A couple of weeks ago, the House broke with four decades of congressional tradition and narrowly passed a federal Farm Bill, 216-208, without any Democratic support. The break in tradition came when the House stripped nutrition programs – notably food stamps, vital to nearly one in seven struggling Americans – out of the bill after many Republicans voted against an earlier version because they felt it did not cut enough out of the food stamp program.

House Republicans say nutrition programs will be broken out and included in a separate, stand-alone bill and may be cut as deeply as they were in the earlier, failed version of the Farm Bill.

“Let’s be clear: this attempt to separate the nutrition title from the rest of the farm bill is all about gutting the nutrition title,” said Rep. James McGovern (D-MA). “It’s all about going after Americans who are struggling in poverty.”

The House Farm Bill would also expand subsidies for agriculture by nearly $9 billion at a time when the farm sector is historically strong, especially compared to the rest of the economy, and makes these subsidies permanent law. Currently, they have to be reauthorized every five years.

The “vote is the latest smoking gun that the House majority isn’t truly interested in deficit reduction,” said Joel Berg, executive director of the New York City Coalition Against Hunger, in a statement. “They’re interested in supporting special interest groups over hungry Americans.”

Billions of dollars could be saved by cutting subsidies while still protecting vital nutrition programs for the poor, if policymakers are willing to make them. Cuts to wasteful agribusiness subsidies would save the American people money while allowing Congress to safeguard food stamps during these weak economic times. Food stamps provide vital food assistance to those who have lost their jobs, who labor in low-wage positions, or who live on a fixed income. At the same time, a more-than-adequate agricultural safety net could continue to be funded. However, doing so would require many in the House majority to drop their aversion to compromise. And members of both parties would have to ignore misinformation and pressure from the crop insurance lobby.

In contrast, the Senate version of the Farm Bill passed with bipartisan support, 66-27. The Senate bill scales back spending on food stamps by about $400 million each year. The earlier House legislation from June would have cut this funding by roughly $2 billion annually. Presumably, a House stand-alone bill funding nutrition programs – if it is ever introduced – would contain similar cuts, although that remains to be seen.

The House Farm Bill that just passed expands farm subsidies that predominantly benefit large agribusiness companies and encourage farming practices that are environmentally risky. The Senate bill expands those subsidies as well, but to a lesser extent.

The two versions of the legislation will have to be reconciled in a conference committee to become law. According to The New York Times, “House and Senate negotiators could produce a compromise measure with the robust food stamp program the Senate wants, but such a bill would almost certainly have to pass the House with significant Republican defections.”

The White House has said it will veto the Farm Bill if it reaches President Obama’s desk without including food stamps.

The deep partisan divide in the House over food stamps belies a potential area of agreement. Conservative groups like the Heritage Foundation and Club for Growth oppose agribusiness subsidies. The Heritage Foundation wrote in a blog post that the House Farm Bill “[s]pends far more than President Obama on the most expensive farm program (crop insurance).”

Reducing crop insurance could create savings to preserve the food stamps program and still maintain an adequate system of emergency agricultural support.

The Costs of Crop Insurance Subsidies Explode from $1.5 to $7.4 Billion

Crop insurance subsidies were originally intended to make insurance against crop losses more affordable to family farmers as part of an agricultural safety net and to reduce the need to pass ad hoc disaster assistance bills in times of inclement weather. However, crop insurance programs have morphed into corporate welfare.

More than half of all crop insurance policies are revenue insurance (these policies first started in 1997), rather than more traditional yield loss insurance that protected farmers from crop losses due to bad weather, according to the Congressional Research Service. Moreover, the generosity of the insurance subsidies has greatly increased. Due to a law passed in 2000, at many levels of insurance, even for very generous amounts of coverage, farmers do not have to pay the majority of the costs of purchasing insurance – taxpayers do. Previously, farmers paid for the majority of the costs of their own insurance, but now the government pays for nearly two-thirds of these premiums, according to the Government Accountability Office (GAO) in a 2012 report.

