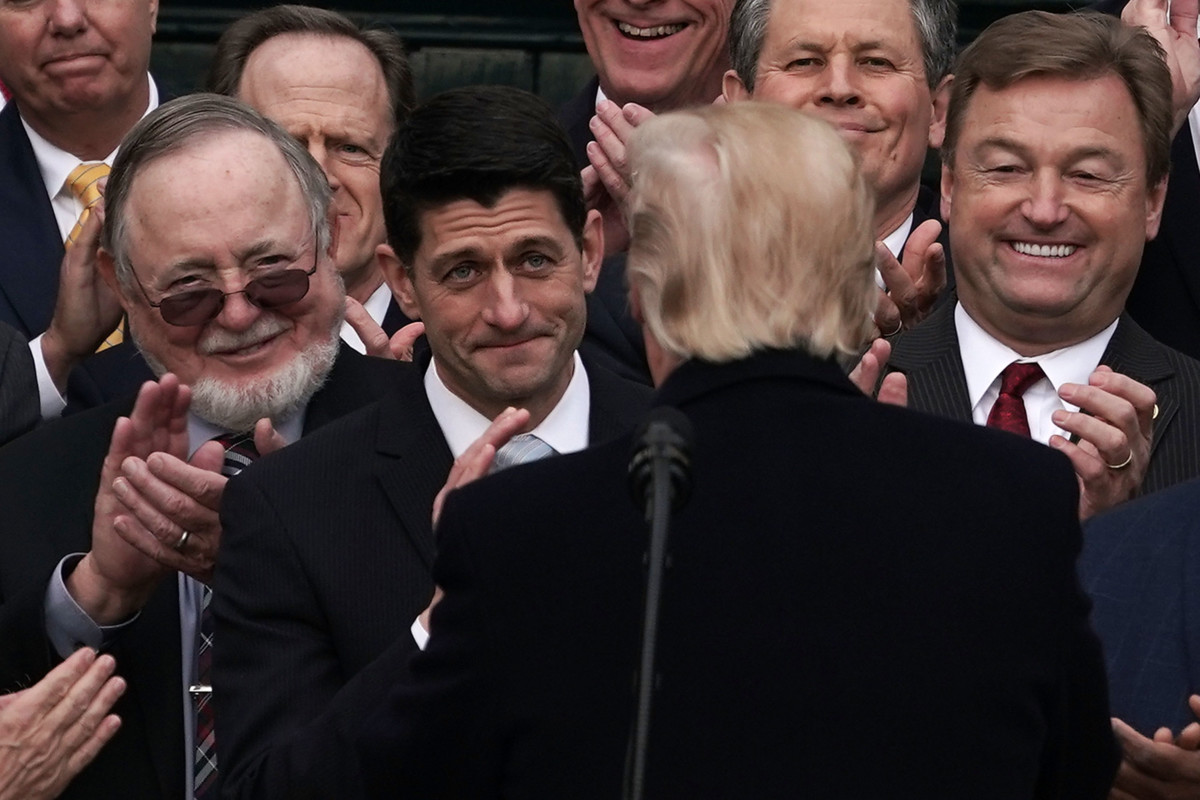

President Trump and conservative congressional leaders are talking up a new incarnation of their 2017 tax plan that they say would come to a vote in Congress before the midterm elections.

The plan would cost hundreds of billions of dollars and would enshrine a more unequal tax system permanently. The new version of the tax plan is meant to appeal to middle-income Americans, but like the original tax plan, its biggest rewards are for the richest 1 percent.

More than just a bad piece of legislation, the new tax plan is also meant as a distraction. It’s a showpiece that’s meant to throw the 2018 congressional election results. Instead of a midterm that’s about a grotesquely inhumane immigration policy, the opioid crisis, suicide epidemic or a tragic lack of good jobs across the country, Trump and his allies in Congress want Americans to focus on the one thing where they think they can flip the story to their advantage.

What Tax Plan Part II Would Do

Some of the tax cuts from the original plan passed in December are temporary — and that includes tax cuts for poor, working-class and middle-class Americans as well as cuts aimed at the wealthiest Americans. This has left conservatives in Congress open to criticism.

