Louisiana plans to collect no industrial property tax from the $15.2 billion Driftwood liquefied natural gas (LNG) export terminal planned for its southwest corner, state officials announced in December.

Critics say this tax break is worth $1.4 to $2.4 billion, making it one of the largest local corporate tax exemptions in American history — even larger than those offered to Amazon for its much sought-after second headquarters.

Proposed by the natural gas firm Tellurian, the Driftwood terminal, which would liquefy and export 4 billion cubic feet of natural gas a day, is one of over a dozen gas export terminals proposed around the U.S. and fueled by a glut of shale gas released by fracking. The final investment decision for Driftwood is expected in early 2019, as are decisions on two other proposed Gulf Coast export terminals.

The move comes as a group of investors and insurers have called on the U.S. and all other G20 nations to end fossil fuel subsidies entirely by 2020, citing the risk that climate change poses to the global economy.

From 2012 to 2016, fossil fuel subsidies were slashed in half, falling from a peak of nearly $500 billion, according to the International Energy Agency’s World Energy Outlook 2018. However, in 2017, global subsidies began to rise again, edging up to $300 billion. (The IEA report looked only at subsidies for energy consumption and left out the costs borne by the public of health impacts and environmental harms.)

By 2025, analysts say, the U.S. could become the world’s largest exporter of the fossil fuel LNG.

Driftwood alone could nearly double American LNG exports, as the industry currently has the capacity to export 3.6 billion cubic feet a day, according to the Energy Information Administration. Tellurian plans to pipe shale gas from Texas’ Permian Basin and Louisiana’s Haynesville shale through not-yet-built pipelines to Calcasieu Parish in Louisiana.

A Major Tax Break But for How Many Jobs?

The 100 percent property tax break for Tellurian’s Driftwood terminal was approved under Louisiana’s Industrial Tax Exemption Program (ITEP), which critics have faulted for being overly industry-friendly.

“This is the most notorious property tax program in the country,” Greg LeRoy, executive director of Good Jobs First, told DeSmog. “The cost for jobs is often phenomenal.”

The tax break for Driftwood will be worth $1.4 billion in its first five years. At that point, it can be renewed for an additional five years. Taking depreciation into account, the company will shave $2.4 billion from its tax bill, according to Together Louisiana, which opposed the plan.

The Driftwood plant is expected to create 200 permanent jobs. That means the tab for the 10-year tax break would run as high as $10 million per permanent job, critics say.

The company predicts that up to 6,400 workers will also secure temporary construction jobs — which amounts to over $312,000 in tax breaks per temporary job.

All together, it’s “the single largest public subsidy by local government in American history,” Together Louisiana wrote in an email, according to The Advocate.

Opponents have raised concerns that local officials, who must sign off on ITEP exemptions under a 2016 executive order by Gov. John Bel Edwards, violated public meeting laws when Driftwood’s exemption was approved.

“I believe the Calcasieu Parish School Board may have voted in favor of a 100 percent exemption without being supplied with very pertinent information,” Mack Dellafosse, the president of the Calcasieu Parish School Board wrote, adding that he was objecting in his personal capacity as a resident. “The information provided to board members was very minimal and failed to include critical details.”

Corporate Subsidies

The Driftwood tax break is larger than the $1.525 billion in local tax incentives that New York City promised Amazon for locating half of its second headquarters in the city — and far larger than the $573 million offered by Virginia for the other half of Amazon’s proposed campus. Each of those sites, Amazon says, will create 25,000 jobs.

There have been larger state tax incentives for corporations in recent years, but the Driftwood subsidy, which comes from the coffers of the local parish government, not the state’s budget, appears to be uniquely large. Both state and local corporate subsidies can be extremely controversial.

In Wisconsin, Gov. Scott Walker put together a $3 billion package of state tax incentives for Taiwanese electronics maker Foxconn, which promised 13,000 jobs (a deal that has grown increasingly contentious as government subsidies have grown and Foxconn’s plant proposal has shrunk).

“I do think we’re giving away the farm,” Teri Johnson, head of the Calcasieu Federation of Teachers, told KPLC TV, a local news affiliate. “It’s kind of like, if somebody comes to buy your best milk cow and you just give it away, you don’t make anything on it.”

Advocates for the deal say that Calcasieu will still generate local tax revenues through sales taxes, which they say could provide up to $780 million to the parish in five years.

“Louisiana has had the foresight to set itself up for long-term economic growth and success using incentives to attract business investment. Driftwood will bring jobs and other revenue to the area for at least the next 40 to 50 years,” a Tellurian spokesperson told KPLC.

A Sinking Feeling

The Louisiana community that will forego Driftwood’s property tax revenues — which would normally fund schools, public safety, and other local government programs — is also among those already facing one of the most visible impacts of a warming climate: sea level rise.

