Honest, paywall-free news is rare. Please support our boldly independent journalism with a donation of any size.

For almost two years, we’ve been hearing a new battle cry in the war against government spending: unless the United States slashes deficits we will become Greece, Europe’s poster child for fiscal insolvency and economic crisis. The debt crisis in the eurozone, the 17 European countries that share the euro as their common currency, is held up as proof positive of the perils that await the United States if it continues its supposedly fiscally irresponsible ways.

Take the Heritage Foundation, the Washington-based think tank that specializes in providing red meat for anti-government pro-market arguments. Heritage introduces its 2011 chart on the rising level of government debt (to GDP) with this dire warning: “Countries like Greece and Portugal have suffered or are anticipating financial crises as a result of mounting debt. If the U.S. continues federal deficit spending on its current trajectory, it will face similar economic woes.”

Even for those who understand that cutting deficits right now will only weaken a still-fragile recovery, and that weakening the recovery will only increase deficits, getting past the argument that “a eurozone crisis is on its way” is no easy task.

What follows is a self-defense lesson on why the United States is not Greece—or Europe. The U.S. economy is far larger and more productive than Greece. The United States has many more tools in its macro-economic policy box than countries in the eurozone. And while calls for austerity have kept the United States from undertaking government spending and investment large enough to support a robust economic recovery, at least thus far, the United States hasn’t undertaken the same self-defeating austerity measures Europe has. If we learn the right lessons from what is happening in the eurozone now, we never will.

Central Banks and Deficit Spending

When economic activity plummeted during 2008 and 2009 in the United States, Europe, and throughout the world, coordinated stimulus spending of nations across the globe prevented the collapse of world output from becoming another Great Depression. Today, deficit spending remains critical as working people continue to struggle through an economic recovery that has done little to create jobs or to lift wages, but much to restore profits.

Governments finance deficit spending by borrowing. Governments sell bonds—promissory notes—to domestic and foreign investors as well as other government agencies, and then use the proceeds to pay for spending in excess of their tax revenues. In the United States, domestic investors, foreign investors, and government agencies hold near equal shares of government bonds issued by the Treasury and receive the interest paid on those bonds.

The Federal Reserve (“the Fed”), the U.S. central bank, can buy U.S. government bonds as well. The Fed can also create money (sometimes metaphorically called “printing money”) simply by entering an appropriate credit on its balance sheet and spending it. When the Fed uses this newly created money to purchase bonds directly from the government, it is financing the government deficit. Economists call the Fed’s direct purchase of government bonds “monetizing the deficit.” By such direct purchases of bonds that finance the deficit, the Fed can fund government spending in an emergency, should it choose to do so. Monetizing the deficit also significantly expands the money supply, which pushes down interest rates, which can also help stimulate the economy.

In the current crisis, the Fed did precisely that. By purchasing government bonds, the Fed financed public-sector spending, and by pushing down interest rates, it encouraged private-sector borrowing. In doing so, the Fed supported a market recovery, but also helped to keep unemployment from rising even higher than it did.

In seeking to lower unemployment, the Fed was exercising what is known as its “dual mandate” under the law to promote both low inflation and low unemployment.

Nevertheless, the Fed’s decision to inject more money into the economy has come under heavy fire from those who worry more about inflation than unemployment, and who think that “printing money” is always inflationary. Neither continued low inflation rates nor persistently high unemployment were enough to change the thinking of these inflation-phobes. Back in August, Rick Perry, the Texas governor and candidate for president in the Republican primary, went so far as to insist that if the Fed “prints more money between now and the election” (in November 2012) it would be “almost treasonous.”

The central banks of most other countries have much the same abilities as the Fed has to inject money into their economies and to buy government debt. As with the Fed, they may or may not choose to use this power. But the power is unquestionably there.

Europe’s Central Bank Is Different

The 17 countries in the eurozone, however, relinquished their ability to print money, expand their money supplies, and lower interest rates when they adopted the euro as their common currency. Only the European Central Bank—known as the ECB—can authorize the “printing of euros,” and the ECB maintains control over the money supply of the eurozone.

Unlike the Fed, the ECB does not have a dual mandate to pursue low employment as well as low inflation. The ECB’s authority is limited to maintaining low inflation, known as “price stability,” which the ECB defines as an inflation rate below 2%.