In addition, the federal government directly pays for the administrative costs of crop insurance companies, including their profit. “The administrative expense subsidies also can be considered a subsidy to farmers; with these subsidies, crop insurance premiums are lower than they would otherwise be if the program followed commercial insurance practices,” according to the GAO. “In private insurance, such as automobile insurance, these administrative expenses typically are included in the premium that a policy holder pays.”

In other words, the government props up the business side of crop insurance companies – paying for their operations and guaranteeing their profits – and also subsidizes farmers’ purchases of crop insurance from those companies.

There is no limit on the amount of the subsidies that can flow to any one recipient. Thus, even very large corporate agricultural operations are raking in the benefits.

For example, in 2011, the largest recipient of subsidies “was a corporation that insured nursery crops across three counties in one state, for a total of about $2.2 million in premium subsidies. In addition, the administrative expense subsidies that the government spent on behalf of this corporation totaled about $816,000,” according to the GAO.

Yet even though “the farm sector continues to be one of the strongest sectors of our economy, with net farm income expected to reach $128 billion in 2013, a nominal record and the highest level in real terms since 1973,” according to President Obama’s Fiscal Year (FY) 2014 budget, the government’s agricultural subsidy programs have expanded over the last decade. The current historic strength of the agricultural sector in the United States was cited by the White House as one reason for scaling back government farm aid.

Echoing the president’s budget in part, both the House and Senate Budget Committees’ plans agree on the need to end the wasteful direct payments program that sent billions of dollars to people for not farming. (Crop insurance subsidies are different from the better known direct payments programs where the federal government paid businesses and individuals if they owned land that historically grew crops, whether crops were currently being grown or not.)

But those congressional budget plans depart from the president’s proposal in that they do not scale back the even more problematic crop insurance subsidies that are projected to cost about $89 billion over the next 10 years, according to the Congressional Budget Office (CBO).

Indeed, both bills would expand spending on crop insurance subsidies, with the House bill increasing funding by an additional $8.9 billion and the Senate bill by about $5 billion over the CBO’s current estimates.

On the other hand, more akin to the White House’s budget, both the very conservative House Republican Study Committee budget plan and the House Congressional Progressive Caucus’s spending blueprint find substantial savings by curbing those insurance subsidies. Legislative proposals introduced by both Republican and Democratic lawmakers would also reform the system in a variety of ways, from simply introducing more transparency of who receives subsidies to rolling back subsidy increases made over a decade ago. Thus, although the House and Senate Farm Bills do not do this currently, there is some momentum from both sides of the aisle, in both legislative chambers, to roll back subsidies that massively grew due to a law passed more than a decade ago.

The Agricultural Risk Protection Act (ARPA) of 2000 greatly increased crop insurance subsidies. Due to this law, “the cost of subsidizing crop insurance premiums has exploded, from $1.5 billion in 2002 to $7.4 billion in 2011,” according to a 2012 Environmental Working Group report by agriculture economist Bruce A. Babcock of Iowa State University. As a share of total premiums, the U.S. government’s share – that is, its subsidies – increased from 37 percent of all premiums in 2000 to 60 percent in 2001 when ARPA became effective, according to the GAO.

At the time, Congress was responding to a problem with how crop insurance premiums were priced by the U.S. Department of Agriculture’s (USDA) Risk Management Agency. The rules at that time made insurance that covered 65 percent or more of losses too expensive for most farmers to buy. Congress stepped in to subsidize the costs of buying insurance instead of fixing the problems with the pricing structure. Eventually, USDA did rectify the pricing problem, but the higher subsidies were left in place.

“The crop insurance program cost at least $4.2 billion more in 2011 than it would have without the enhanced subsidies,” according to Babcock’s report. “The excess costs are actually even higher because farmers respond to the incentives by buying more expensive coverage than they would if they had to pay more of the premium.”