So, they’re now proposing to make many of the tax cuts permanent — something they didn’t originally do because of legal limits on how much the legislation could raise the national debt. (This is still a constraint, but one that they’re momentarily unconcerned with).

The temporary-to-permanent tax cuts include a lower tax rate for the wealthiest Americans and larger tax breaks for most taxpayers, including a larger standard deduction (that everyone gets) and a larger child tax credit for families with children.

There’s also talk of new tax cuts in the second-wave bill, including cuts that benefit only the wealthiest Americans, such as cutting capital gains taxes that the wealthiest Americans pay on their investment earnings.

Doubling Down on Inequality

The original tax plan that passed in December and is now the law of the land featured tax cuts that favored the rich at the expense of working-class Americans, but some of its provisions expired after 10 years. The new tax plan promises to make those changes permanent.

If the new tax rules are made permanent, Americans in the bottom fifth of earners would actually pay higher taxes — an average of $50 more per year in 2026. Meanwhile, the richest 1 percent would get an average tax cut of $29,910. The tax cut for the richest 1 percent is more than twice the $14,000 in total annual earnings that the average family in the bottom 20 percent earns each year.

Extending the tax cuts would not only benefit the richest Americans most, it would enhance conservative claims that the United States can’t afford to fund things, such as health care, higher education, an economic safety net for struggling workers and investment in infrastructure. Extending tax provisions from the 2017 law could cost the United States an additional $650 billion over the next 10 years, in addition to the roughly $2 trillion the tax plan will already withhold from public coffers. Just like the original plan, the new tax plan would compromise government’s ability to provide programs and services that make life fairer and alleviate suffering.

Meanwhile, there are many better ways to create jobs than through tax cuts. In a 2011 study, economists found that tax cuts created fewer jobs than every investment studied, except for the military. Investments in education, health care and clean energy all created more quality jobs than tax cuts did.

Whatever Happened to Infrastructure?

While conservatives in Congress fuss over their tax bill, Americans from rural towns to big cities struggle with unsafe drinking water, an opioid crisis and suicide epidemic, and jobs that don’t pay the bills.

Why won’t congressional leaders address the country’s real problems?

The United States has a $2 trillion gap in infrastructure funding over the next 10 years. Coincidentally, this is about the same as the cost of the existing tax plan over the same time period. One in 20 Americans drinks water from a supply that violates health standards, but each dollar in tax cuts is a dollar that can’t be used to address unsafe drinking water in Flint, Michigan, and thousands of other cities. That $2 trillion infusion into infrastructure could create something like 3.6 million jobs over the next 10 years.

Broadly speaking, infrastructure could include everything from safe drinking water systems to public health and job training. Public health investments are desperately needed to address both the opioid crisis and higher rates of suicide. And while official unemployment rates are low, wages are also low. Using the Census’s alternative poverty measure that takes into account not just income but expenses, 43 percent of Americans are low-income. A federal jobs program (or even a job guarantee) could go a long way toward lifting working Americans into the middle class.

None of these ideas for investing in the US are on the table, however. Instead of building the country up, the GOP just wants to redistribute wealth upward.

A Political Ploy to Divide Us

Sen. Jeff Flake, an Arizona Republican and noted Trump critic who has opted not to run for re-election, has called the new bill a “show vote.” And he’s right.

Due to pre-existing legislation meant to control the national debt, the original tax package was able to pass the Senate with 50 votes rather than 60 only because the expiration of some tax cuts kept the plan’s costs down. But the Senate isn’t invoking the legislative procedure that let them pass a bill with 50 votes, meaning they would need nine Democrats to support any new legislation to get to 60 votes. That support is not forthcoming.

The reason is simple: The new tax legislation is meant only to gin up support among the conservative base and swing voters who haven’t read the tax legislation’s fine print before the midterm elections. Holding a show vote on another tax bill allows conservatives to avoid the topics they don’t want to talk about: namely, immigration and the fact that fundamental problems with our economic system mean that years after the end of the Great Recession, far too many Americans are still struggling to make ends meet.

The proposed tax plan won’t solve the problems plaguing the US. It will only double down on a tax policy that worsens inequality, bankrupts public coffers so that real solutions remain out of reach, and possibly allows conservatives to maintain control of the House and Senate. The timing of this legislation is no mistake. Americans shouldn’t take the bait.