And the ECB is prohibited from directly buying government bonds. The ECB is authorized to buy government bonds only on the “secondary” bond market, when original purchasers resell them.

The result of these policies is that eurozone countries must sell their bonds on the open market. That leaves them entirely dependent on private bond buyers (i.e., lenders), whether from their own country or other countries, to finance their government deficits. Governments must offer their bonds for sale with rates of returns (or interest rates) that will attract those bonds buyers. Each uptick in the interest rate adds to the debt burden of these countries, and makes deficit spending to stimulate the economy that much more expensive.

Another way a country can stimulate its economy is by increasing exports. Typically, individual countries’ currencies (when not fixed to the value of a dominant currency such as the U.S. dollar) lose value, or “depreciate,” when an economy falls into a crisis, such as the crisis Greece is in now. As the value of its currency depreciates, a country’s exports become cheaper, and that boosts export sales and domestic production and aids recovery. While currency fluctuations can open the door to speculative excesses, the falling value of a country’s currency is yet another way to help turn around a flagging economy not available to the eurozone economies. The problem is that all countries in the eurozone have the same currency. So individual countries can’t let their currencies depreciate. Nor can they take steps countries outside the eurozone can take to intentionally lower their exchange rates to become more competitive, known as devaluing.

Similarly, central banks outside the eurozone routinely stimulate economies by pushing down key interest rates at which banks lend to each other. This helps lower other interest rates in the economy, such as rates for business and consumer loans, and can lead to the expansion of borrowing and spending. But the ECB targets one interest rate for lending between banks for the whole eurozone. It is not possible to set one interest rate for Germany to fight inflation, and a second, lower, rate in Greece or Italy to stimulate growth.

Without the ability to use separate exchange rates or interest rates to stimulate lagging economies, the crisis-ridden eurozone had but one public policy left to get their economies going again: expansionary fiscal policy. But even that remaining policy option was constrained. The ECB was not about to ease the burden of increased government spending (or the cost of tax cuts) by directly buying government bonds. Eurozone guidelines prohibit budget deficits that exceed 3% of GDP, or national debt in excess of 60% of their GDP. And there is no central fiscal authority with deep pockets to turn to. Contrast this with the United States, where states also share the same currency and the Fed targets one interest rate, but where states can turn to the federal government for assistance in times of economic stress.

In effect, the eurozone countries were left to confront the global downturn and the sovereign debt crisis with one policy hand tied behind their back, and a couple of digits lopped off the other. Market pressure on interest rates made it yet more difficult for eurozone countries to get out of trouble by undertaking countercyclical, or stimulus, spending when economies slowed.

In the few cases where eurozone authorities have provided loans to indebted countries, they have insisted on austerity measures ranging from slashing government spending to public- and private-sector wage cuts as the pre-condition for providing relief. But since cutting government spending in a downturn leads to both a fall in demand and rise in unemployment, this emergency lending is making it even harder for eurozone countries to recover.

No wonder the global downturn hit the most vulnerable eurozone countries so hard, turning their sovereign (or government) debt as toxic as the mortgage-based securities that sparked the initial global downturn. This is what we’re seeing played out with the Greek debt crisis.

Greek Austerity

When the 2008-2009 global collapse pushed down GDP and trade, and pushed up budget deficits around the world, Greece already had a large trade deficit and high government debt. Greece had consistently run government deficits greater than 5% of its GDP, and had carried government debt that just about matched its GDP for nearly a decade, both clear violations of eurozone guidelines. Nonetheless, Greek banks, and then banks elsewhere in Europe (including Germany and France), readily lent money to the Greek government, buying their bonds, which regularly yielded a handsome 5% rate of return (the rate of interest on a ten-year government note), and which presumably carried limited risk as the sovereign debt of a developed country unlikely to default.

But as the Greek economy tumbled downward, Greece had to raise its interest rates to above 12% to sell the additional debt it needed to stay afloat. By the summer of 2010, Greece was pushed to the point of default—not being able to pay its lenders.

The European Union and the IMF gave Greece a $140 billion loan so debt payments to the banks could continue. But both the IMF and the European Union insisted on austerity to reduce deficits and ensure repayment. Greece was forced to agree to sharp cuts in government spending, public employment, and wages and benefits of public employees; to tax increases; and to privatization of government assets. The banks that had happily lent Greece money well beyond the allowable eurozone limits escaped without having to write down the value of their loans to the Greek government.