In addition, unlike the direct payments and counter-cyclical payments programs, there are no caps on the crop insurance premium subsidy program. In 2011, 26 farm businesses received more than $1 million each; more than 10,000 growers received more than $100,000 each; overall, 10 percent of farm businesses received more than 54 percent of the benefits from crop insurance subsidies, according to Environmental Working Group research. Given that only roughly two percent of the American working population is employed in agriculture, a very small group receives the bulk of these crop insurance subsidy benefits.

A House amendment limiting subsidized crop insurance to farm businesses with $250,000 or less in adjusted gross income failed (though it received more support than the original House Farm Bill itself). This is a reasonable reform, since, as GAO has noted, “large farms are better positioned than smaller farms to pay a higher share of their premiums.”

The extent of the subsidies also encourages farmers to make decisions that negatively impact the environment without increasing production. One farmer told The New York Times, “When you can remove nearly all the risk involved and guarantee yourself a profit, it’s not a bad business decision” to farm on land unlikely to produce. “I can farm on low-quality land that I know is not going to produce and still turn a profit.” Research has found farmers increasingly moving into environmentally sensitive areas that are less likely to be productive, and the current subsidy system is creating incentives for farmers to do more of this.

Congress could, of course, change this. “As it goes about writing a new farm bill this year in the face of intense pressure to reduce the federal deficit,” Babcock’s report continues, “Congress could reduce these distortions, avoid deep cuts to nutrition and conservation programs and other important priorities and provide farmers with a full suite of appropriately priced risk management options — simply by moving back to the pre-ARPA premium subsidy structure.”

Other reforms that would scale back crop insurance subsidies could also save significant amounts of money. For example, the White House has proposed establishing a reasonable rate of return for crop insurance companies and reducing the federal reimbursement of crop insurance companies’ administrative expenses. These would save an estimated $4 billion over ten years. A much bolder package of several farm subsidy reforms – broader than those dealing solely with crop insurance – proposed by the Environmental Working Group would save an estimated $80 billion over ten years.

Supplemental Nutrition Assistance Program, a.k.a. Food Stamps

In stark contrast to lavish crop insurance subsidies that benefit only a few, an effective program that benefits a much wider swath of the population – food stamps – is being targeted for cuts.

The biggest program typically funded by the Farm Bill is the Supplemental Nutrition Assistance Program (SNAP), which is the official name for the food stamps program. SNAP helps feed approximately 47 million struggling Americans with an average benefit of $4.45 a day for each beneficiary in fiscal year 2012. “Nearly 72 percent of SNAP participants are in families with children; more than one-quarter of participants are in households with seniors or people with disabilities,” according to the Center on Budget and Policy Priorities (CBPP).

SNAP benefits cannot be used to “buy beer, wine, liquor, cigarettes or tobacco” or “nonfood items, such as pet foods, soaps, paper products and household supplies; vitamins and medicines;” or “food that will be eaten in the store; and hot foods,” according to the U.S. Department of Agriculture’s Food and Nutrition Service, which administers SNAP on the federal level.

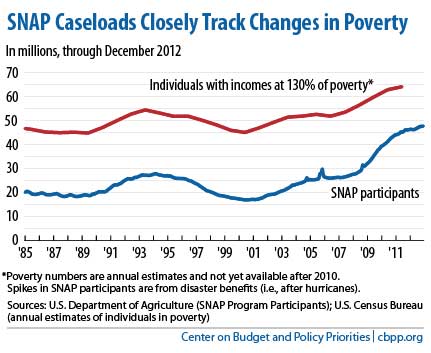

Spending on SNAP increased from late 2007 through 2011 due to the recession and the continued weak job market – which is exactly how SNAP is supposed to work. SNAP enrollment slowed last year, as the economy modestly improved, and is expected to further decline as more Americans get jobs. About $81 billion was spent on SNAP in FY 2012, and spending on SNAP as a share of the nation’s economy is projected by the Congressional Budget Office to return to 1995 levels by the end of the decade. CBPP has also written extensively on how food stamps do not create disincentives to working; in fact, quite the opposite is true:

…the SNAP benefit formula contains an important work incentive. For every additional dollar a SNAP recipient earns, her benefits decline by only 24 to 36 cents — much less than in most other programs. Families that receive SNAP thus have a strong incentive to work longer hours or to search for better-paying employment.

