In a move that has many on the left cautiously celebrating, Reuters reported on July 28 that Germany might reject a new trade agreement between Canada and the European Union.

The deal is called the Comprehensive Economic and Trade Agreement, or CETA. It’s part of a new wave of large, aggressive trade deals that also includes the Transatlantic Trade and Investment Partnership (TTIP) between the United States and the European Union, and the Trans Pacific Partnership (TPP) between 12 countries of the Pacific Rim.

If all the deals passed, they would affect more than half of the world’s economy. But the red light from Germany could signal that these agreements are not as inevitable as their advocates suggest.

Germany’s objections are centered specifically on the so-called “investor-state dispute settlement” provisions in CETA. These provisions—also known by the acronym ISDS—allow transnational corporations to take legal action against individual governments if they believe that the country’s domestic laws violate a trade agreement. And the legal disputes happen through arbitration, which is a way to settle disputes completely outside of the involved countries’ courts.

We’ve seen this movie before. Chapter 11 of the North American Free Trade Agreement (NAFTA) stipulates that three-person panels of private attorneys decide who wins in disputes between corporations and individual governments. These proceedings are closed to public observation.

The fallout has been dramatic: Corporations have used the NAFTA tribunals to win big-ticket monetary settlements from the taxpayers of nations whose domestic laws interfere with corporate profits. According to a report by the consumer-rights advocacy group Public Citizen, there are 17 pending claims in which corporations are seeking a total of $38 billion through NAFTA and other deals.

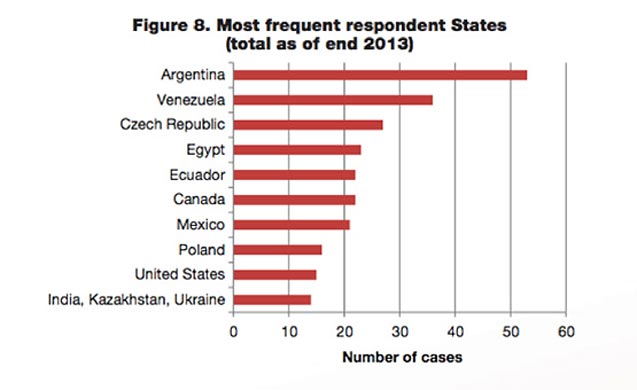

The compensation won through these claims hits particularly hard in Argentina—the most frequent target of these cases according to a 2014 report by the United Nations Conference on Trade and Development. In one example, Argentina was ordered to pay $185.3 million to the energy company BG Group, who sued for profits lost when the country froze gas prices in 2001.

Argentina is not alone: another report by the same U.N. group shows that 66 percent of investor-state cases initiated in 2012 were brought against “developing or transition economies”:

(Chart courtesy of UNCTAD)

(Chart courtesy of UNCTAD)

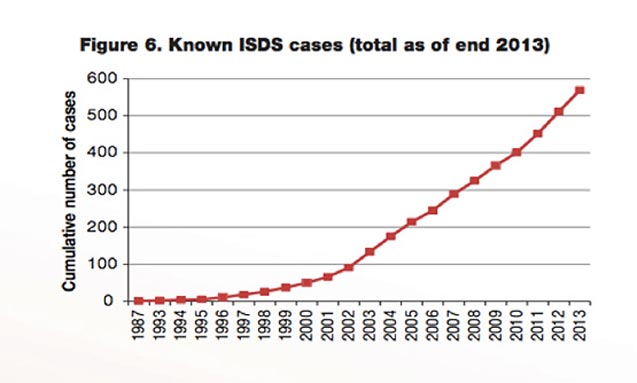

Meanwhile, the number of corporate claims has been on the rise: The UNCTD’s report from 2014 shows that in 2002 there were fewer than 100 known treaty-based ISDS cases. By 2013, that number had reached 568—a five-fold increase over 11 years:

(Chart courtesy of UNCTAD)

(Chart courtesy of UNCTAD)

The cases settled through NAFTA’s dispute resolution tribunals show corporate and investor rights trumping national sovereignty and domestic laws. Exxon Mobil won $60 million from Canada in 2007 because local regulations required oil companies to pay to support research and development in the country’s poorest provinces. U.S. energy company Lone Pine Resources is seeking CA$250 million in damages because the firm “expended millions of dollars and considerable time and resources” on a fracking project before Quebec banned fracking in 2011—a decision Lone Pine called “arbitrary” and “capricious.”

Opposition to these provisions is not limited to the political left. The Cato Institute, a libertarian think tank, has taken issue with investor-state dispute provisions in trade agreements like the TPP and TTIP. The institute’s Free Trade Bulletin argued in March that investor-state dispute settlements are “an unnecessary, unreasonable, and unwise provision to include,” and suggests sacrificing the provision in order to save the trade agreements.

Some implications

Germany is no stranger to similar dispute settlements. After the country decided to phase out nuclear power following the disaster at the Fukushima Daiichi Nuclear Power Plant in 2011, the Swedish energy firm Vattenfall filed for arbitration to seek €3.5 billion ($4.6 billion) in damages, blaming the country for past and future loss of profits.

Considering how that worked out, Germany’s change of heart is perhaps to be expected. But some commentators see the move as proof that global organizing against the new round of trade agreements is gaining ground. Arthur Stamoulis, director of the Citizens Trade Campaign, noted that “The German government and other governments are starting to feel the heat from public opposition to [investor-state dispute settlements].”

Yet not everyone is convinced by the messages coming out of Berlin. Peter Fuchs, executive director of PowerShift, a Berlin-based NGO focused on international trade and investment policy, expressed skepticism toward the idea that German opposition will sink CETA.

“Unfortunately, you cannot trust this government at all when corporate interests are at stake,” Fuchs said, calling the German government “a staunch proponent of neoliberal trade and investment agreements.”

According to Fuchs, this is a time for the public to ramp up pressure by calling on politicians to reject the trade deals. He pointed to the upcoming European Citizens Initiative against TTIP and CETA as one campaign aimed at making that happen.

However seriously one takes Germany’s apparent about-face, the development has emboldened the fight against the agreement. And with a growing chorus of skeptics from both left and right, these problematic provisions seem newly vulnerable, as do the agreements overall.

As Arthur Stamoulis told YES, “With renewed activism, corporate power grabs like CETA, TTIP and the TPP … really can be stopped.”

Join us in defending the truth before it’s too late

The future of independent journalism is uncertain, and the consequences of losing it are too grave to ignore. To ensure Truthout remains safe, strong, and free, we need to raise $46,000 in the next 7 days. Every dollar raised goes directly toward the costs of producing news you can trust.

Please give what you can — because by supporting us with a tax-deductible donation, you’re not just preserving a source of news, you’re helping to safeguard what’s left of our democracy.