The Greek economy, on the other hand, dropped like a stone. In the year that followed, Greece lost more output than the United States had during the Great Recession. Unemployment rates reached 18.4%, over one-third of young people were unemployed, and more than one-fifth of the population was poverty stricken. The austerity measures did trim the Greek budget deficit. Nonetheless the ratio of public debt to GDP continued to rise as Greek output plummeted.

One year later, Greece was on the brink of default again. The interest rate on Greek government bonds had skyrocketed to above 20% on ten-year government bonds, only adding to Greece’s already unsustainable debt burden.

In October 2011 the IMF and the European Union granted an additional $173 billion loan to Greece in return for a new round of austerity measures. More public-sector workers lost their jobs, public pensions were cut further, and the privatization program expanded. The austerity measures were “equivalent to about 14 percent of average Greek take-home income,” according to the Financial Times, the authoritative British newspaper, or an impact about “double that brought about by austerity measures in the other two eurozone countries subject to international bail-out programmes, Portugal and Ireland.”

Also as part of the price for its debt reduction, Greece would have to accept monitoring of its fiscal affairs by the European Union. Greek Prime Minister George Papandreou, forced to cancel a referendum on the second round of austerity cuts, resigned in favor of a “government of national unity” headed by Lucas Papademos, a former banker sure to listen to the markets.

This time, banks and other holders of Greek government bonds seemed not to have escaped unharmed. The value of their bonds were to be written down to 50% of their face value, meaning they could still insist on repayment of half the amount lent, although the market value of those bonds was surely far less than that. In addition, the agreement was “voluntary,” and it is yet to be seen if the agreement will be enforced.

As 2011 came to a close with this second round of austerity measures and the near collapse of the Greek economy, the Greek government was paying out a crippling 35% interest rate to attract buyers for their ten-year bonds.

Vortex Europe

European banks are the main buyers of European debt. French and German banks hold large quantities of Greek bonds.

So does the ECB, which began buying Greek bonds and other sovereign debt on the secondary (or resale) market in 2010. It resumed the practice in late 2011 to ease pressures on interest rates. Ordinarily, this bond-buying would also stimulate the economy by increasing the money supply, since the ECB creates the money it uses to buy the bonds. But the ECB also “sterilizes” its bond buying by contracting the money supply in the same amount as its purchases. This eliminates any possibility of inflation, but also negates the stimulus effect.

The bottom line is that because of the extensive holdings of Greek and other government debt within the European banking system, a Greek default would cause substantial losses in the European banking system and destabilize it.

In the last weeks of 2011, the ECB did extend a financial lifeline to banks—exactly what it had refused to give to the Greek government. To help buffer them against sudden losses, the ECB offered the banks $638 billion in three-year loans with the bargain basement interest rate of 1%. The majority of eurozone banks, some 523 of them, took out loans. The ECB’s backdoor bailout, as a Wall Street Journal editorial called it, was twice the combined size of the two rescue packages for Greece. The banks, unlike governments, would not have to turn to the bond markets for funding if a Greek default occurred. And like banks bailed out in the United States, no requirements were placed on them to continue lending—in Europe’s case, to continue lending to governments.

While the ECB move shored up the banks for now, it won’t protect them from the large losses that will come with an outright default by Greece or another of the crisis-ridden southern eurozone countries. Such large losses would in turn force countries to bail out banks again, as they did in 2008, to avoid the prospect of cascading banking failures. Because the ECB is prohibited from directly buying European government debt, a new round of bailouts would raise the specter of increasing government deficits, of rising interest rates, and of additional countries defaulting, a sequence that could induce a depression-like downturn.

As a result, private lenders are now insisting on higher interest rates on government bonds not just in Greece, but throughout much of Europe. These interest rate rises began in weaker economies with higher debt levels, including the Italian and Spanish economies, both of which are far larger than the Greek economy. Interest-rate hikes have even spread to France and (very briefly) to Germany, the eurozone’s two largest economies. The spikes in rates not only increase the likelihood of default, they put real roadblocks in the way of the spending and investment needed for recovery and long-term growth.

The danger is not only to Europe. The European Union is the largest economy in the world, accounting for nearly 20% of global economic activity. Every region of the world that trades with Europe will be affected by a slowdown there. The eurozone is the largest export market for both the United States and China. The default of any European country would cause losses and instability throughout the global economy. The U.S. financial system would also be sharply affected, for European global banks provide much of the credit for the U.S. economy.

