Introduction

The United States has world’s most creative, comprehensive and competitive financial services Industry. This industry offers the greatest array of financial instruments and products to allow consumers to manage risk, create wealth, and meet financial needs [1]. Financial services and products help facilitate and finance the export of U.S. manufactured goods and agricultural products.

In order to take advantage of the financial services sector in US, 132 of Global Fortune 500 companies have located their corporate headquarters in US [1]. Investing in US financial services have offered significantly good return on investments for the financial firms. However, these services have primarily benefited the top 1% of population who exercise their control on the financial industry and not the ordinary middle class and poor Americans who invest their hard earned money in this industry with a hope of growing their hard earned money with rising inflation.

An Overview of US Financial Industry

In order to consider the need for reforms, let us understand the various sub-sectors of US financial Industry. In 2010, the United States exported $90 billion in financial services and had a $5.4 billion deficit in financial services and insurance trade (excluding re-insurance, the financial services and insurance sectors had a surplus of $52.3 billion) [1]. According to the U.S. Department of Labor, 803,800 people were employed in the securities and investment sector at the end of 2011.

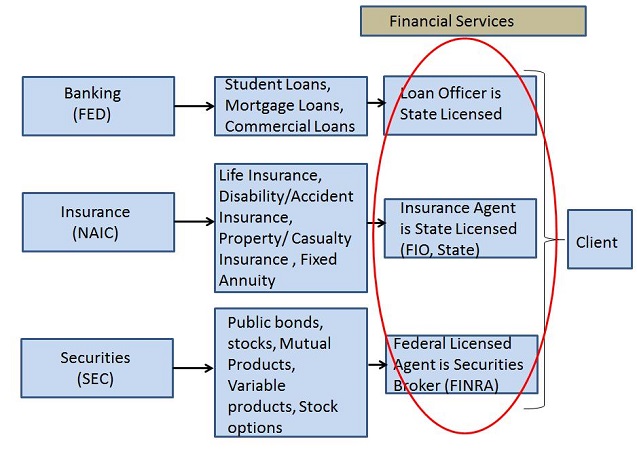

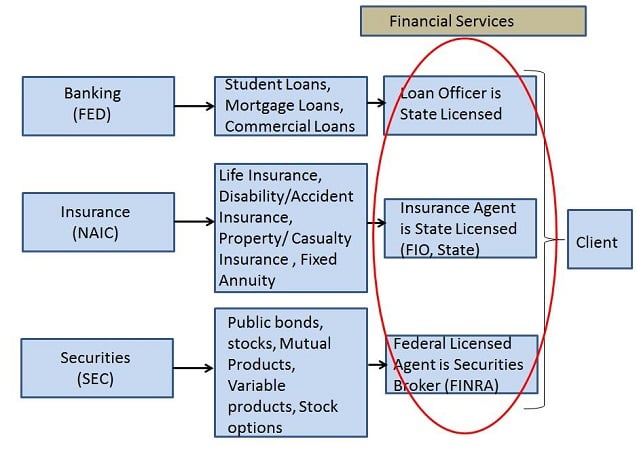

Figure 1: Overview of US Financial Industry

Figure 1: Overview of US Financial Industry

Fig. 1 above gives an overview of US Financial industry which constitutes nearly 10% of US GDP. After 2008 stock market crash, then US President Mr. George W. Bush passed a bill to allow $700 Billion bailout called Troubled Asset Relief Program (TARP) by permitting US Department of Treasury to buy assets and equity from financial institutions to strengthen its financial sector from subprime mortgage crisis [2]. The main street of America viewed this bailout to be a way of rewarding the Wall Street Pundits for the mistakes they have committed. By permitting tax payers to bailout the financial industry, it was an outrage for the main street where citizens have since then been losing their cars, houses and livelihoods as a result of the bad bets made by Wall Street culminating into “Occupy Wall Street” movement against crony Capitalism of Wall Street. Let us look into the contributions of each of these sub-sectors inside the US Financial industry.

