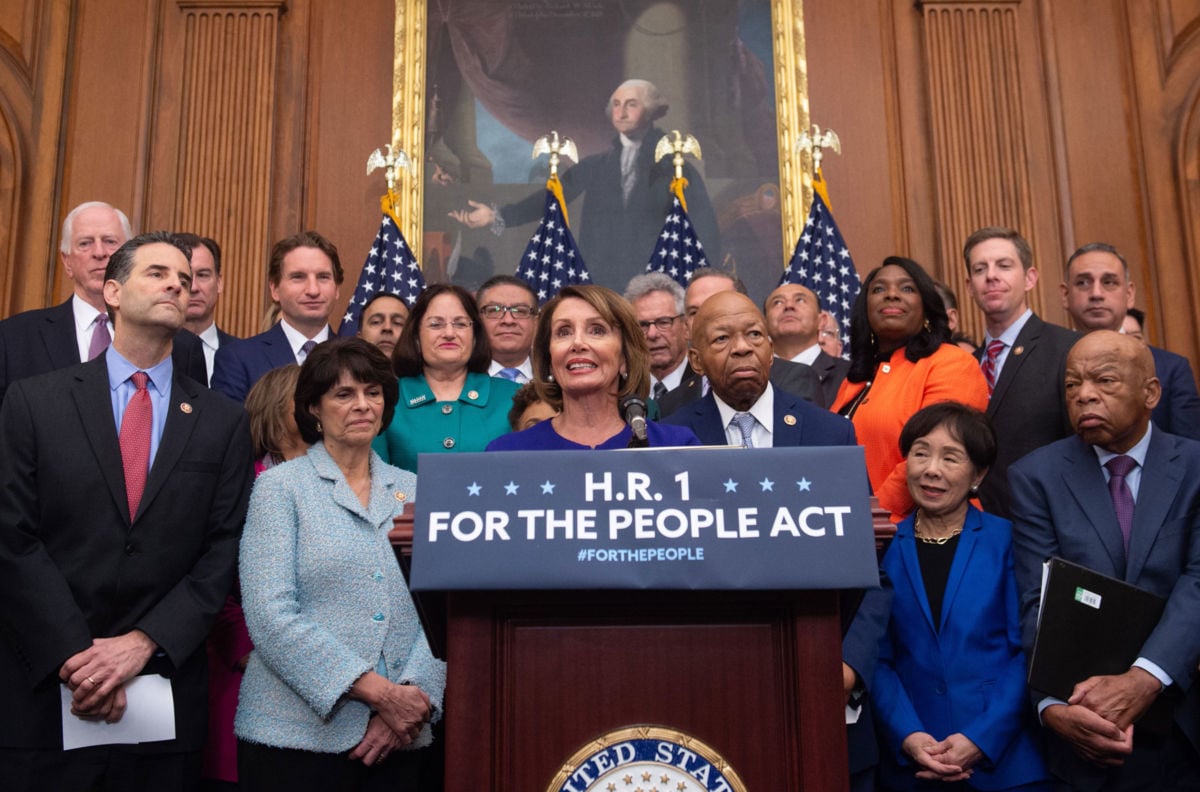

Voters across the political spectrum want policymakers to enact anti-corruption legislation, and Democrats responded by making corruption a signature issue in the 2018 election. This month, they followed through on that promise by introducing the For the People Act, an ethics and government reform package. The bill is the first real movement in Congress on government corruption since the Watergate era, and it includes important reforms to voting rights and campaign finance law that will help reclaim elections from the wealthy and powerful and give them back to the American people. However, the bill falls short in one key area: curbing corruption in government via the influence of money in policymaking.

Money’s influence in our elections typically receives far more attention than its sway on the legislative and administrative policy processes that follow once elected officials take office. Last year, Rohit Chopra and I released a report examining how our country’s current patchwork of ethics laws guard against corruption and conflicts of interest. We found that the wealthy and well-connected are able to buy influence over the policymaking process in many ways, including providing financial incentives to public servants, hiring lobbyists who maintain cozy relationships with government officials, and even buying up think tanks to produce favorable research. Though subtle, this stacking of the deck tilts policy decisions toward the interests of those who can afford to buy influence: big corporations and the very affluent. As a result, corruption in policymaking stands in the way of addressing nearly every issue on the progressive agenda, from wealth inequality to climate change.