To stem the bleeding, many in Europe and beyond have urged and continue to urge the ECB to step up and find a way to act as most normal central banks would in the situation: inject money into these economies by buying government debt in unlimited quantities. That in turn would lower interest rates, and give countries time to rebuild and restart growth. Germany, the largest and the dominant economy in Europe, continues to block this option on the grounds that printing money is not only inflationary but a “moral hazard” and makes borrowing too easy. At the last European summit, Germany successfully insisted instead on a “fiscal stability union” that will require balanced budgets (before taking interest payments into account). In other words, austerity for workers.

Rejecting Austerity

Austerity won’t work for Europe: Europe needs growth, and austerity can’t produce growth. Austerity also can’t work because the proposed cure—budget cuts—assumes the disease is government spending. But excessive social spending by its government did not cause Greece’s debt problems. In 2007, the year before the crisis hit, Greece’s social expenditures relative to the size of its economy stood at 21.3% of GDP, lower than the social expenditures in France (28.3% of GDP) and Germany (25.2% of GDP), the two countries most responsible for orchestrating the austerity measures that have slashed social spending in Greece.

Europe didn’t have a government debt crisis before the subprime collapse of 2008. It had countries like Germany in the north with large permanent trade surpluses, and countries in the south like Greece with large permanent trade deficits. Fixing these trade deficits and imbalances can’t be done by pushing down wages. In fact, repressive wage and labor policies, especially as practiced in Germany, are what lie at the heart of those imbalances that made the weaker southern eurozone countries so vulnerable to the crisis that followed. (See sidebar, “Greece was Pushed.”)

Rather, what’s needed is government investment and coordination throughout Europe. A public investment program could modernize the infrastructure of the southern eurozone economies and boost the productivity of their workforce by improving workers’ health and education.

A recession—or worse—in Europe will slow down growth and raise budget deficits in the United States as well. It will create political pressure for austerity exactly when we need more investment and more stimulus spending.

If this happens, it will be more important than ever to remember that Europe is in the position it is in, first, because it insisted on austerity for Greece and, second, because Europe has a central bank that is prohibited from financing government deficits and whose sole policy mandate is to limit inflation. Without the insistence on austerity, and without having relinquished these basic tools of economic policy—both of which the United States retains—the mess in Europe could never have happened. The United States is not and will never be Greece.

Yet like the crisis in Europe, the crisis in the United States isn’t temporary or fleeting. The outcome will determine what kind of jobs and economic security people will have for a long time to come. It will have a huge effect on public-sector unions. And it will affect democracy itself, especially if we stay silent. Austerity in Europe is being imposed from above. There’s no reason to let it be imposed here.

Greece Was Pushed

It wasn’t just the austerity packages of 2010 and 2011 that pushed Greece into a governmental and economic crisis. Eurozone policies combined with Germany’s wage repression policies had already set off a race to bottom in which Germany and industrial capital were the big winners and the southern eurozone countries and labor were the big losers.

Here is more or less what happened:

The adoption of the euro as common currency in 2002 coincided with Germany instituting flexible labor-market policies—which allow wages to fall with market forces—as a way of controlling wage increases. That proved to be a lethal combination for not only German workers but other eurozone countries as well.

German “unit labor costs” (or compensation per unit of output) hardly rose after 2001. Unit labor costs rise with wage increases that push up costs and fall with gains in productivity that lower costs. But with the new German labor market policies keeping wage growth in check, German unit labor costs in 2010 (including benefit costs) were just 10% higher than they had been a decade earlier.

As a result, despite posting better productivity gains than Germany, the southern eurozone economies of Greece, Portugal, Spain, and Italy saw unit labor costs and prices rise considerably more quickly than they did in Germany. By the end of the decade wage gains in those four Southern Eurozone economies pushed up their unit labor costs by one-third.

