Part I: The Tax Lie

Fact: Tax Hikes Don’t “Cripple Job Creation”

Conservatives say they are prepared to blow up the economy by not lifting the debt limit if that is what it takes to avoid raising taxes on the rich – even to avoid closing loopholes that have hedge fund billionaires paying a lower tax rate than their chauffeurs.

“Everything is on the table,” says House Speaker John Boehner, but tax hikes are “off the table” because they would “wreak havoc on the economy” and further cripple job creation.

Nonsense. First, neither tax hikes nor spending cuts should take place until the economy gets going. The president has suggested delaying tax hikes until 2013. Second, the “job creators” that Boehner doesn’t want to tax aren’t in fact creating jobs. Big corporations are reaping record profits, sitting on literally trillions in cash, and shipping jobs abroad. Small businesses are lacking not in confidence but in customers. The rich keep getting richer, without generating jobs. We’d be better off taxing them and spending the money rebuilding the country and putting people to work.

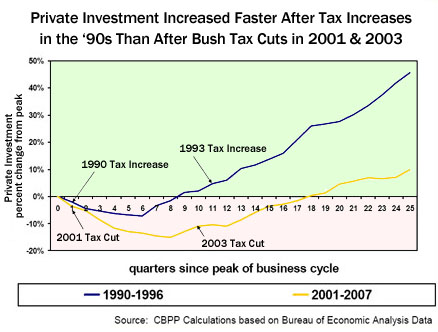

Finally, this basic conservative article of faith is simply not supported by evidence. As the chart below shows, when taxes were raised under the Bill Clinton, private investment took off. The job creators created record numbers of jobs. When taxes were cut under George Bush, private investment, and job growth were disappointing. But conservatives will not let the facts get in the way of their gospel.

Summary:

Conservatives say they are prepared to blow up the economy by not lifting the debt limit if that is what it takes to avoid raising taxes on the rich – even to avoid closing loopholes that have hedge fund billionaires paying a lower tax rate than their chauffeurs.

Nonsense. First, neither tax hikes nor spending cuts should take place until the economy gets going. The president has suggested delaying tax hikes until 2013. Second, the “job creators” that Boehner doesn’t want to tax aren’t in fact creating jobs.

Part II: The Spending Cuts Myth

Fact: Cutting Government Spending Does Not Create Jobs

Conservative Republicans hold as an article of faith that cutting government spending creates jobs, even in the midst of a recession. House Majority Leader Eric Cantor, the conservative zealot who has personally blown up the debt ceiling talks twice over the mere hint of closing tax loopholes, says, “All of our efforts are centered around jobs – starting with cutting spending and federal regulations – to grow the economy so that people can get back to work.”

But this is nonsense. There’s no economic theory that would suggest that in current conditions, cutting government spending would create jobs.

Conservative Republicans hold as an article of faith that cutting government spending creates jobs, even in the midst of a recession. House Majority Leader Eric Cantor, the conservative zealot who has personally blown up the debt ceiling talks twice over the mere hint of closing tax loopholes, says, “All of our efforts are centered around jobs – starting with cutting spending and federal regulations – to grow the economy so that people can get back to work.”

But this is nonsense. There’s no economic theory that would suggest that in current conditions, cutting government spending would create jobs.

Despite the conservative mantra that “government doesn’t create jobs, the private sector creates jobs,” even Cantor and Republican conservatives admit, news flash, that cutting government spending will cut government jobs.

As Speaker John Boehner put it, if cuts cost government jobs, “so be it.” But as government employment has been going down over the last months, we’ve seen no burst of private sector jobs creation. Last month’s horrific jobs report illustrated this: Cuts in government spending at the state, local and national level led to the loss of 39,000 jobs in the public sector, while the private sector generated only 57,000. The result, given the increasing numbers coming into the workforce, kicked up the unemployment rate to 9.2% – or over 14 million people. Great Britain which has embarked on deep spending cuts with the election of a conservative government has witnessed rising unemployment, nine months without any growth whatsoever, and appears headed back into recession.