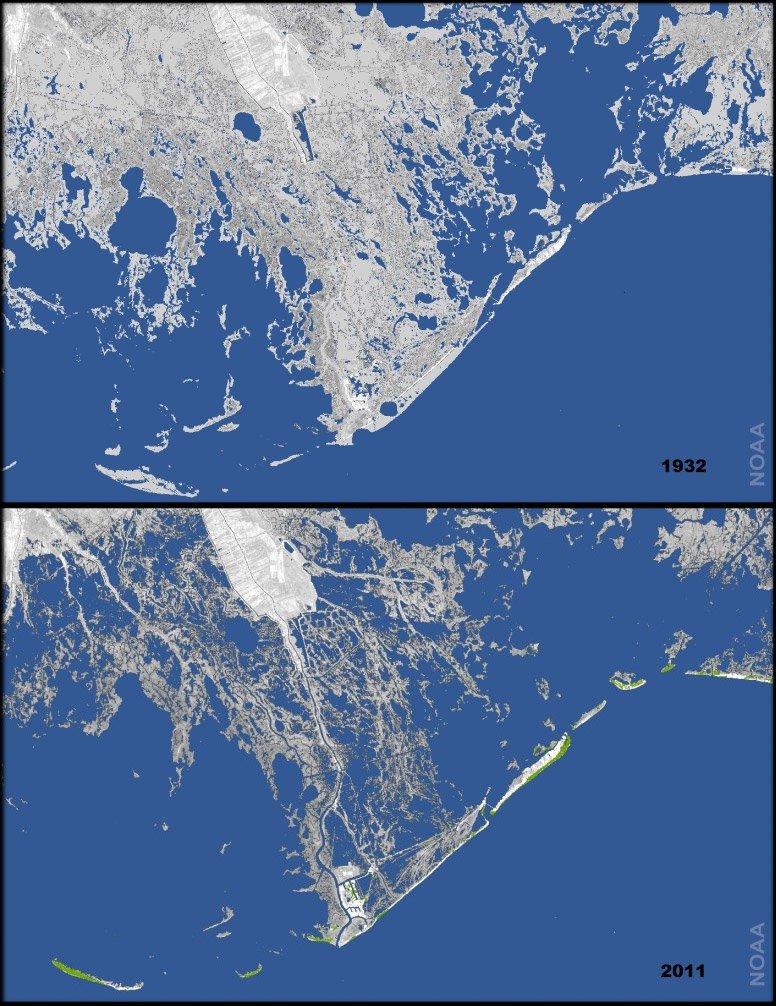

In addition, coastal erosion erased roughly 1,900 square miles — an area about the size of Delaware — from Louisiana from 1932 to 2000. “We’re sinking faster than any coast on the planet,” Bob Marshall, a Times Picayune columnist who won a Pulitzer in 1996 for his coverage of Louisiana’s wetlands, told Matter in 2014. “An area approximately the size of a football field continues to slip away every hour,” the publication added.

Louisiana is planning a $92 billion campaign to combat coastal flooding — a plan whose funding source remains partly unclear. And even with that plan, most of the land south of Interstate 10 from Lake Charles to Slidell will eventually slip into the sea, a 2017 state report shows.

Climate change and sea level rise will also carry costly implications for storm surge flooding and hurricanes. The Calcasieu area was hard hit by hurricanes Harvey and Rita. State officials recently reduced ambitions aimed at flood-proofing some businesses and homes and buying out others, cutting the budget for the program, originally estimated at $125.1 million, roughly in half.

Submerged by Climate Science Denial

But as the sea creeps closer, this southwestern corner of Louisiana has gained international fame for its resistance to accepting climate change as the cause of sea level rise. In August 2017, The Guardian profiled neighboring Cameron Parish, which it reported “could be the first town in the U.S. to be fully submerged by rising sea levels and flooding.”

“Instead, Cameron has earned a different kind of fame: it’s the county that, percentage-wise, voted more in favor of Trump than all but two other counties in the U.S. in last year’s election.”

The regional economy is heavily reliant on the petrochemicals and refining industry — and has faced extraordinary impacts from pollution. Virtually everyone in Mossville, a town in Calcasieu Parish, received buyout offers from Sasol, which planned a petrochemical plant expansion in the area, after tests showed that locals carried triple the national average levels of dioxin, a known carcinogen, in their blood, The Intercept reported in 2015.

Driftwood has a state Clean Air Act permit that will allow it to pump 9.5 million tons of greenhouse gases into the air annually, according to the Environmental Integrity Project — about as much as building two new coal power plants and further contributing to the climate change impacts the region is already facing.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $46,000 in the next 7 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.