Soon after Michael Bloomberg took office in 2002, 40 of the 51 members of the New York City Council sponsored legislation aimed at curbing the growth of predatory lending practices by banks. According to the Daily News, “thousands of homeowners” had been taking on “subprime mortgages that have hidden charges, fees and conditions that are essentially designed to force homeowners into foreclosure.”

In May 2002, New York’s two most prominent black elected officials, State Comptroller Carl McCall and City Comptroller Bill Thompson, announced their support for the bill. In late September, the New York Times editorial board endorsed the measure.

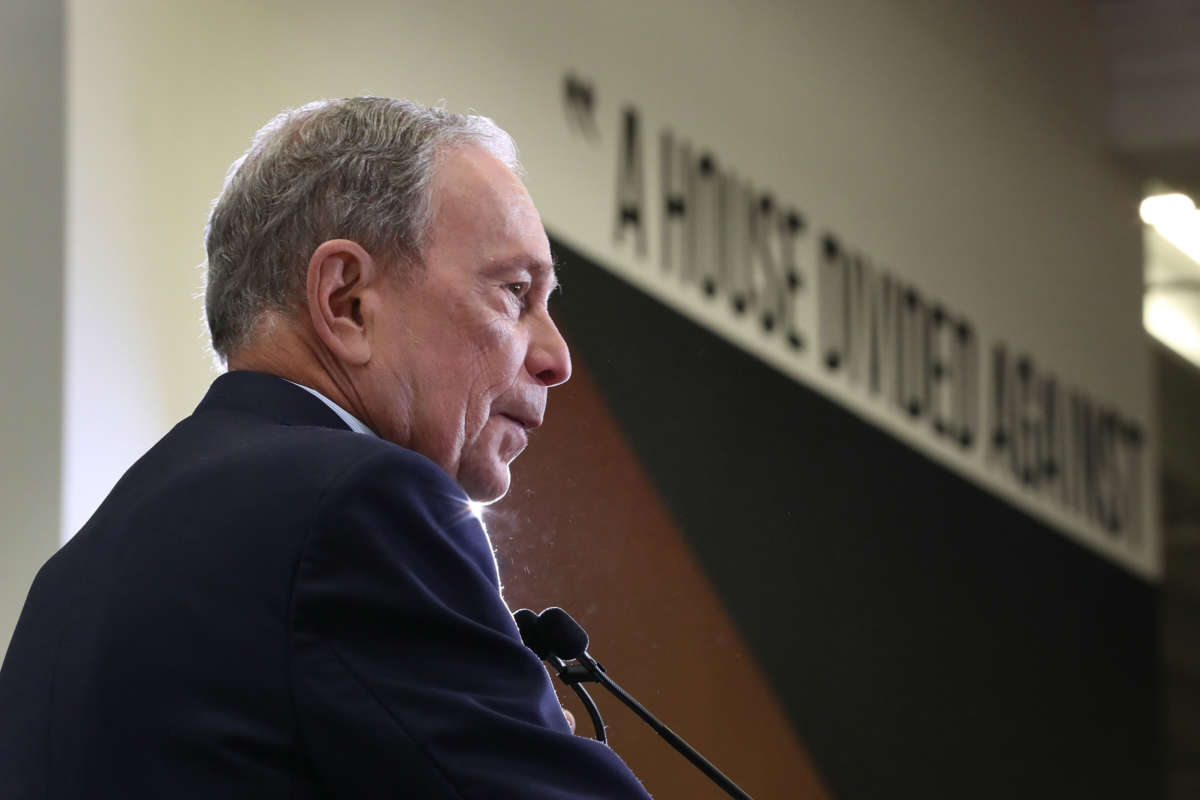

Throughout the year, Mayor Bloomberg expressed opposition to the bill, known as Local Law 36. At the end of the Albany legislative session that June, the divided legislature (which had a Democratic Assembly and a Republican Senate, while Republican George Pataki was governor) rushed through its own, less-stringent bill targeting predatory lending.

In early October, Governor Pataki signed the state legislation. A few weeks later, the City Council passed Local Law 36 by a vote of 44-5. Mayor Bloomberg then vetoed the bill, arguing that it was “not the appropriate vehicle” for addressing the dubious lending practices.

While the state bill outlawed scams including balloon payments (lump sums that, if not paid off, caused foreclosure) and required lenders to notify borrowers of the risks, the city bill went much further. It expanded the range of predatory practices to include excessive points and fees, required home loan counseling, and eliminated prepayment penalties.

Even more distressing for lenders was the provision of Local Law 36 that allowed the city comptroller to monitor banks’ compliance with the new rules. Failure to comply could have resulted in those lenders no longer being allowed to conduct business with the city government.

The lead architect of the legislation was then-councilman James Sanders of Southeast Queens, a hot-spot of subprime lending. As Sanders later observed, “We think the City Council was well within its authority to set some standards for who [the city] does business with.”

After the Council overrode his veto, Mayor Bloomberg then tried to stop the measure in court. In late January 2004, New York State Supreme Court Judge Michael D. Stallman struck down Local Law 36. Stallman did so almost entirely according to the doctrine of “preemption,” meaning that state law overrules city law. Without the state measure, most of the city’s provisions against predatory scams would have taken effect.

In early 2003, I asked City Comptroller Bill Thompson why Mayor Bloomberg fought so hard against Local Law 36. Thompson explained that in Bloomberg’s view, “you’ll do damage to the companies — you’ll undercut subprime lending.”

In New York City and across the nation, the subprime mortgage crisis was the key catalyst of the Great Recession of 2008, which saw black families lose more than one-third of their wealth. But Michael Bloomberg went to bat for his allies in the financial sector. In embracing Bloomberg, the 2020 Democratic establishment is showing that it simply does not care about the plight of the party’s large base of black voters.

The newspaper Naomi Klein calls “utterly unique,” full of insightful dispatches from around the world, The Indypendent offers a fresh take on today’s events.

Thank you for reading Truthout. Before you leave, we must appeal for your support.

Truthout is unlike most news publications; we’re nonprofit, independent, and free of corporate funding. Because of this, we can publish the boldly honest journalism you see from us – stories about and by grassroots activists, reports from the frontlines of social movements, and unapologetic critiques of the systemic forces that shape all of our lives.

Monied interests prevent other publications from confronting the worst injustices in our world. But Truthout remains a haven for transformative journalism in pursuit of justice.

We simply cannot do this without support from our readers. At this time, we’re appealing to add 43 monthly donors in the next 2 days. If you can, please make a tax-deductible one-time or monthly gift today.