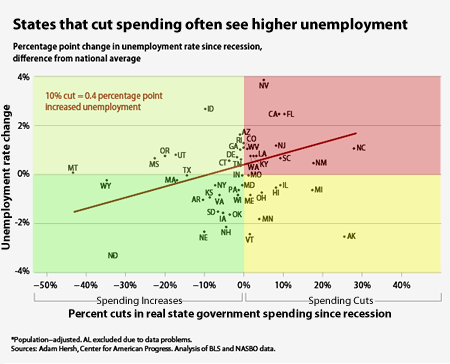

The following chart is complicated but shows that while different economic conditions produce widely different outcomes, in the states, larger government spending cuts have tended to produce higher unemployment.

In a growing economy, conservatives argue that deficit spending by the government crowds out private investment by raising interest rates. Since they heroically assume that the private sector invests more efficiently than the public sector, they argue this costs jobs. (How that assumption can be made after the private sector has just burned several trillion gambling on the housing bubble and peddling junk is testament to faith over evidence.) Yet conservative economists admit that those assumptions don’t apply in current conditions. With mass unemployment, companies are sitting on over a trillion dollars in cash looking for customers, and interest rates are near record lows.

So conservatives (and sadly, the president on his bad days) now invoke what Paul Krugman calls the “confidence fairy.” Turns out our businesses are struck with a crisis of confidence, about debts, potential tax hikes, perilous futures. So conservatives argue if we make wrenching cuts in spending, laying off government workers, forcing seniors to pay more for health care and students to pay more in tuition, and promise never, never, never to raise taxes, businesses will gain the confidence to invest, despite the resulting government layoffs. But businesses lack customers, not confidence. They lack demand for the products they are selling. They are happy to invest in countries like China and Brazil where markets are growing, despite Communist government piracy and regulation in China or currency and inflation instability in Brazil.

Deep spending cuts will lay off government workers and contract employees, reduce demand and customers. It takes a blind belief in market fundamentalism – divorced from any known economic model – to believe that deep cuts in government spending now will magically generate private sector job growth.

Summary:

Conservative Republicans hold as an article of faith that cutting government spending creates jobs, even in the midst of a recession. House Majority Leader Eric Cantor, the conservative zealot who has personally blown up the debt ceiling talks twice over the mere hint of closing tax loopholes, says, “All of our efforts are centered around jobs – starting with cutting spending and federal regulations – to grow the economy so that people can get back to work.”

But this is nonsense. There’s no economic theory that would suggest that in current conditions, cutting government spending would create jobs.

Part III: The Revenue Problem

Fact: Washington Has a Revenue Problem.

“.. Washington doesn’t have a revenue problem, it has a spending problem,” says House Majority Leader Eric Cantor (R-Va.). All Republican legislators have been taught to chant this tired Republican “talking point” as if it were the Hare Krishna mantra.

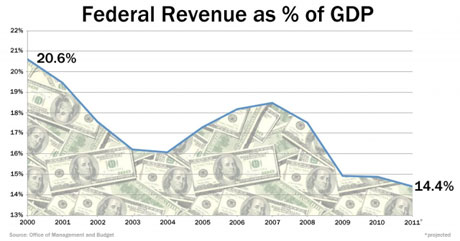

To borrow one of Cantor’s favorite sneers, “How could anyone believe that?” Here’s a graph showing federal revenues as a percentage of GDP. Clearly Washington has a revenue problem.

In fact, Americans are paying the lowest percentage of their income in taxes since 1958. Corporate taxes which brought in over 6% of GDP in 1950 are now near historic lows of barely 1%. Senator Carl Levin has just introduced the Stop Tax Haven Abuse Act of 2011 targeting the $100 billion in taxes lost annually to offshore tax havens. (Needless to say, House Republicans vow to go to the mat to protect the corporate tax dodges since loopholes are deemed tax hikes in thier Fox world)

It gets worse. Hedge Fund billionaires now pay a lower tax rate than their chauffeurs, or the teachers of their children, or the cops that patrol their streets. The IRS reports that the richest 400 Americans – who made an average of $354 million a year in 2007 – paid an effective tax rate of 16.6%, down from 30% in 1995 and 23% in 2002. Even as their incomes doubled from 2001 to 2007, their effective tax rates were virtually halved from 1995.

If you count payroll taxes, the richest 400 Americans, pocketing over $354 million a year, are paying a lower tax rate than a hospital orderly working for $29,000 a year.

Clearly we have a “revenue problem” – and a major league indecency problem.

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. We have hours left to raise the $12,0000 still needed to ensure Truthout remains safe, strong, and free. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.