- Banks – The banking sector supports the world’s largest economy with a greatest diversity in its banking institutions and concentration of private credit. Private Banks make loans available for students to pursue their studies, to citizens to mortgage their houses and also to businesses for setting up their business. As of the end of 2011, the U.S. banking system had $13.9 trillion in assets [1]. All Banks come under the central authority of the US Federal Reserve, also called the FED. The loans issued by the banking sector are through state licensed loan officer.

- Insurance – The insurance sector offers life insurance, disability or accident insurance, property insurance, auto insurance, fixed annuities like services. Having insurance is very important for all citizens to insure their assets and to prepare for unforeseen circumstances. In 2011, the insurance industry’s net premiums written totaled approximately $1.2 billion. According to the Swiss Reinsurance Company, premiums recorded by life and health insurers accounted for 45%, and premiums by property and casualty insurers accounted for 55% [1]. The National Association of Insurance Commissioners (NAIC) is a regulatory support organization created and governed by the chief insurance regulators from the 50 states, the District of Columbia and five U.S. territories. Through the NAIC, state insurance regulators establish standards and best practices, conduct peer review, and coordinate their regulatory oversight. NAIC staff supports these efforts and represents the collective views of state regulators domestically and internationally [3].

- Securities – In US, the public offer and sale of securities must be either registered pursuant to a registration statement that is filed with the U.S. Securities and Exchange Commission (SEC) or are offered and sold pursuant to an exemption. Dealing in securities is regulated by both federal authorities (SEC) and state securities departments. In addition, the brokerage industry is supposedly self-policed by Financial Industry Regulatory Authority (FINRA).

The combination of services offered by the banks, Insurance companies and securities through their certified financial agents also called financial advisors forms the US Financial Industry.

A Brief history of regulatory reforms in the US Financial Industry

In year 1871, U.S. State insurance regulators created NAIC (National Association of Insurance Commissioners) to regulate the conduct of insurance companies and their agents. In year 1913, the US congress passed the Federal serve act which created the US Federal Reserve which is also called as the FED. In year 1916, the National Bank Act was passed by congress to limit insurance sales except in small towns. The Securities and Exchange Commission (SEC) was created in 1933-34 when the US congress passed the Securities Act of 1933 and Securities Exchange Act of 1934. In order to prevent another Great depression like the one that occurred in 1929, Glass-Steagall Act of 1933 was passed to prohibit commercial banks and securities firms from engaging in each other’s businesses. This Glass-Steagall act was repealed by President Clinton in year 1999. The National Association of Securities Dealer (NASD) was formed in 1939 as a self-regulatory organization of the securities industry responsible for the operation and regulation of the Nasdaq stock market and make sure the market operates correctly. In 2007, the NASD merged with the New York Stock Exchange’s (NYSE) regulation committee to form the Financial Industry Regulatory Authority, or FINRA.

1940s saw the US congress passing Investment Company Act and Investment Advisors Act. Along with the Securities Exchange Act of 1934 and Investment Advisers Act of 1940, and extensive rules issued by the SEC formed the backbone of United States financial regulation. It has been updated by the Dodd-Frank Act of 2010. This Act is also known as the Company Act or 1940 Act and was passed to regulate the mutual funds and closed-end funds which constitutes a Trillion Dollar Investment Industry as of today. In 1956, Bank Holding Company Act was implemented to regulate and control banks that had formed bank holding companies in order to own both banking and non-banking businesses. This law generally prohibited a bank holding company from engaging in most non-banking activities so as to prevent the non-banking side of this business from taking risky bets on hard earned money put in savings bank account.

In 1995, US Supreme court approved decision to permit banks to sell Annuities thereby allowing banking sector to get involved in securities through variable annuities. In 1996, US Supreme court also permitted banks to sell Insurance Nationwide. The 1999 Gramm-Leach-Bliley Act allowed banks, insurance companies and securities firms to affiliate and sell each other’s products which nullified all good regulatory reforms that were put in place in 1940s and 1950s.