Furthermore, research shows that most people who receive SNAP benefits and who can work are employed.

There are robust anti-fraud measures in the SNAP program, and it has a lower fraud rate than farm subsidy programs. Furthermore, it is an efficiently run program with low administrative expenses; 92 percent of SNAP spending goes to benefits.

Reforms of the Crop Insurance Subsidy Program Could Pay for Food Stamps

Cuts to the SNAP program could be avoided if savings from reforming crop insurance subsidies were adopted. Rep. Jim McGovern (D-MA) tried to do just that with an amendment he introduced in June that replaced the deep cuts to food stamps with cuts in crop insurance subsidies.

“It would restore those cuts by eliminating or reducing some of the wasteful, excessive subsidies to the highly profitable big agribusiness,” McGovern said on the House floor. “Not only that, the amendment would actually reduce the deficit by $12 billion beyond the base bill” because of its reductions in crop insurance subsidies over several years.

His amendment failed 234 to 188. It attracted five Republican votes. Eight Democrats voted against the amendment – including the senior Democrat on the House Agriculture Committee, who has been a staunch supporter of crop insurance subsidies, and four other Democrats on the committee.

The House Republican leadership did not allow any amendments to the version of the Farm Bill the House passed.

Implications of the Breakdown of the Farm Bill Coalition in the House

The rejection of the earlier version of the Farm Bill, which typically receives bipartisan support in the House, and the passage of a bill that omitted nutrition programs underscores the growing partisan divide evident in that chamber. For the last 40 years, the Farm Bill has depended on a rural conservative-urban liberal coalition. Members of Congress with large numbers of poor in their urban districts would team up with legislators representing rural areas dominated by agriculture to support the interests of their respective constituencies.

The result was never perfect – billions of dollars in wasteful agricultural subsidies were one byproduct – but good nutrition programs were funded in the Farm Bill. That urban-rural coalition has frayed with the rise of the Tea Party, which is allergic to compromise with Democrats and ideologically opposed to assistance to low-income Americans.

However, this could pose problems for staunchly conservative Republicans who are often found in rural America, especially in the South. Research by the Carey Institute at the University of New Hampshire shows that the rural population depends on food stamps disproportionately more than those in cities. “Overall, 7.5 percent of the nation’s rural population relied on food stamps, compared with 4.8 percent of urban residents,” according to the Carey Institute report. Rural users of SNAP are especially concentrated in the South.

In opposition to the House Farm Bill that ultimately passed, House Minority Leader Nancy Pelosi (D-CA) told Republicans in a floor speech that “you are taking food out of the mouths of your own poor constituents.”

With rural poverty rates higher than in urban or exurban areas – and with two-thirds of rural areas experiencing higher poverty rates in recent years – it may be hard for many of these voters to continue to ignore the consequences of further government cutbacks in a program on which they and their neighbors rely.

It doesn’t have to be like this. We could reduce wasteful subsidies and protect an effective program that helps hungry Americans get back on their feet. But a different course will require political will and the desire to actually make government work.

We have 10 days to raise $50,000 — we’re counting on your support!

For those who care about justice, liberation and even the very survival of our species, we must remember our power to take action.

We won’t pretend it’s the only thing you can or should do, but one small step is to pitch in to support Truthout — as one of the last remaining truly independent, nonprofit, reader-funded news platforms, your gift will help keep the facts flowing freely.