a thorough investigation to ensure that Ross was working on behalf of the American people and not just his own bank account,” Wyden said.