Institutions to avoid operational risks

- FDIC – The Federal Deposit Insurance Corporation (FDIC) preserves and promotes public confidence in the U.S. financial system by insuring deposits in banks and thrift institutions for at least $100,000, with exception of IRA account remaining at $250,000; by identifying, monitoring and addressing risks to the deposit insurance funds; and by limiting the effect on the economy and the financial system when a bank or thrift institution fails. The FDIC is a private insurance company created by congress in 1933 to avoid bank runs like those during the 1930s great depression [9].

- SIGA – The State Insurance Guarantee Association (IGA) was put forth to secure investments of the investors in case the Insurance company becomes Insolvent. All Insurance companies are required by law to be members of IGA in states where they are licensed. In most states, there is an overall cap of $300,000 in total benefits for any one individual with one or multiple policies with the insolvent insurer.

- SIPC – Securities Investor Protection Corporation (SIPC) is the first line of defense in the case a brokerage firm fails owing its clients cash and securities that are missing from customer accounts. Although not every person is protected by SIPC, no fewer than 99% who are eligible get their principal investments back from SIPC. From its creation by congress in 1970 to December 2008, SIPC advanced $520 million in order to make possible the recovery of $160 billion in assets for an estimated 761,000 investors. Investment contracts which are not registered under SEC act of 1933 are ineligible for SIPC protection. The customers of a failed brokerage firm get back all securities (such as stocks and bonds) that are already registered in their name or are in process of being registered in their name. After this step, the firm’s remaining customer assets are shared in proportion to size of claims. If sufficient funds are not available to satisfy claims, the reserve funds of SIPC are used to supplement distribution with up to $500,000 per customer and maximum of $100,000 for cash claims. Additional funds are raised taking into consideration cost of liquidating brokerage firm [10].

Salient features of Dodd-Frank Wall Street reform and Consumer Protection Act

The year 2010 marked the passage of landmark legislation that will have widespread impact on the financial services industry. In July 2010 Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act, a sweeping overhaul of how financial services are regulated in the United States. Key provisions include [11]:

- The creation of the Financial Stability Oversight Council and the Office of Financial Research, which increase federal oversight of large bank holding companies and “systemically risky” non-bank financial companies.

- The establishment of a liquidation fund supported by future assessments on large banks and the requirement to submit details on how to unwind failing non-bank financial companies.

- Registration and recordkeeping requirements for hedge funds.

- The creation of the Federal Insurance Office (FIO) to monitor the insurance industry, while maintaining state regulation of insurance. The FIO has the authority to identify regulatory gaps or systemic risk, deal with international insurance matters and monitor the extent to which underserved communities have access to affordable insurance products.

- The establishment of the Consumer Financial Protection Bureau, with consumer regulatory authorities consolidated from other banking agencies, to reside in, but stay autonomous from, the Federal Reserve.

- The reduction of total TARP spending from $700 billion to $475 billion.

- A prohibition on new TARP programs.

Performance of Financial Services sector post TARP bailout of 2008

The crash of stock market in year 2007 and bailout of the Financial Industry by government with taxpayers’ money has resulted into profiteering of this Industry on the backs of middle class and poor Americans who have been experiencing lower wages, layoffs, furloughs and cuts in their social security paychecks and unemployment benefits. Let us look at how the Public Financial Industry services industry benefitted from the stock market rise with TARP bailout package [12].

- The assets of the financial services sector rose 2.2 % in 2009 to $60.6 trillion from $59.3 trillion in 2008, when assets had fallen 4.4 % from 2007.

- The financial services industry’s GDP, excluding the real estate sector, reached $1.20 trillion in 2008, accounting for 8.3 % of the national GDP.

- Financial assets of the personal sector grew 8.9 % to $41.6 trillion in 2009, following a 16.1 % decline in 2008. This sector includes households, non-farm, non-corporate business and farm business.

- Retirement assets rose $2 trillion to $16 trillion in 2009, after falling 22 % in 2008.

- Insurance fee income reported by bank holding companies (BHCs) rose by $4.7 billion to $47.2 billion in 2009, following a $1.1 billion decline in 2008.

- BHC investment fee income rose by $33.5 billion to $89.8 billion in 2009, after falling by $5.9 billion from the previous year.

Why the US Financial Industry does need to be revamped?