The huge gap in unit labor costs gave Germany a tremendous competitive advantage and left the southern eurozone economies at tremendous competitive disadvantage. As a result, their trade flows changed dramatically. The four southern Eurozone economies and Germany all had modest current account deficits (the broadest measure of a trade deficit) in 2000. A decade later Germany enjoyed a current account surplus of 5% of its GDP, while the southern eurozone economies were saddled with a current account deficit of 5% of their GDP. And Greece’s current account deficit has ballooned to 10.5% of GDP. Usually countries at such a severe trade disadvantage would devalue their currency. Devaluing a currency lowers the exchange rate, or cost, of the currency to foreign buyers, thus lowering the cost of exports priced in the currency. But because Greece and the other southern eurozone countries share a currency with Germany, that option was not available to them. Germany has thus maintained its competitive advantage at the expense of its neighbors’ trade and economic growth. While Germany is a developed, high-wage country, this is the same combination of wage repression and keeping its currency undervalued with respect to its costs that has boosted Chinese trade and output at the expense of its trading partners.

In this way, wage repression is an essential component of the euro crisis. Germany’s net export success comes at the expense of the export failure of the southern eurozone countries.

How might these trade imbalances be resolved? Further austerity measures are not the answer. While cutting wages in the southern eurozone economies might reduce their cost differential with Germany, wage cuts would threaten the collapse of these economies and deflation across the eurozone.

The only answer is for Germany to reverse its wage repression. Productivity gains must be shared with German workers. Higher wages would boost domestic demand in Germany and accelerate the growth of the German economy. Likewise, putting an end to the austerity measures imposed on Greece and the other struggling eurozone economies would boost their demand as well and stabilize the system, which so far has benefited Germany and the profit-making class at the expense of most of the population. Otherwise crises and stagnation will persist.

Greece and the United States: Do You Know the Difference?

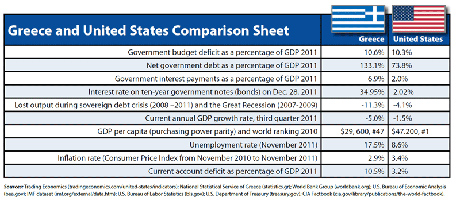

Is a Greek crisis coming to the United States? That’s far from what the data actually suggest. The similarities between the U.S. and Greek fiscal positions are nowhere near as great as these alarmist comparisons allege. In addition, their economic positions as well as their tools for supporting government spending and responding to an economic crisis of the two countries are also starkly different. Take a look at the “Greece and United States Comparison Sheet.”

Let’s begin with the supposed similarities between the U.S. and Greek fiscal woes. True enough, last year the U.S. and Greek governments ran annual budget deficits of about one-tenth of their national output. But relative to the sizes of their economies, cumulative U.S government debt, while rising steadily, was still far below the level of Greece’s debt, and the U.S. government paid out less than one-third of what the Greek government paid in interest payments.

On top of that, the U.S. government had no problems selling its bonds. As global economic conditions worsened, the rush to safe investments such as U.S. Treasury bonds intensified, pushing down the rates of return on ten-year notes to their lowest rate of interest in fifty years. The current 2% interest rate is well below the U.S. rate of inflation. Greek government bonds, on the other hand, have found few buyers. With its economy on the verge of collapse, the Greek government by year’s end was forced to offer a rate of return of 35% to sell their ten-year notes (and finance their deficit).

Nor is the U.S. economy in the same dire straits as the Greek economy. Since the onset of its sovereign debt crisis, the Greek economy has lost three times the output that the U.S. economy did during the Great Recession. And while the U.S. economy limps along yet to escape its ongoing crisis, the Greek economy continues to contract. Stubbornly high unemployment rates in the United States are but one-half of those in Greece. The U.S. current account deficit (the broadest measure of a trade deficit) is but a third of that of the Greek economy. Finally, the United States remains the richest economy in the world, and its central bank can underwrite its public spending in an emergency. Greece has far fewer resources available to its citizens and far less influence on the world economy, and its central bank is unable to underwrite its deficit spending.

Trump is silencing political dissent. We appeal for your support.

Progressive nonprofits are the latest target caught in Trump’s crosshairs. With the aim of eliminating political opposition, Trump and his sycophants are working to curb government funding, constrain private foundations, and even cut tax-exempt status from organizations he dislikes.

We’re concerned, because Truthout is not immune to such bad-faith attacks.

We can only resist Trump’s attacks by cultivating a strong base of support. The right-wing mediasphere is funded comfortably by billionaire owners and venture capitalist philanthropists. At Truthout, we have you.

Truthout has launched a fundraiser, and we have only 72 hours left to raise $25,000. Please take a meaningful action in the fight against authoritarianism: make a one-time or monthly donation to Truthout. If you have the means, please dig deep.