The For the People Act mends some of the fissures in anti-corruption and ethics laws, but it also leaves gaping holes. For example, it fails to address one of the most glaring conflicts of interest of our time: the president’s continued ownership of his personal business interests. President Trump’s vast business holdings have raised concerns about the conflicts they create for him personally and also about how foreign business interests and governments can exercise influence over American policy. Instead of requiring the president and vice president to divest from assets that could pose a conflict of interest, the For the People Act expresses a non-binding “sense of Congress” that the president and vice president ought to divest. The practice of presidents placing assets in a blind trust to avoid the appearance of a conflict of interest had been consistent for 40 years, until 2017, when President Trump took office. It seems unlikely that presidents who choose not to adhere to longstanding norms or traditions will choose to adhere to a non-binding “sense of Congress” provision.

Another problematic area of the bill is its restrictions on members of Congress and their staff. Members of Congress often have significant financial interests in decisions that ought to be made based solely on the best interests of the public. When the laws policymakers write can jeopardize their personal finances, this creates an incentive to avoid actions that will hurt their returns — or to take those that would boost their profits. According to The New York Times,one-third of the House Energy and Commerce Committee — the body responsible for laws relating to pharmaceuticals — trades in biotech, pharmaceutical, and medical device stock. And in just the past few years, former Representative Tom Price (R-MI) and Rep. Chris Collins (R-NY) have faced scrutiny for pushing legislation that would benefit companies in which they were invested.

Though the For the People Act would restrict members of Congress from using their public positions for private gain and prohibit members of Congress from sitting on corporate boards, sitting on corporate boards is hardly the only financial conflict elected officials engage in. And the bill’s prohibition on private gain is extremely narrow: It only restricts members from knowingly promoting bills that boost their financial positions alone or the financial interests of an immediate family member. As such, it would not cover legislation that has a significant effect on a member’s financial interests but also enriches a broad class of people. A stronger and more straightforward solution, albeit difficult for policymakers to swallow, would be to ban stock ownership by both members of Congress and senior government officials in order to minimize conflicts of interest.

Other holes in the bill are subtler but still harmful. For example, it codifies President Obama’s ethics pledge, which includes restrictions aimed at slowing the revolving door and limiting the ability of former government officials to use the contacts they gain during service for lobbying, but also gives the president broad authority to waive certain provisions. Hindsight has proven that the broad waiver authority in the Obama ethics pledge significantly undermined its effect: As of 2015, President Obama had appointed 56 officials who came directly from the industries that they were tasked to oversee. Additionally, the ethics pledge keeps former government officials from lobbying senior executive branch officials, but it allows them to leverage their extensive contacts to lobby relevant policymakers in Congress.

It’s natural to think of proposals that solve some, but not all, problems as “a good first step.” Accomplishing real ethics reform, however, means acknowledging that incremental steps will fail to insulate policymakers from corrupting influences because this only encourages influence peddlers to take advantage of the gaps that remain. Under current law, there are hundreds of different points of influence available to those who wish to buy favorable policies — and thus hundreds of avenues for policymakers to root out corruption. History shows us that when we foreclose on only some of these pathways, those who wish to tilt policy in their favor simply flood the paths that remain open. As the For the People Act makes its way through the legislative process, policymakers must focus on building a strong package of reforms that tames the outsized influence of the wealthy and clears the way to center the most pressing issues faced by American people and their families.

We have 9 days to raise $50,000 — we’re counting on your support!

For those who care about justice, liberation and even the very survival of our species, we must remember our power to take action.

We won’t pretend it’s the only thing you can or should do, but one small step is to pitch in to support Truthout — as one of the last remaining truly independent, nonprofit, reader-funded news platforms, your gift will help keep the facts flowing freely.