A Senate Democrat introduced two bills on Thursday that would chip away at the major advantage that employers hold in union campaigns and disputes by tweaking tax laws.

One bill, the No Tax Breaks for Union Busting Act, would bar companies from writing off union busting expenses as business expenses on their taxes, ending taxpayer subsidization of union busting, as a press release on the bill puts it. Economists have estimated that employers spend $340 million on union busting yearly, often hiring expensive anti-union lawyers and consultants, but are able to write these expenses off the same way they can write off things like employee health benefits.

The other bill, the Tax Fairness for Workers Act, would restore union members’ ability to deduct union dues from their taxes, a benefit that Republicans nixed in their 2017 tax overhaul. It would allow union members to subtract dues from their gross incomes, allowing workers to receive the tax benefit regardless of whether or not they itemize their taxes.

It also contains other benefits for workers that mirror tax boons that are already provided for businesses, like travel costs and business expenses, in restoring another benefit that was axed by Republicans’ Tax Cuts and Jobs Act.

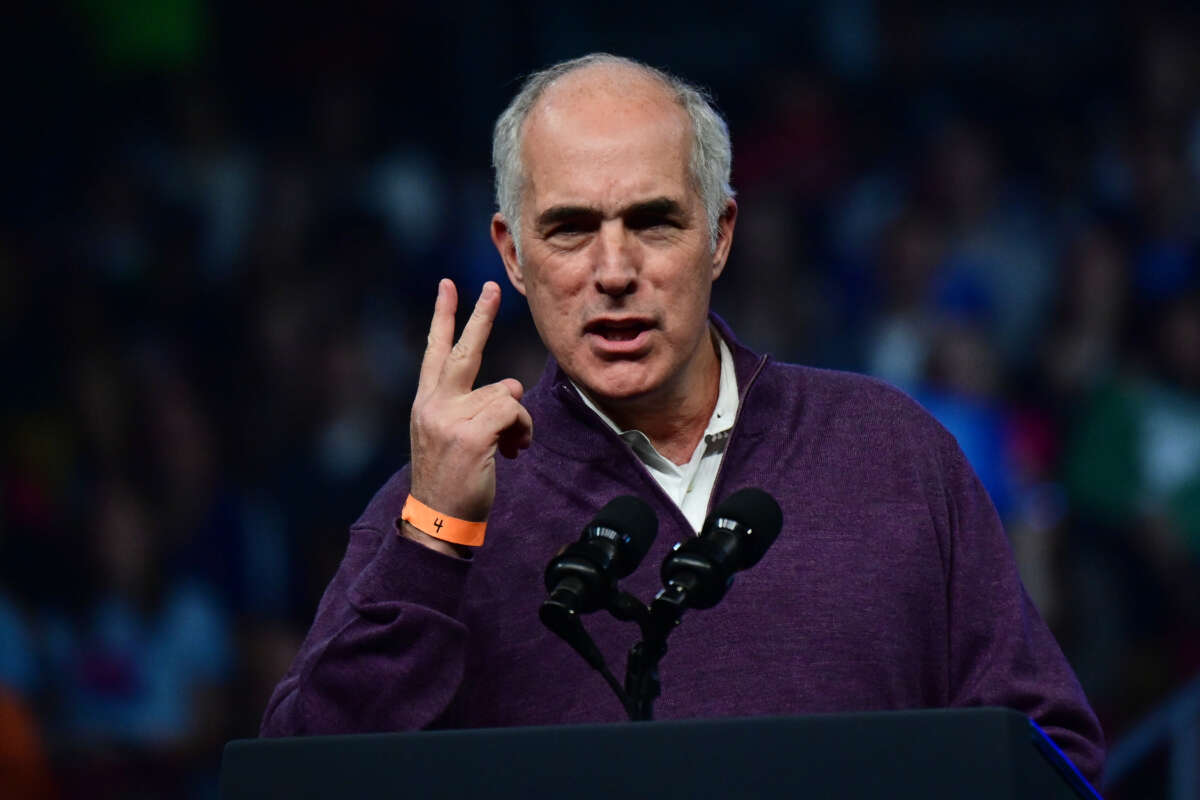

News of the bills was first reported by HuffPost. Both bills were introduced by Sen. Bob Casey (D-Pennsylvania).

“For too long, the deck in Washington has been stacked against workers. My bills will use the tax code to help level the playing field for workers and empower them to exercise their right to organize,” said Casey in a statement. “There are commonsense steps to restore fairness to our Nation’s tax code and stop rewarding corporations’ bad behavior when taking advantage of hardworking Americans and their families.”

The No Tax Breaks for Union Busting Act has been cosponsored by 27 Democrats and progressives in the Senate, including Senators Bernie Sanders (I-Vermont) and Elizabeth Warren (D-Massachusetts). The Tax Fairness for Workers Act has more support among the Senate at 40 cosponsors, also with the endorsement of Sanders and Warren.

Similarly, while both bills have picked up the support of progressive organizations and labor unions like the AFL-CIO and the International Brotherhood of Teamsters, the Tax Fairness for Workers Act has picked up more endorsements from unions like the American Federation of Teachers and the Service Employees International Union.

“It is no secret that wealthy corporations have used every trick in the book to put their profits over their workers,” AFL-CIO President Liz Shuler said in support of the bills. “Now is the time to fix this broken system by putting working people first. It’s simple – companies shouldn’t be rewarded for union-busting. And our tax code should grant relief to working people – who actually need it – by allowing them to deduct union dues and work-related expenses.”

Labor advocates have long criticized labor laws for being unfairly skewed to favor employers. Largely due to lax labor regulations, the share of American workers belonging to a union has hit an all-time low — despite public support for labor unions recently hitting an over half-century high.

In fact, labor laws are so weak that it is often more lucrative for employers to break the law and face the penalties than it is for them to act lawfully; the Economic Policy Institute (EPI) has found that employers are charged with breaking labor laws in 4 in 10 union election cases, and that’s only counting cases where employees got to the point of filing for a union.

At the same time, many employers find it more financially expedient to spend millions of dollars busting the union than to allow their workers to exercise their collective rights. Starbucks has likely spent multiple millions of dollars on consultants to oppose its workers’ historic union effort, while documents have shown that Amazon spent $4.3 million on anti-union consultants in 2021 — the same year that the company was found by labor officials to have cheated in the union election in Bessemer, Alabama.

Progressives and labor advocates have been trying to balance the scales between employers and workers. Last month, Senator Sanders reintroduced the Protecting the Right to Organize (PRO) Act, a sweeping bill that would massively expand protections of workers’ rights in union drives and beyond. The bill has become a rallying cry for labor advocates and unionists, and passed the House under Democratic rule in 2021, but stands essentially no chance of passing the Senate’s 60-vote filibuster threshold.