In year 2011, Middle-class Americans, spearheaded by a movement increasingly known as “Occupy Wall Street” began to revolt against Wall Street greed and crony capitalism [13]. It is obvious from the 2009 performance of Financial Services Industry that if such a great performance of this Industry were to benefit majority of Americans, there would have been no Occupy Wall Street movement. The Dodd-Frank reforms might help solve future crisis but the way TARP bailout package was distributed is a proof that the way Financial Industry operates, it makes the rich richer and poor poorer. Hence, the Financial Services Industry needs to be revamped.

Post the economic crash of 2008, American citizens can’t trust the banks; but unless they can trust the banks, another major financial crisis is inevitable, since banks are built on trust, and without trust they are nothing. The huge disparity in wages and the bailout of the big banks from tax payers’ money have just showed how the entire financial sector has been rigged with cronyism. As a result of uncontrolled commercial freedom given to the bankers, these bankers have been able to gamble with hard earned money of Americans in speculative trading and hedge funds which have primarily benefitted the bankers. The uncontrolled freedom has also made it difficult to curb the domination of these greedy financial industry professionals by trying to force them to pay high taxes. The tax evaders are much more intelligent and skillful than those who collect taxes because tax evaders are united by their mutual interest while tax collectors are not [4].

Because of Political corruption, today a dishonest man accepts bribes and indulges in various corrupt practices. He does not pay his income tax and builds a palace for himself. The loopholes in existing tax structure have also resulted in a huge margin between the taxes levied on the ultra-wealthy Americans and the actual taxes which are paid to the government. Although this huge margin could have been reduced by imposing a tax like income tax on personal income of the wealthy, Political corruption has made it impossible to make that happen [7].

As a result of Free Trade Policies, not only have the rich corporations shipped high paying manufacturing jobs offshore but the policies have also enabled these corporations to move their profit from operations into tax havens like Swiss bank vaults, etc. This has enabled corporations to evade taxes by moving money to offshore tax havens instead of paying their fair share of taxes to government. These Free trade policies have not just resulted into growing annual trade deficit [6] due to increasing imports and decreasing exports but also have resulted in loss in government revenue to run its operations in best interests of citizens who democratically elect the government hoping that such kind of government would work in best interest of their electorate.

What reforms would revamp the US Financial Industry?

For a healthy overall economy and for a healthy financial industry, money has to circulate hands of the people. The more the money circulates, it gains in value. Hence, the financial industry has to ensure that money keeps circulating in the economy. Therefore the financial products which are designed by the industry should be carefully analyzed by regulators so that it encourages the citizens to invest into these products with a full understanding of the investment risks and returns on their investments. Additionally, the financial products should not be used for any kind of speculative investments which results in malpractices and economic troubles.

In order to eliminate the profiteering through manipulation by government, businessmen or different levels of middlemen, financial industry should promote distribution of essential commodities through neo co-operative corporations where the majority of shares of corporations are owned by employees of these corporations. It is extremely difficult to control prices of commodities without price speculation and also to enforce a fair collection of taxes by a central body like Internal Revenue Service (IRS). To improve the efficiency in its collection of tax revenue, the entire economy should undergo a wholesome decentralization [5].

Such an economic decentralization and co-operative system would make it easy to control the prices of commodities. Additionally, Economic Decentralization would result in lower taxes on all local citizens as local taxes would be paid for local development purposes. Additionally, Decentralized body of IRS would be able to enforce a fair tax code on all citizens based on local factors without neglecting essential needs of local citizens. For example, in cases of crop failure in any year, the local IRS would reduce its taxes on local farmers. Also, in cases of abundant harvest, the local government could increase taxes through levies to overcome the shortfall that might have resulted due to past crop failures.

In order to increase the domestic consumer purchasing capacity, taxes should be lower on consumers of goods. In today’s economy, huge tax cuts are given to the producers of goods in anticipation that producer would hire more workers and result in better economic growth when these workers spend their wages. However, the revenue lost as a result of huge tax cuts given to wealthy corporations which results in budget deficits. Instead of tax cuts are given to consumers, consumers would have higher purchasing capacity and they would invest their wages in buying goods which would generate economic demand. This would force the manufacturer to increase their supply of goods to meet the ever growing demands of consumers.

In order to avoid the accumulation of black money in domestic economy because of evasion on income taxes, the existing tax structure should undergo following common sense reforms. All taxes should be levied at starting point of production instead of giving tax cuts to the corporations. This would increase collection of tax revenue from corporations and reduce tax burden on consumers [4]. These taxes on corporations should be levied such that all essential commodities should be tax free and by means of levying 10% excise taxes on luxury goods and other excisable commodities, there would be no net loss in revenue collected by government. This way income tax on citizens could be minimized to boost their consumer purchasing power. When there are low income taxes on all, nobody would try to accumulate black money [4]. In this way as black money would be eliminated from domestic economy, all money would be white money. White money would result in less hoarding and increased circulation of money in domestic economy which would result in rise in value of domestic currency as a result of its circulation. This would further drive economic growth and have a multiplier effect on domestic economy.

To instill confidence in the banking system, the big banks of US should be broken down into smaller banks which are co-operatively managed and have exchange relationships amongst themselves in form of a decentralized supply chain [5]. The Fed should be controlled by democratically elected government and should enforce a monetary policy so that wages of citizens catch up with their productivity [6]. In order to minimize valueless hoarding of money in Bank vaults and also to minimize price speculation with huge capital by a few, the local government should put a ceiling on bank balances so that sufficient money circulates in domestic economy. This way valueless hoarding would be converted into valuable investments.

Free Trade of US should be replaced by Fair Trade policies [6] .Trade in decentralized economy should be organized by distributing commodities through consumer cooperatives [4]. There should be minimal income taxes levied on citizens to boost domestic consumer purchasing power and instead the taxes should be levied on production of each commodity. The commodities should be exported from one region to another through co-operatives by designing a three tier model as explained in my article “A Three Tier Business Model for the Semiconductor industry” [8].

Conclusion

The above proposed reforms would revamp the US Financial industry and result in economic solidarity, an increase in trade and commerce, more investment, more employment and an improvement in position of foreign revenue for US. These reforms would also be emulated by countries around the world and lead to a better Macro-economic growth along with growth of local economies. Additionally, These reforms would also solve the 99:1 issue of Occupy Wall Street protesters and result in a vibrant domestic and National economy establishing a Free Market balanced economy.

References:

[1] The Financial Services Industry in the United States, Dept. of Commerce.

[2] TARP, Wikipedia – the free encyclopedia.

[3] National Association of Insurance Commissioners, Wikipedia – the free encyclopedia.

[4] P R Sarkar, PROUT in a Nutshell, Ananda Marga Publications, 1959.

[5] Apek Mulay, Decentralize to Improve Supply Chain Efficiency, EBN, 11 October 2013.

[6] Apek Mulay, A Failure Analysis of the US Economy, Truthout.org, 2 March 2013.

[7] Apek Mulay, Truthout.org, Reforms for Converting the Present Corporate Democracy into Meaningful Civilian Democracy, 16 September 2013.

[8] Apek Mulay, electronics.ca publications, A Three-Tier Business Model for the Semiconductor Industry, 9 December 2013.

[9] Federal Deposit Insurance Corporation, Wikipedia – the free encyclopedia.

[10] Securities Investor Protection Corporation, Wikipedia – the free encyclopedia.

[11] Dodd–Frank Wall Street Reform and Consumer Protection Act, Wikipedia – the free encyclopedia.

[12] The Financial Services Fact Book, Insurance Information Institute (1 January 2009).

[13] Ravi Batra, Truthout.org, The Occupy Wall Street Movement and the Coming Demise of Crony Capitalism (11 October 2011).

We have 10 days to raise $50,000 — we’re counting on your support!

For those who care about justice, liberation and even the very survival of our species, we must remember our power to take action.

We won’t pretend it’s the only thing you can or should do, but one small step is to pitch in to support Truthout — as one of the last remaining truly independent, nonprofit, reader-funded news platforms, your gift will help keep the facts flowing freely.